Novavax (NASDAQ:NVAX) Surprises With Q3 CY2025 Sales

Vaccine biotechnology company Novavax (NASDAQ:NVAX) beat Wall Street’s revenue expectations in Q3 CY2025, but sales fell by 16.6% year on year to $70.45 million. The company expects the full year’s revenue to be around $1.05 billion, close to analysts’ estimates. Its non-GAAP loss of $1.25 per share was 10.5% below analysts’ consensus estimates.

Is now the time to buy Novavax? Find out by accessing our full research report, it’s free for active Edge members.

Novavax (NVAX) Q3 CY2025 Highlights:

- Revenue: $70.45 million vs analyst estimates of $43.75 million (16.6% year-on-year decline, 61% beat)

- Adjusted EPS: -$1.25 vs analyst expectations of -$1.13 (10.5% miss)

- Adjusted EBITDA: -$171.4 million (-243% margin, 41.3% year-on-year decline)

- Operating Margin: -253%, down from -159% in the same quarter last year

- Free Cash Flow was $105.8 million, up from -$146.8 million in the same quarter last year

- Market Capitalization: $1.09 billion

Company Overview

Pioneering a nanoparticle technology that mimics the molecular structure of disease pathogens, Novavax (NASDAQ:NVAX) develops and commercializes protein-based vaccines for infectious diseases, with a primary focus on its COVID-19 vaccine and combination respiratory vaccine candidates.

