European Growth Companies With High Insider Ownership In January 2026

As Europe’s STOXX 600 Index hovers near record highs amid optimism about future earnings and economic recovery, investors are increasingly focusing on growth companies with substantial insider ownership. Such companies often reflect strong confidence from those closest to the business, making them attractive in a market environment where cautious optimism prevails.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Guard Therapeutics International (OM:GUARD) | 13.1% | 103.3% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

CTT Systems (OM:CTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: CTT Systems AB (publ) develops and supplies humidity control systems for aircraft across Sweden, Denmark, France, the United States, and other international markets, with a market cap of SEK2.50 billion.

Operations: CTT Systems AB generates revenue from its Aerospace & Defense segment, amounting to SEK291.20 million.

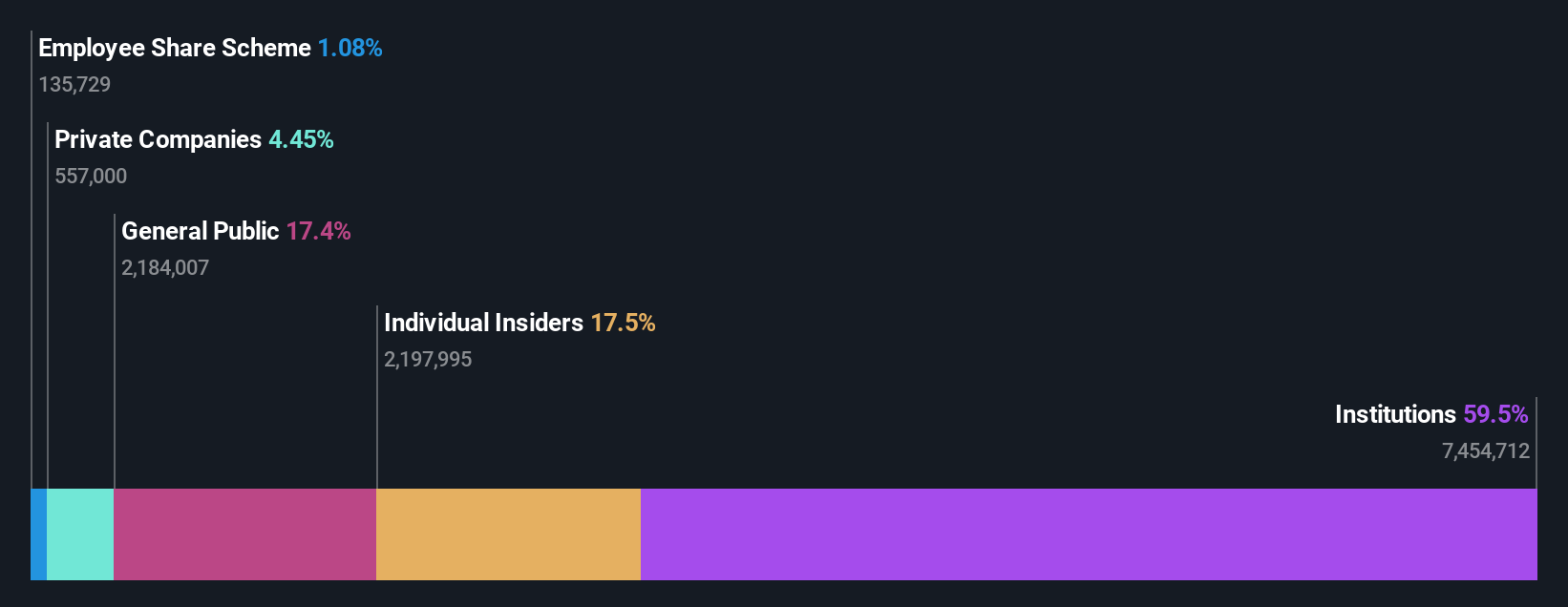

Insider Ownership: 17.5%

Return On Equity Forecast: 45% (2028 estimate)

CTT Systems exhibits strong growth potential with earnings forecasted to grow significantly at 52% annually, outpacing the Swedish market. Revenue is expected to rise by 25.2% per year, also above market rates. Despite trading at a substantial discount to estimated fair value, recent results show mixed performance with declining profit margins and lower nine-month net income compared to last year. The dividend yield of 2.69% lacks coverage from earnings or free cash flow.

- Unlock comprehensive insights into our analysis of CTT Systems stock in this growth report.

