Discovering US Market's 3 Undiscovered Gem Stocks

As the United States market wraps up a year of impressive gains, with major indexes like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting double-digit increases despite a recent downturn, investors are keenly observing economic indicators that could impact small-cap companies. In this dynamic environment, identifying undiscovered gem stocks involves looking for those with strong fundamentals and growth potential that might not yet be reflected in their current valuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Senstar Technologies | NA | -15.82% | 43.55% | ★★★★★★ |

| Security Federal | 20.04% | 5.77% | 1.59% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

John Marshall Bancorp (JMSB)

Simply Wall St Value Rating: ★★★★★★

Overview: John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank, offering a range of banking products and financial services in the United States, with a market cap of $283.05 million.

Operations: The company generates its revenue primarily from banking activities, with reported revenues of $59.27 million.

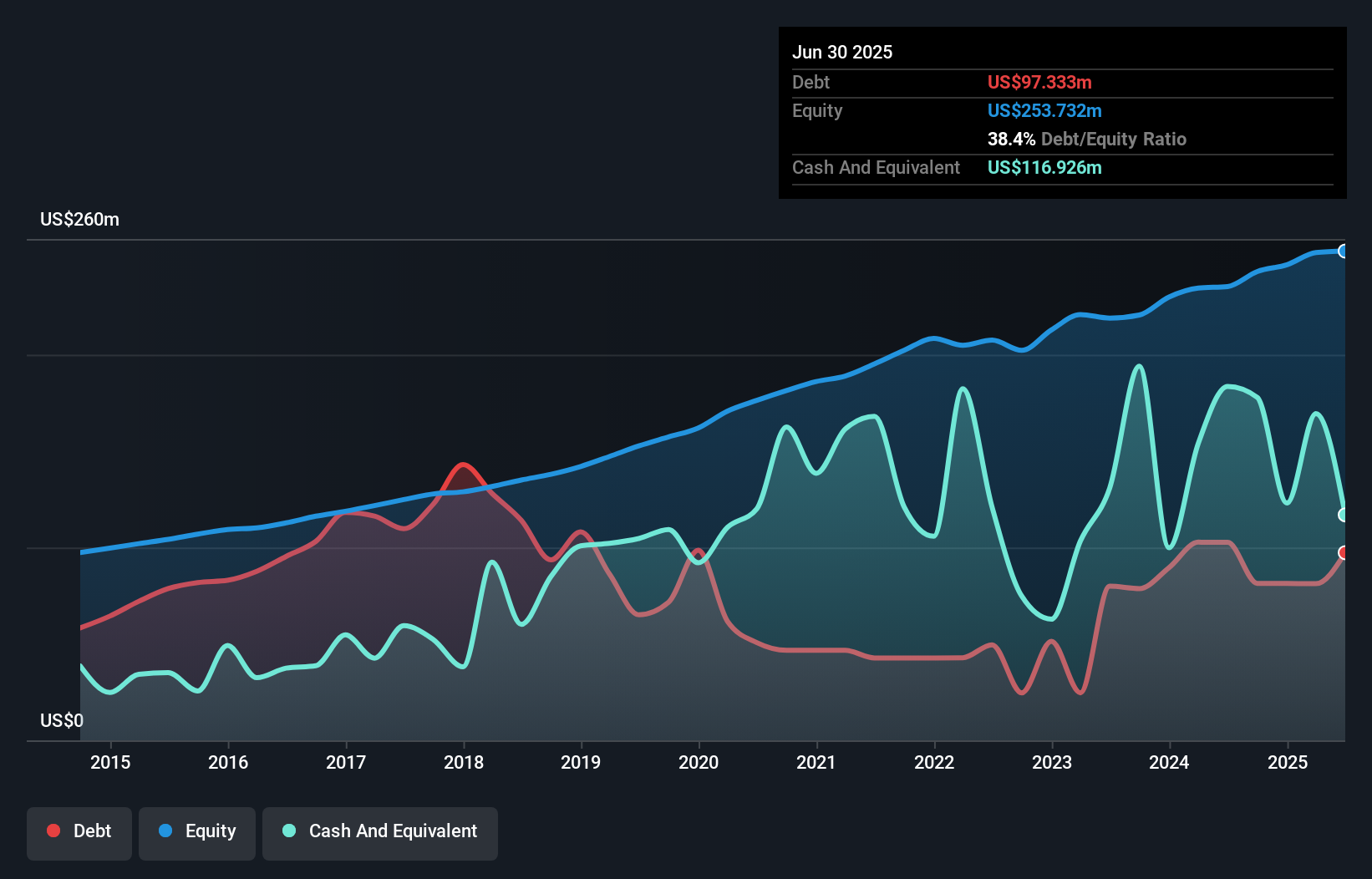

John Marshall Bancorp is making strides with its total assets at US$2.3 billion and equity of US$259.7 million, showcasing a solid financial base. Notably, it has a sufficient allowance for bad loans at 188%, covering the low 0.5% of non-performing loans effectively. The bank's earnings growth outpaced the industry with a robust 19.2% increase over the past year, supported by high-quality earnings and primarily low-risk funding sources comprising 95% customer deposits. Its price-to-earnings ratio stands attractively at 14.1x against the broader market's 19x, indicating potential value for investors exploring this space.

