Undervalued Opportunities Penny Stocks To Watch In January 2026

As 2025 closes, the U.S. stock market reflects a year of robust gains despite ending with a streak of losses, driven largely by advancements in technology stocks. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing area for investors seeking affordability combined with potential growth. While the term "penny stocks" might seem outdated, their relevance persists as they can offer unique opportunities when backed by strong financial health.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.49 | $533.62M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8251 | $142.68M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.27 | $553.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.11 | $1.29B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.07 | $550.42M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Nephros (NEPH) | $4.88 | $50.16M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.99105 | $7.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.95 | $89.94M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 344 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Universal Electronics (UEIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Universal Electronics Inc. specializes in the design, development, manufacturing, and support of home entertainment control products and smart home solutions, with a market cap of $42.64 million.

Operations: The company's revenue is derived from its Audio/Video Products segment, amounting to $391 million.

Market Cap: $42.64M

Universal Electronics Inc. is navigating the penny stock landscape with a focus on smart home solutions, despite ongoing unprofitability and increased losses over the past five years. The company has a stable cash runway exceeding three years, supported by positive free cash flow. Recent executive changes include appointing Wade M. Jenke as CFO to strengthen financial strategies amid declining sales and net losses reported for Q3 2025. Universal's innovative product offerings like QuickSet homeSense aim to enhance user experience and energy efficiency, potentially positioning it well in its industry segment despite current financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Universal Electronics.

- Assess Universal Electronics' future earnings estimates with our detailed growth reports.

Perfect (PERF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perfect Corp. is an artificial intelligence software as a service company that offers AI and AR-powered solutions for the beauty, fashion, and skincare industries globally, with a market cap of $179.25 million.

Operations: The company generates revenue of $66.90 million from its Internet Software & Services segment.

