Midland Holdings And 2 Other Penny Stocks To Watch In Global

Global markets have recently shown a mix of optimism and caution, with U.S. stocks reaching record highs and economic growth accelerating, while consumer confidence has weakened. For investors interested in smaller or newer companies, penny stocks—though an outdated term—still represent an intriguing investment area that can offer surprising value. By focusing on those with robust financials, investors may find opportunities for stability and growth in this niche market segment.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.44 | HK$890.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.30 | £493.82M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$462.61M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.00 | A$3.43B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.745 | $433.09M | ✅ 3 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.135 | £182.65M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,583 stocks from our Global Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Midland Holdings (SEHK:1200)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Midland Holdings Limited is an investment holding company offering property agency services in Hong Kong, Macau, and Mainland China with a market cap of HK$1.65 billion.

Operations: The company generates revenue primarily from its property agency services, with HK$5.21 billion coming from residential properties and HK$53.95 million from commercial, industrial properties, and shops.

Market Cap: HK$1.65B

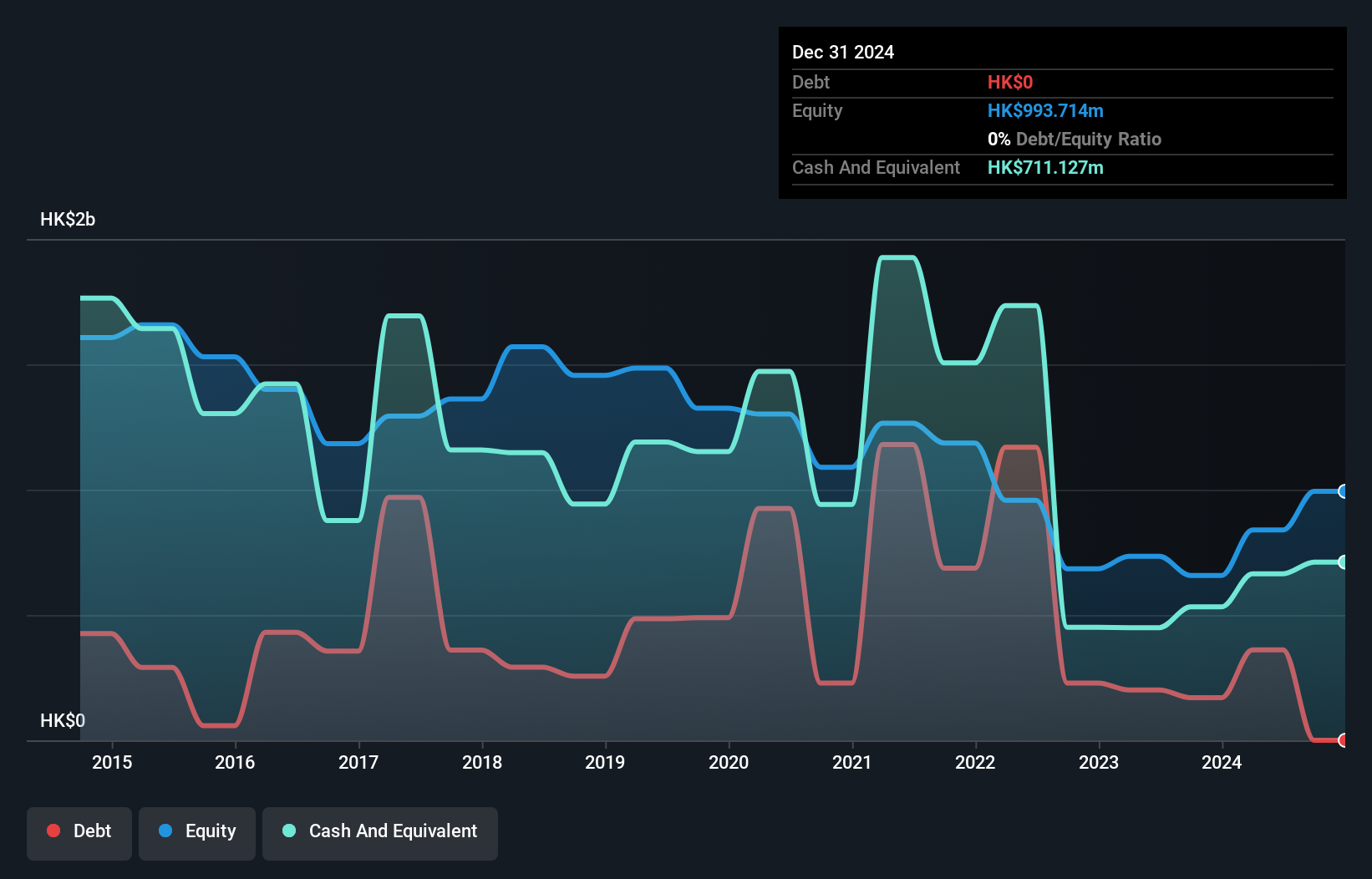

Midland Holdings, with a market cap of HK$1.65 billion, has shown significant earnings growth of 219.7% over the past year, surpassing its five-year average and outperforming the Real Estate industry. The company is debt-free, which alleviates concerns about interest coverage and long-term liabilities as its short-term assets exceed both short- and long-term obligations. Its current net profit margin has improved to 5.6%, up from last year's 1.8%. Additionally, Midland's Return on Equity stands at a high 26%, while it trades at a substantial discount compared to its estimated fair value.

- Unlock comprehensive insights into our analysis of Midland Holdings stock in this financial health report.

- Gain insights into Midland Holdings' future direction by reviewing our growth report.

Grace Wine Holdings (SEHK:8146)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Grace Wine Holdings Limited is an investment holding company involved in the production and distribution of wine, spirits, and other alcoholic products across Hong Kong, Mainland China, and internationally, with a market cap of HK$308.23 million.

Operations: The company's revenue primarily comes from the production of wines, totaling CN¥39.63 million.