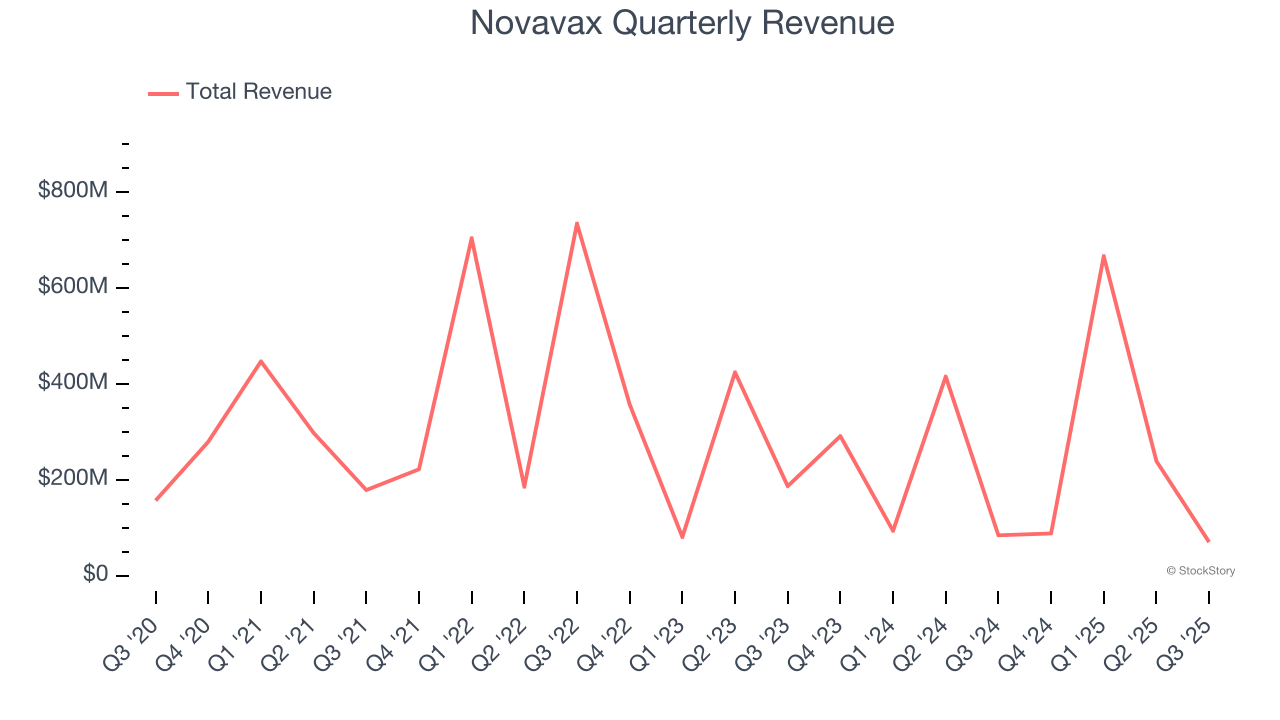

Revenue Growth

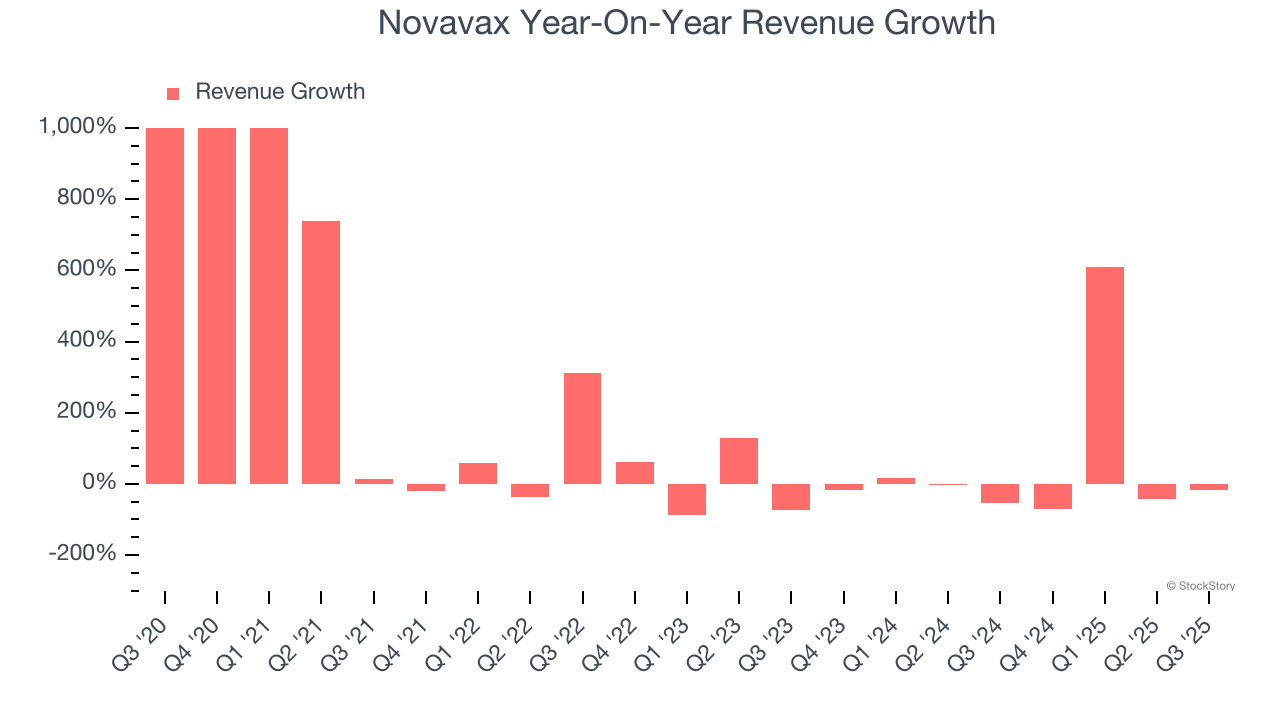

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Novavax’s 40.1% annualized revenue growth over the last five years was incredible. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Novavax’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

This quarter, Novavax’s revenue fell by 16.6% year on year to $70.45 million but beat Wall Street’s estimates by 61%.

Looking ahead, sell-side analysts expect revenue to decline by 32.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