- Delve into the full analysis health report here for a deeper understanding of John Marshall Bancorp.

Assess John Marshall Bancorp's past performance with our detailed historical performance reports.

Timberland Bancorp (TSBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Timberland Bancorp, Inc. is the bank holding company for Timberland Bank, offering a range of community banking services in Washington, with a market cap of $282.05 million.

Operations: Timberland Bancorp generates revenue primarily through its community banking services, with $81.62 million in revenue.

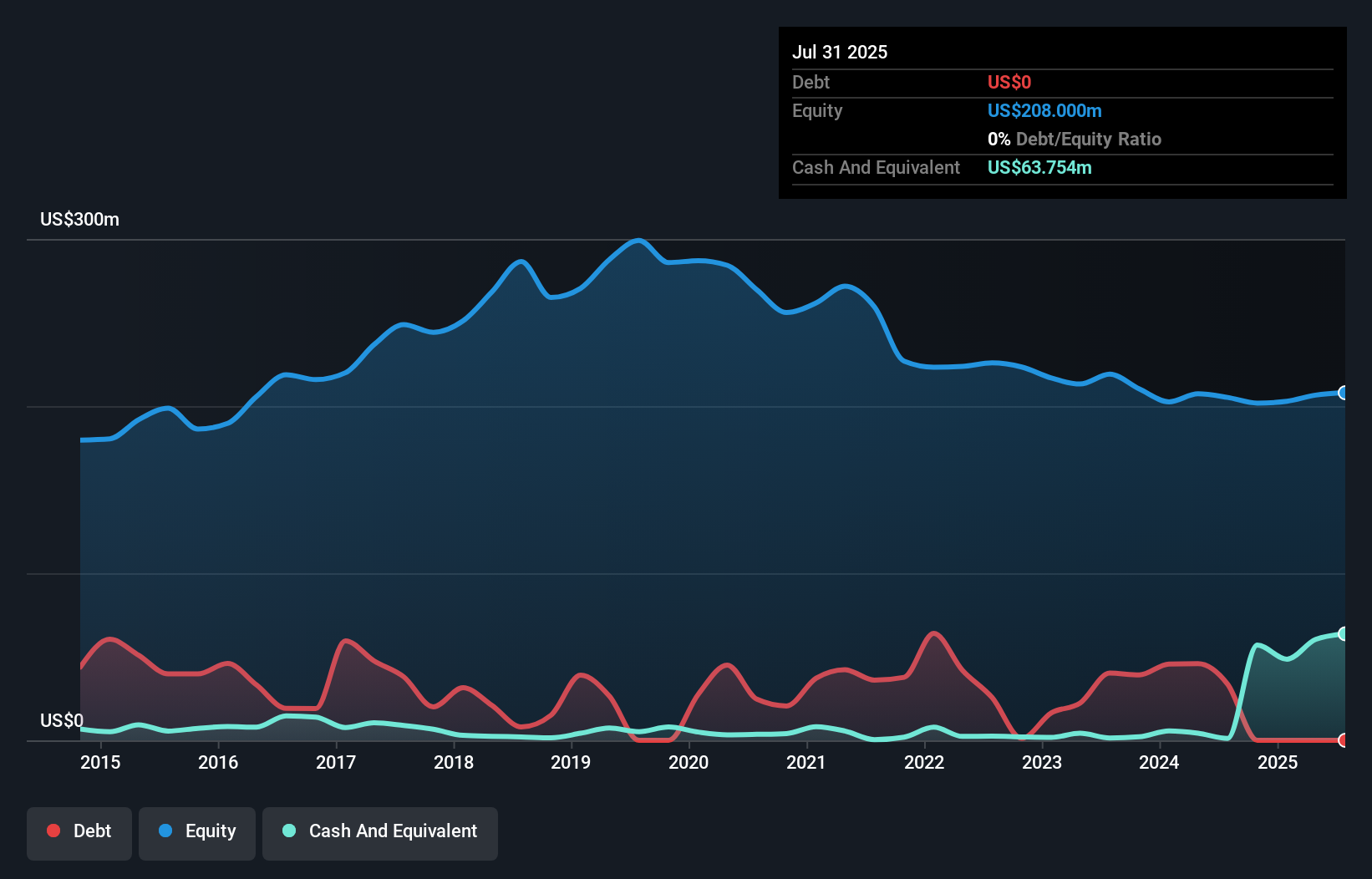

Timberland Bancorp, with assets totaling US$2B and equity of US$262.6M, presents a compelling opportunity in the banking sector. The company is trading at 41% below its estimated fair value, suggesting potential undervaluation. With total deposits of US$1.7B and loans amounting to US$1.5B, it maintains a net interest margin of 3.8%. Its allowance for bad loans stands at an impressive 411%, reflecting prudent risk management with non-performing loans at just 0.3%. Recent earnings growth outpaced the industry, rising by 20%, while a recent share repurchase program further underscores confidence in its financial health and future prospects.

