TSX Penny Stocks With Market Caps Under CA$200M To Consider

As the Canadian market navigates a landscape of sector-specific opportunities and challenges, diversification remains a key strategy for investors. Penny stocks, though an older term, continue to highlight smaller or less-established companies that can offer significant value. By focusing on those with strong financials and clear growth potential, investors can uncover promising opportunities in this often overlooked segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.15 | CA$54.6M | ✅ 3 ⚠️ 4 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.33 | CA$255.45M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.20 | CA$125.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.415 | CA$3.43M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.36 | CA$52.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.27 | CA$871.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.20 | CA$24.58M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.29 | CA$166.88M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.02 | CA$30.04M | ✅ 1 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$184.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 386 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

First Lithium Minerals (CNSX:FLM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: First Lithium Minerals Corp. is a mineral exploration and development company with operations in Chile and Canada, and it has a market cap of CA$8.67 million.

Operations: First Lithium Minerals Corp. does not report any revenue segments.

Market Cap: CA$8.67M

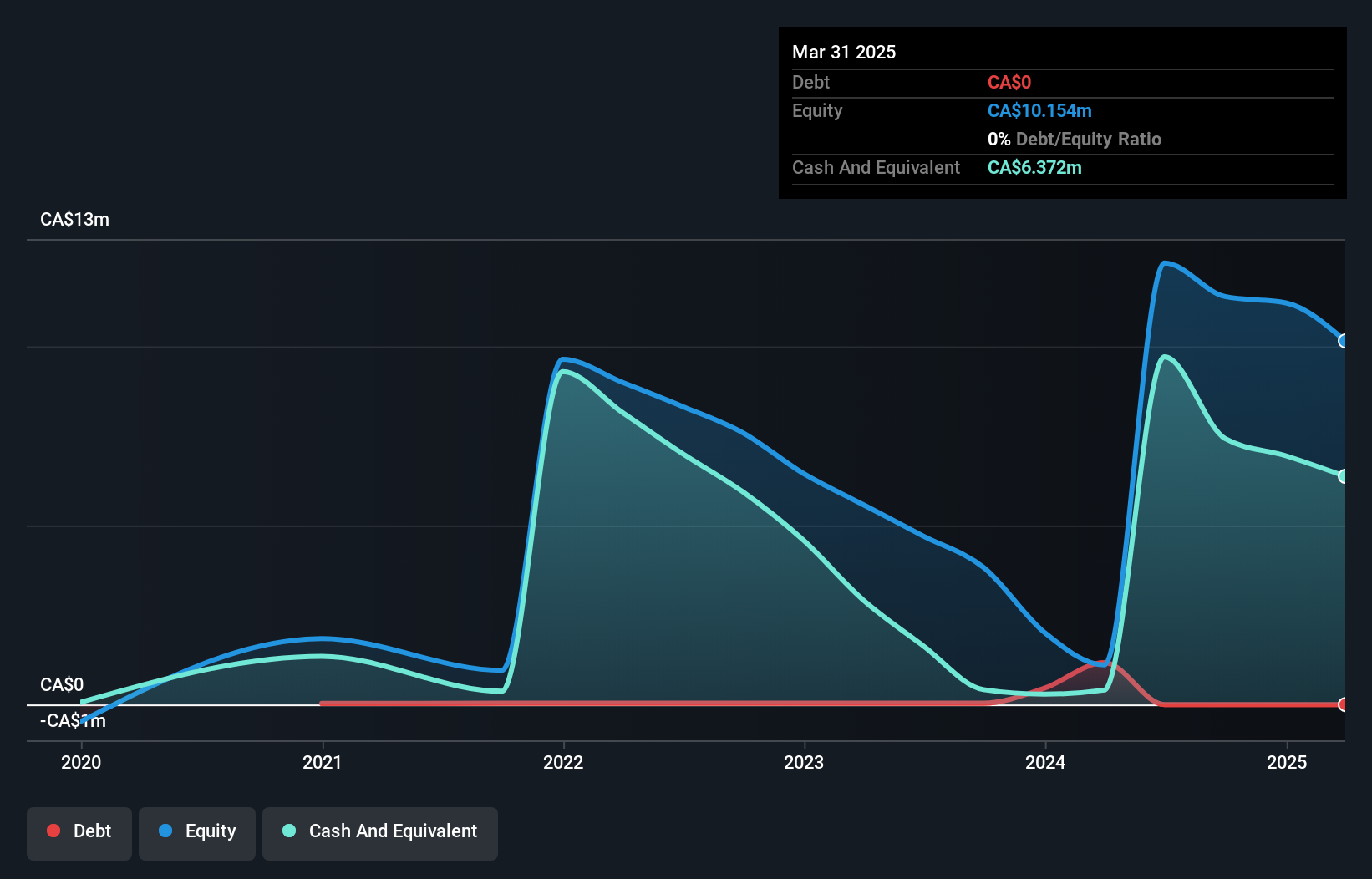

First Lithium Minerals Corp. is a pre-revenue company with operations in Chile and Canada, holding a market cap of CA$8.67 million. The company recently initiated an exploration program at its Lidstone Project in Ontario, aiming to identify gold or base metal mineralization targets for future drilling. Despite being unprofitable, First Lithium has reduced its losses by 19.8% annually over the past five years and maintains more cash than debt with no long-term liabilities. However, it faces challenges such as high share price volatility and limited cash runway if free cash flow grows at historical rates.

- Navigate through the intricacies of First Lithium Minerals with our comprehensive balance sheet health report here.

- Learn about First Lithium Minerals' historical performance here.

Greenheart Gold (TSXV:GHRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Greenheart Gold Inc. is a mineral exploration company operating in Guyana and Suriname with a market cap of CA$126.37 million.

Operations: Greenheart Gold Inc. has not reported any revenue segments.

