TSX Penny Stocks To Watch In January 2026

The Canadian market has been marked by a focus on diversification, with particular attention to the energy, industrials, and materials sectors as key areas for potential growth. As investors navigate these evolving conditions, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities. Despite their somewhat outdated moniker, these stocks can provide significant value when backed by strong financial fundamentals, making them worthy of consideration for those seeking potential growth at lower price points.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.15 | CA$54.6M | ✅ 3 ⚠️ 4 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.33 | CA$255.45M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.20 | CA$125.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.415 | CA$3.43M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.36 | CA$52.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.27 | CA$871.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.20 | CA$24.58M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.29 | CA$166.88M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.02 | CA$30.04M | ✅ 1 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$184.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 386 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Almaden Minerals (TSXV:AMM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Almaden Minerals Ltd. is an exploration stage company focused on acquiring, exploring, evaluating, and developing mineral properties in Mexico with a market cap of CA$25.41 million.

Operations: Almaden Minerals Ltd. has not reported any revenue segments.

Market Cap: CA$25.41M

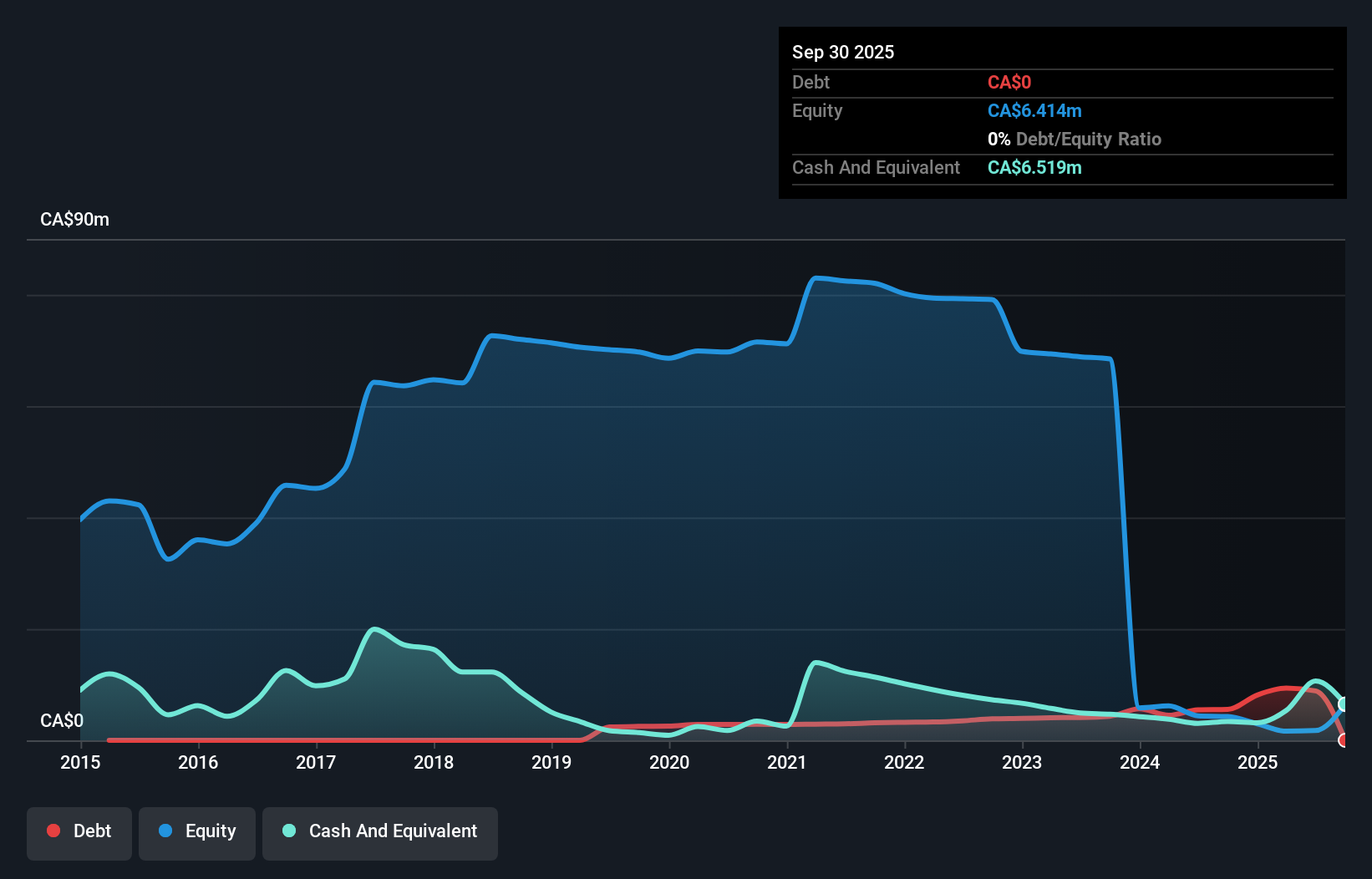

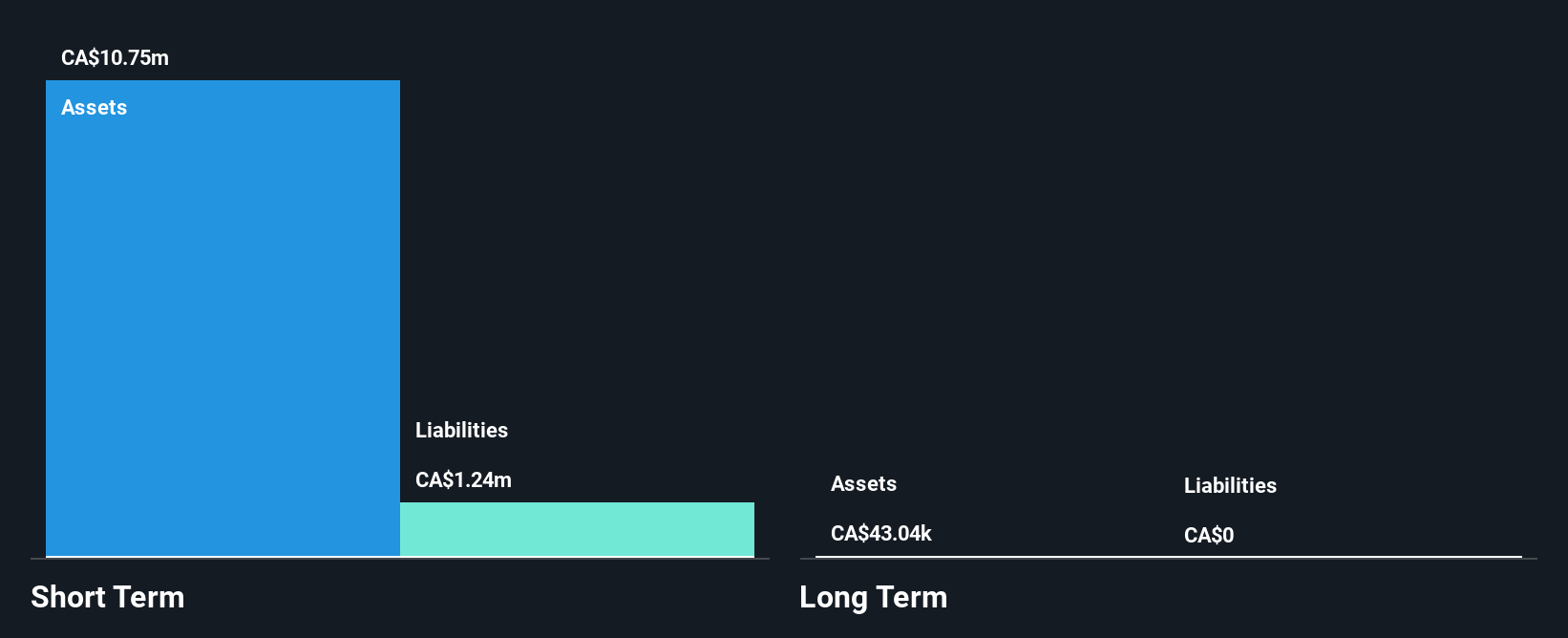

Almaden Minerals Ltd., with a market cap of CA$25.41 million, is pre-revenue and recently reported a significant one-off gain of CA$4.3 million, impacting its financial results. The company has become profitable in the last year, reporting net income for the third quarter of 2025 at CA$4.51 million compared to a loss previously. Almaden remains debt-free with short-term assets exceeding liabilities, offering financial stability amidst volatility. Recent leadership changes include Douglas McDonald as CEO, bringing extensive experience in resource policy and investment banking, potentially guiding strategic growth initiatives amid ongoing challenges in Mexico.

- Dive into the specifics of Almaden Minerals here with our thorough balance sheet health report.

- Assess Almaden Minerals' previous results with our detailed historical performance reports.