- Click here to discover the nuances of Timberland Bancorp with our detailed analytical health report.

Calavo Growers (CVGW)

Simply Wall St Value Rating: ★★★★★★

Overview: Calavo Growers, Inc. is involved in the marketing and distribution of avocados and other perishable foods to a global clientele, including retail grocery and foodservice sectors, with a market cap of $377.95 million.

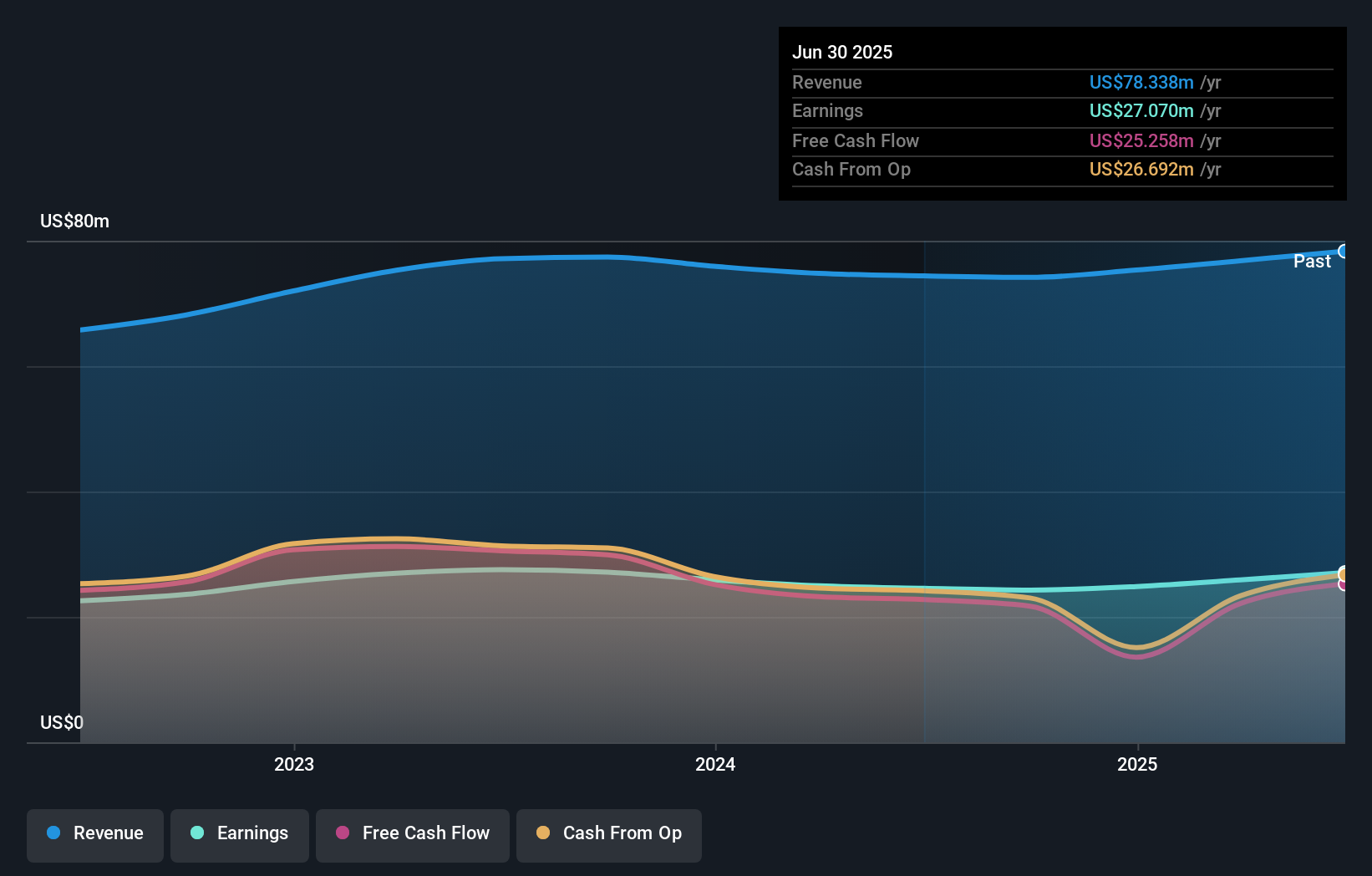

Operations: Calavo Growers generates revenue primarily from its Fresh segment, contributing $624.93 million, and its Prepared segment, adding $68.78 million.

Calavo Growers, a notable player in the food industry, has seen impressive earnings growth of 192.8% over the past year, significantly outpacing the industry's 2.8%. Trading at 53.3% below its estimated fair value suggests potential for value investors. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 9.1%, indicating improved financial health and no concerns about interest payments coverage. Recent executive changes include B. John Lindeman stepping in as CEO, bringing extensive leadership experience from Hydrofarm Holdings Group and previous roles within Calavo itself, which could influence strategic direction positively moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Calavo Growers.

Evaluate Calavo Growers' historical performance by accessing our past performance report.

Where To Now?

- Click here to access our complete index of 301 US Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com