Market Cap: HK$308.23M

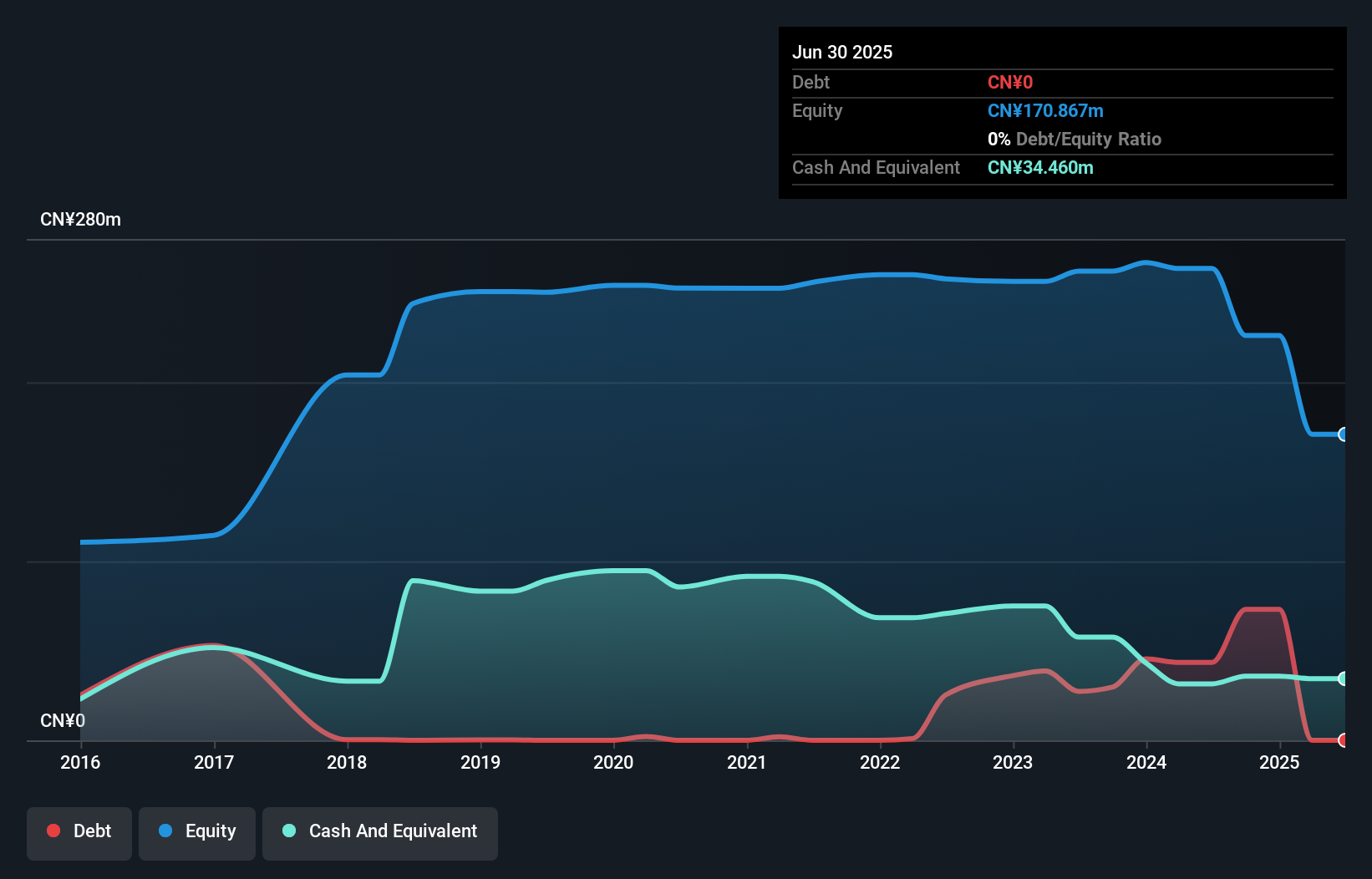

Grace Wine Holdings, with a market cap of HK$308.23 million, is currently unprofitable and has seen its losses increase significantly over the past five years. Despite this, the company benefits from being debt-free and having sufficient cash runway for over a year based on current free cash flow trends. Its short-term assets comfortably cover both short- and long-term liabilities, providing some financial stability amid high share price volatility. Recently, Yang Lingjiang completed the acquisition of a 73.63% stake in Grace Wine Holdings for HK$22.1 million and aims to acquire the remaining shares, supported by financing arrangements through Eddid Securities and Future Limited.

- Click here to discover the nuances of Grace Wine Holdings with our detailed analytical financial health report.

- Examine Grace Wine Holdings' past performance report to understand how it has performed in prior years.

JTF International Holdings (SEHK:9689)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: JTF International Holdings Limited is an investment holding company involved in blending and selling fuel oil in the People's Republic of China, with a market cap of HK$381.30 million.

Operations: The company's revenue is derived entirely from its operations in blending and selling fuel oil, refined oil, and other petrochemicals, generating CN¥742.33 million.

Market Cap: HK$381.3M

JTF International Holdings, with a market cap of HK$381.30 million, is focused on blending and selling fuel oil in China, generating revenue of CN¥742.33 million. Despite being unprofitable and experiencing increased losses over the past five years, the company benefits from having no debt and a seasoned management team with an average tenure of 9 years. Its short-term assets significantly exceed both its short- and long-term liabilities, offering some financial stability despite high share price volatility. The stock trades at 97.6% below estimated fair value, suggesting potential undervaluation in the market's view.

- Dive into the specifics of JTF International Holdings here with our thorough balance sheet health report.

- Assess JTF International Holdings' previous results with our detailed historical performance reports.

Taking Advantage

- Click through to start exploring the rest of the 3,580 Global Penny Stocks now.

- Want To Explore Some Alternatives? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com