3 Insider-Owned Growth Stocks For Your Watchlist

As 2025 comes to a close, the U.S. stock market has experienced a robust year with significant gains across major indices despite ending on a slightly downbeat note. In this environment, identifying growth companies with high insider ownership can be particularly appealing as insider confidence often signals potential for long-term success and alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 59% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.8% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.5% | 43.3% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

Below we spotlight a couple of our favorites from our exclusive screener.

Abeona Therapeutics (ABEO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Abeona Therapeutics Inc. is a clinical-stage biopharmaceutical company focused on developing gene and cell therapies for life-threatening diseases, with a market cap of $280.71 million.

Operations: Abeona Therapeutics Inc. currently does not report any revenue segments as it is focused on developing gene and cell therapies for life-threatening diseases.

Insider Ownership: 10.3%

Abeona Therapeutics, a company with substantial insider ownership, is experiencing significant growth potential. Recently becoming profitable, it trades at a value below its estimated fair value and peers. Despite some shareholder dilution over the past year, Abeona's revenue is forecast to grow at 42.5% annually, outpacing the US market average. The company's recent product developments include FDA-approved ZEVASKYN gene therapy for treating rare skin disorders and strategic leadership appointments to enhance business operations and development strategies.

- Delve into the full analysis future growth report here for a deeper understanding of Abeona Therapeutics.

- Our valuation report unveils the possibility Abeona Therapeutics' shares may be trading at a discount.

Streamex (STEX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Streamex Corp. is a real world asset tokenization company that provides institutional-grade infrastructure, with a market cap of $461.52 million.

Operations: Streamex Corp.'s revenue segments are not specified in the provided text.

Insider Ownership: 16.1%

Streamex, with significant insider ownership, is positioned for growth through innovative initiatives like Project Open and strategic partnerships. The company's focus on tokenizing real-world assets, such as its gold-backed GLDY token, aligns with regulatory advancements to enhance market transparency and efficiency. Despite recent financial losses of US$15.58 million in Q3 2025 and shareholder dilution, Streamex's revenue is projected to grow rapidly at over 100% annually, outpacing the US market average.

- Click here and access our complete growth analysis report to understand the dynamics of Streamex.

- According our valuation report, there's an indication that Streamex's share price might be on the expensive side.

Fiverr International (FVRR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of approximately $727.95 million.

Operations: The company generates $427.40 million in revenue from its Internet Software & Services segment.

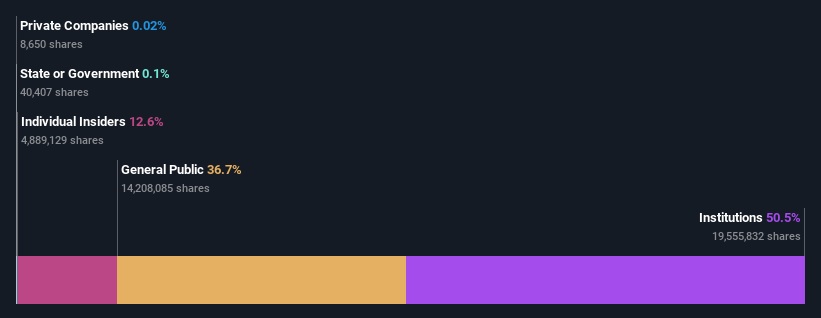

Insider Ownership: 11.6%

Fiverr International, with substantial insider ownership, has demonstrated strong earnings growth, reporting a net income of US$5.54 million in Q3 2025 compared to US$1.35 million the previous year. Despite revenue growth forecasts lagging behind the broader market at 6.3% annually, its earnings are projected to grow significantly at 47.5% per year, surpassing market averages. Currently trading below fair value estimates and analyst price targets suggest potential for stock appreciation amidst robust profit expansion expectations.

- Click here to discover the nuances of Fiverr International with our detailed analytical future growth report.

- According our valuation report, there's an indication that Fiverr International's share price might be on the cheaper side.

Where To Now?

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 208 more companies for you to explore.Click here to unveil our expertly curated list of 211 Fast Growing US Companies With High Insider Ownership.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com