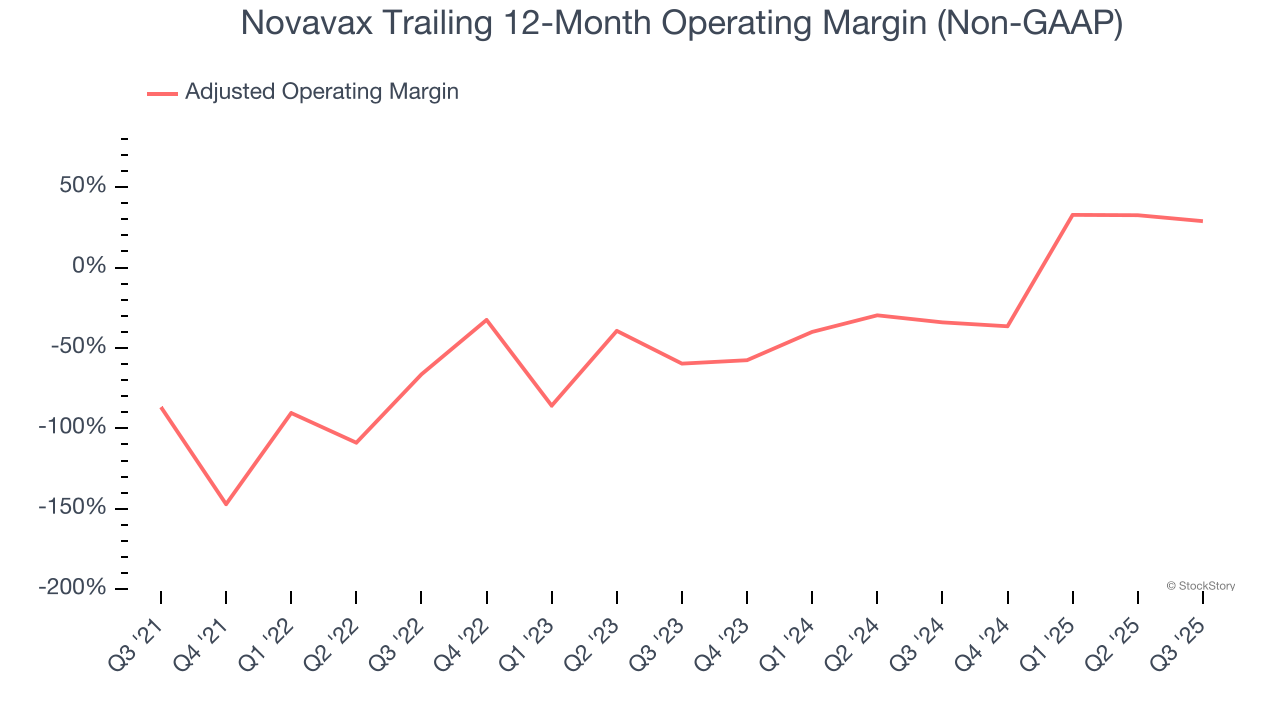

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Novavax’s high expenses have contributed to an average adjusted operating margin of negative 47.8% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Novavax’s adjusted operating margin rose over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 88.6 percentage points on a two-year basis.

This quarter, Novavax generated a negative 253% adjusted operating margin.

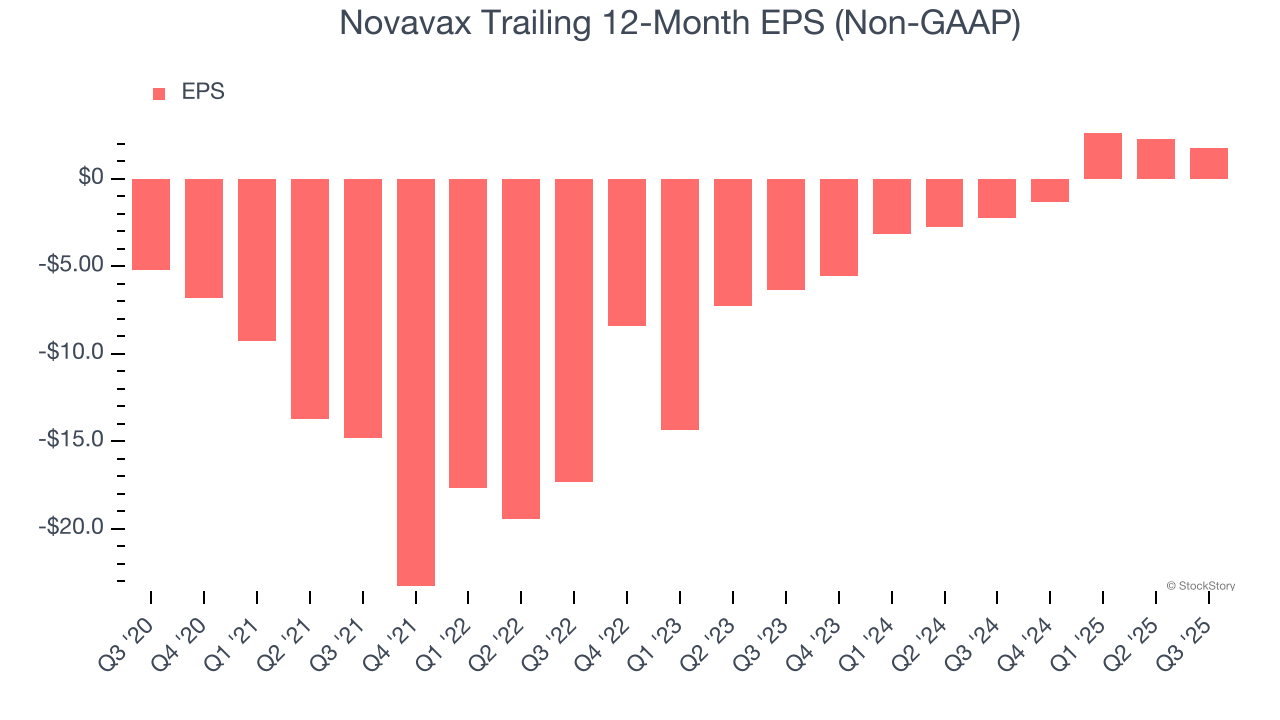

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Novavax’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, Novavax reported adjusted EPS of negative $1.25, down from negative $0.76 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Novavax to perform poorly. Analysts forecast its full-year EPS of $1.78 will invert to negative negative $0.79.

Key Takeaways from Novavax’s Q3 Results

We were impressed by how significantly Novavax blew past analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $6.69 immediately following the results.

Is Novavax an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.