NamSys (TSXV:CTZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NamSys Inc. offers software solutions for currency management and processing to the banking and merchant sectors in North America, with a market cap of CA$37.61 million.

Operations: The company generates CA$7.72 million in revenue from software-related sales and services.

Market Cap: CA$37.61M

NamSys Inc., with a market cap of CA$37.61 million, has shown consistent financial stability and growth in the software solutions sector for currency management. The company reported earnings growth of 21.8% over the past year, surpassing industry averages, while maintaining high net profit margins at 31.5%. Its financial health is underscored by being debt-free and having short-term assets significantly exceed liabilities. Despite significant insider selling recently, NamSys has not diluted shareholders' value meaningfully over the past year. Additionally, its experienced board contributes to strategic oversight as evidenced in recent presentations at industry conferences like Planet MicroCap Showcase: Toronto 2025.

- Get an in-depth perspective on NamSys' performance by reading our balance sheet health report here.

- Explore historical data to track NamSys' performance over time in our past results report.

Western Investment Company of Canada (TSXV:WI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Western Investment Company of Canada Limited is a private equity firm focused on buyout and middle market investments, with a market cap of CA$106.43 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: CA$106.43M

Western Investment Company of Canada Limited, with a market cap of CA$106.43 million, recently reported third-quarter sales of CA$10.02 million and net income growth from the previous year. The company has become profitable this year, supported by high-quality earnings and strong financial health with short-term assets exceeding both short- and long-term liabilities. Despite a new management team, Western's debt reduction strategy is evident in its decreased debt-to-equity ratio over five years. The recent appointment of Keith Lau as Chief Actuary strengthens its strategic direction in the insurance sector while ensuring regulatory compliance and actuarial best practices are upheld.

- Navigate through the intricacies of Western Investment Company of Canada with our comprehensive balance sheet health report here.

- Gain insights into Western Investment Company of Canada's past trends and performance with our report on the company's historical track record.

Next Steps

- Navigate through the entire inventory of 386 TSX Penny Stocks here.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com