Market Cap: CA$126.37M

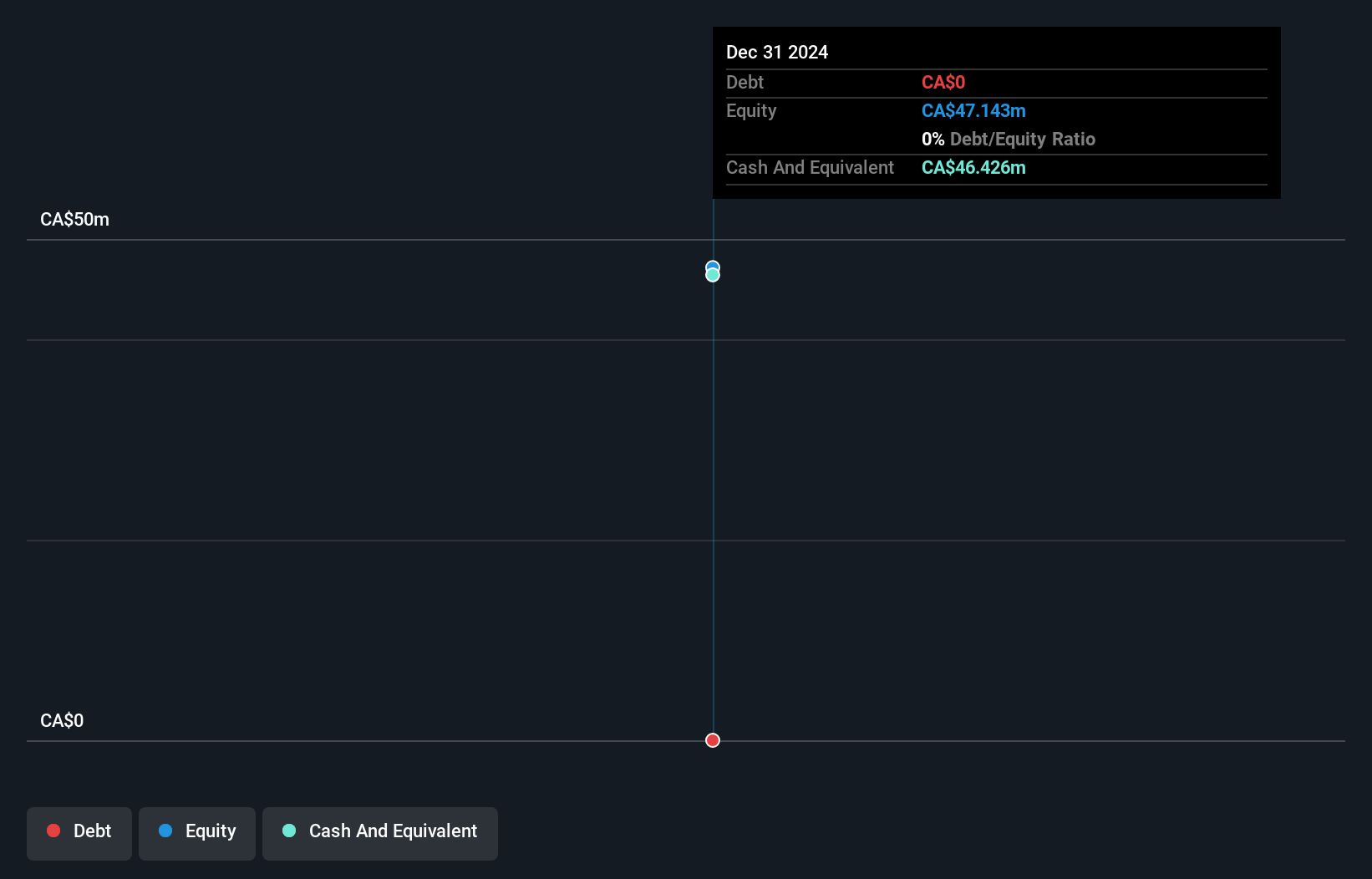

Greenheart Gold Inc., with a market cap of CA$126.37 million, is a pre-revenue mineral exploration company operating in Guyana and Suriname. Recently, the company completed an 11-hole diamond drill program at its Majorodam project in Suriname, confirming a North-South trending gold mineralized system. Despite these promising geological findings, Greenheart Gold remains unprofitable and reported increased net losses for the third quarter of 2025 compared to the previous year. The management team and board are relatively new with an average tenure of 1.4 years, which could impact strategic continuity as they advance their exploration initiatives.

- Click here to discover the nuances of Greenheart Gold with our detailed analytical financial health report.

- Explore historical data to track Greenheart Gold's performance over time in our past results report.

SPARQ Systems (TSXV:SPRQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SPARQ Systems Inc. designs, manufactures, and sells single-phase microinverters for residential and commercial solar electric applications, with a market cap of CA$87.70 million.

Operations: The company's revenue is derived entirely from its Electric Equipment segment, totaling CA$2.52 million.