- The analysis detailed in our CTT Systems valuation report hints at an inflated share price compared to its estimated value.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions primarily in the Nordic region and has a market capitalization of approximately SEK3.82 billion.

Operations: The company's revenue is primarily derived from selling and implementing CRM software systems, amounting to approximately SEK731.63 million.

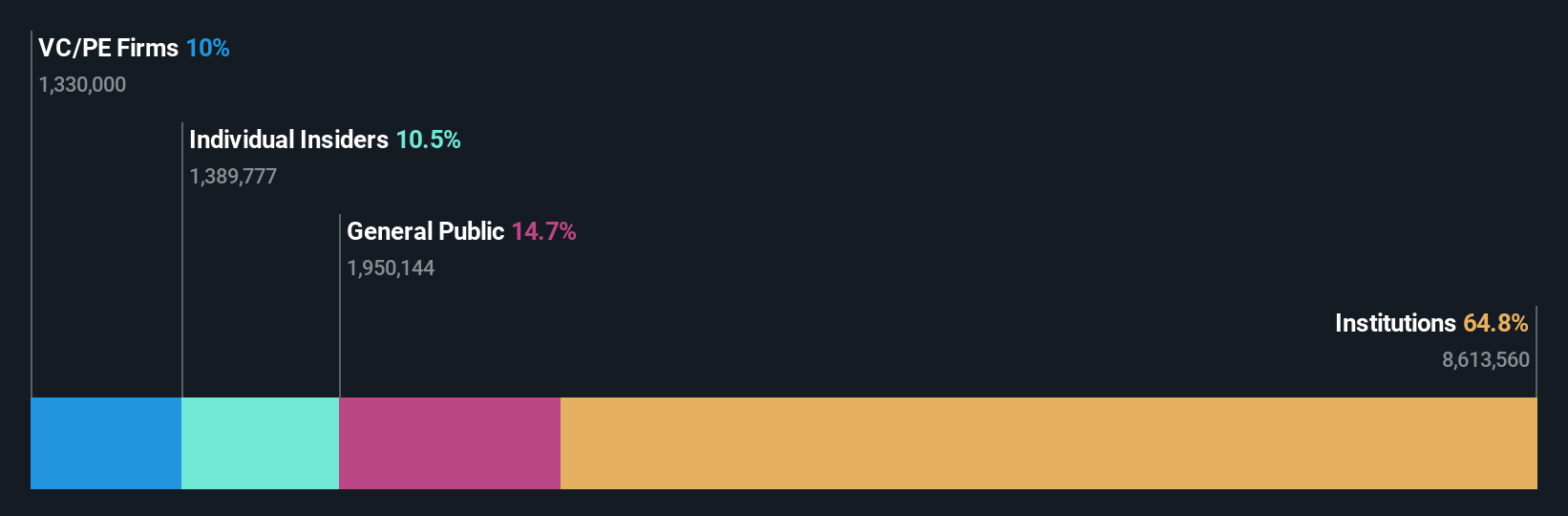

Insider Ownership: 10.4%

Return On Equity Forecast: 32% (2028 estimate)

Lime Technologies demonstrates robust growth prospects with earnings expected to grow significantly at 20.8% annually, surpassing the Swedish market rate. Revenue is forecasted to increase at a slower pace of 10.8% per year but still above market averages. The company trades at a notable discount to its estimated fair value, and recent executive changes suggest strategic alignment for future expansion phases. Third-quarter results reported increased sales and net income, reflecting ongoing operational strength.

- Click here to discover the nuances of Lime Technologies with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Lime Technologies shares in the market.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medicover AB (publ) operates healthcare and diagnostic services in Poland, Sweden, and internationally with a market cap of SEK33.29 billion.

Operations: The company generates revenue from two main segments: €1.62 billion from Healthcare Services and €732.10 million from Diagnostic Services.

Insider Ownership: 11.2%

Return On Equity Forecast: 24% (2028 estimate)

Medicover shows promising growth with earnings expected to rise significantly at 25.1% annually, outpacing the Swedish market. Revenue is forecasted to grow at 10.8% per year, faster than the market average. Insider buying has been substantial recently, indicating confidence in future prospects. The company trades below its fair value estimate and third-quarter results revealed increased sales and a return to profitability, highlighting operational improvements and strategic advancements in their MRD assay development.

- Take a closer look at Medicover's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Medicover is priced lower than what may be justified by its financials.

Taking Advantage

- Reveal the 208 hidden gems among our Fast Growing European Companies With High Insider Ownership screener with a single click here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com