Market Cap: $179.25M

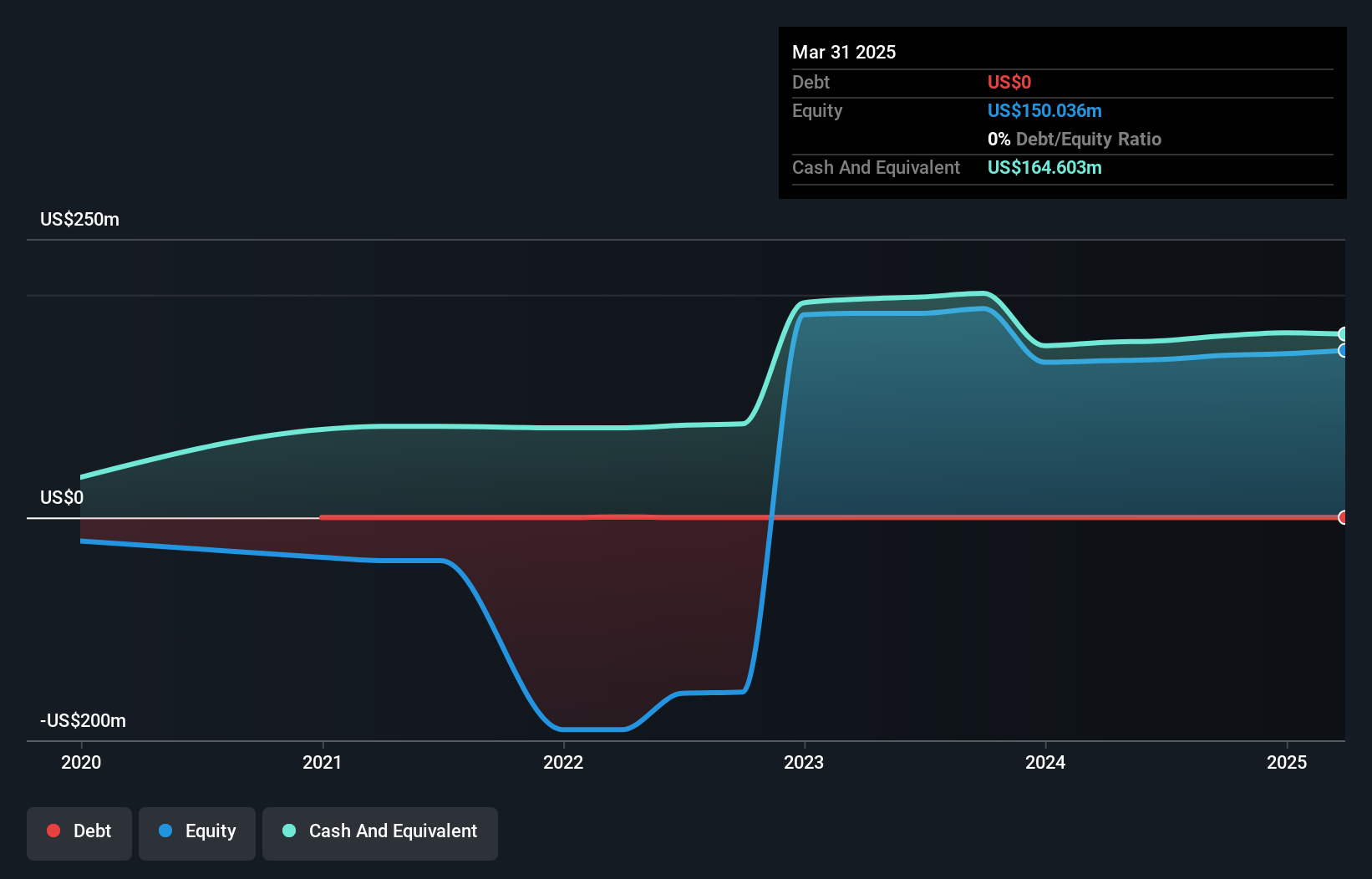

Perfect Corp. is leveraging its AI and AR technologies to redefine personalization in the beauty and fashion industries, with recent collaborations enhancing its market presence. The partnership with Tom Ford Fashion introduces advanced virtual try-on technology for eyewear, aiming to boost customer confidence and reduce returns. At CES 2026, Perfect will unveil new AI agents that offer personalized digital beauty consultations across multiple platforms. Despite a modest earnings growth of 6.6% last year compared to a five-year average of 24.9%, Perfect remains debt-free with robust short-term assets exceeding liabilities, underscoring financial stability amid evolving industry dynamics.

- Take a closer look at Perfect's potential here in our financial health report.

- Examine Perfect's earnings growth report to understand how analysts expect it to perform.

CreateAI Holdings (TSPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CreateAI Holdings Inc. is an artificial intelligence technology company specializing in video game and anime production and publishing, with a market cap of $49.77 million.

Operations: There are no reported revenue segments for CreateAI Holdings Inc.

Market Cap: $49.77M

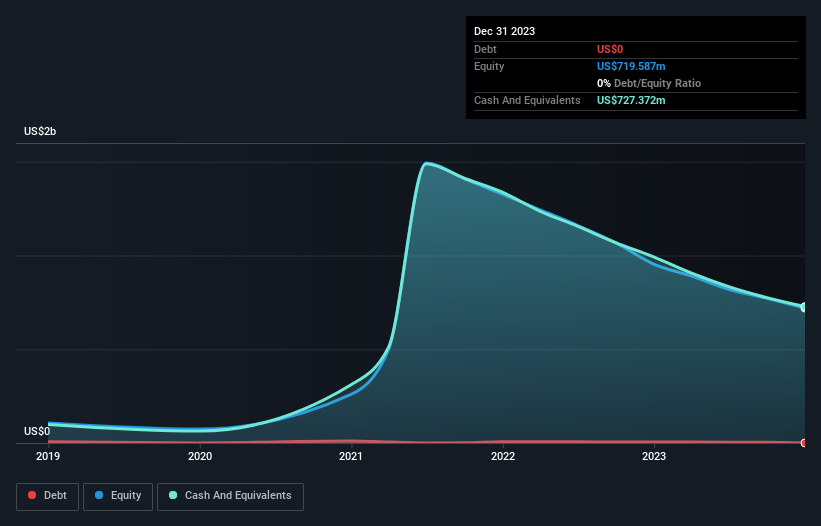

CreateAI Holdings, an artificial intelligence company in video game and anime production, remains pre-revenue with sales under US$1 million. Despite a substantial net loss of US$47.97 million for the first nine months of 2025, losses have significantly decreased from the previous year. The company declared a special cash distribution totaling US$132.8 million, highlighting its strong cash position despite financial challenges. With no debt and experienced management and board teams averaging 3.1 years in tenure, CreateAI's short-term assets far exceed liabilities, offering some financial stability as it navigates high share price volatility.

- Dive into the specifics of CreateAI Holdings here with our thorough balance sheet health report.

- Gain insights into CreateAI Holdings' past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Navigate through the entire inventory of 344 US Penny Stocks here.

- Searching for a Fresh Perspective? Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com