Market Cap: CA$87.7M

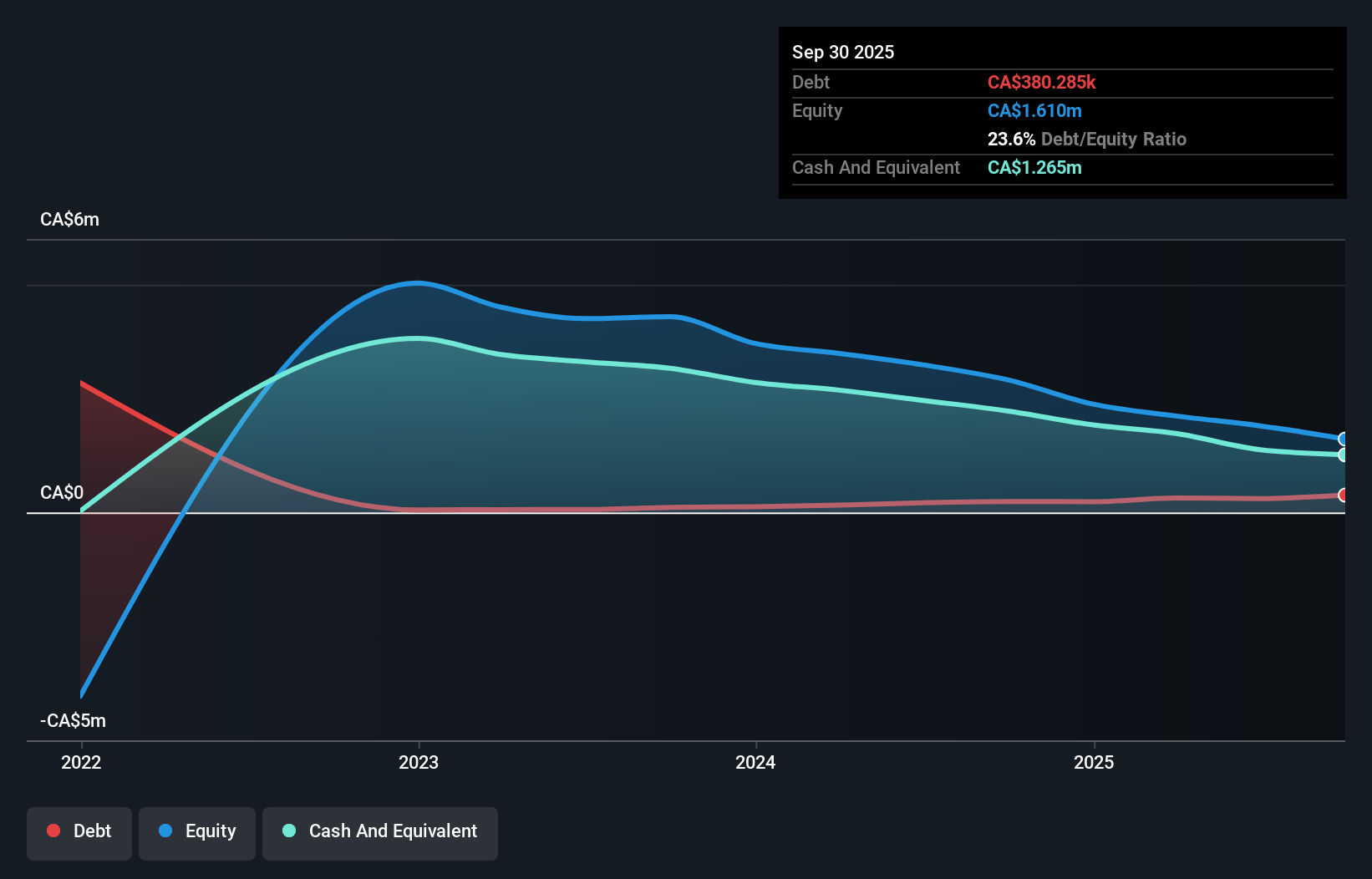

SPARQ Systems Inc., with a market cap of CA$87.70 million, has demonstrated revenue growth, reporting sales of CA$1.08 million for Q3 2025 compared to the previous year's CA$0.36 million. Despite this progress, the company remains unprofitable with a net loss of CA$0.91 million for the same period. Recent product innovations include an AI-driven grid-power control device and the D1200 Duo Microinverter, both enhancing its solar solutions portfolio. Strategic partnerships in sub-Saharan Africa may expand market reach but financial stability is bolstered by sufficient cash runway and no debt obligations currently on its balance sheet.

- Take a closer look at SPARQ Systems' potential here in our financial health report.

- Gain insights into SPARQ Systems' outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Embark on your investment journey to our 386 TSX Penny Stocks selection here.

- Interested In Other Possibilities? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com