Global's Top Growth Companies With Insider Ownership January 2026

As global markets continue to show resilience, with U.S. indices like the S&P 500 and Dow Jones Industrial Average reaching record highs amid AI optimism and robust economic growth, investors are increasingly focusing on companies that combine strong growth potential with significant insider ownership. In this context, a good stock often exhibits not only promising financial prospects but also a high level of commitment from those within the company, suggesting confidence in its future trajectory.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's dive into some prime choices out of the screener.

Techwing (KOSDAQ:A089030)

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc. develops, manufactures, sells, and services semiconductor inspection equipment in South Korea and internationally, with a market cap of ₩1.62 trillion.

Operations: Techwing, Inc., along with its subsidiaries, focuses on the development, manufacturing, sales, and servicing of semiconductor inspection equipment both domestically in South Korea and internationally.

Insider Ownership: 19.1%

Earnings Growth Forecast: 96.3% p.a.

Techwing's recent earnings report showed a decline in sales and a net loss for the third quarter, yet its nine-month figures reveal strong net income growth. The company is forecasted to achieve high revenue growth of 65.2% annually, outpacing the market significantly. Despite current financial challenges, Techwing is expected to become profitable within three years with substantial projected earnings growth. However, interest payments are not well covered by current earnings and there has been no significant insider trading activity recently.

- Dive into the specifics of Techwing here with our thorough growth forecast report.

- Our expertly prepared valuation report Techwing implies its share price may be too high.

Satrec Initiative (KOSDAQ:A099320)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Satrec Initiative Co., Ltd. and its subsidiaries provide Earth observation mission solutions globally, with a market cap of ₩751.26 billion.

Operations: Satrec Initiative Co., Ltd. generates revenue through its global provision of Earth observation mission solutions.

Insider Ownership: 12.2%

Earnings Growth Forecast: 37.6% p.a.

Satrec Initiative's earnings report for Q3 2025 highlights strong year-over-year growth, with sales reaching KRW 2.59 billion and net income at KRW 2.42 billion. Despite a decline in profit margins from the previous year, the company is poised for significant annual earnings growth of over 37%, surpassing market expectations. Revenue growth is projected to outpace the Korean market, although share price volatility remains high. No recent insider trading activity has been reported.

- Click here to discover the nuances of Satrec Initiative with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Satrec Initiative is trading beyond its estimated value.

PharmaResearch (KOSDAQ:A214450)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating primarily in South Korea, with a market cap of ₩4.19 trillion.

Operations: The company, along with its subsidiaries, generates revenue primarily from its pharmaceuticals segment, amounting to ₩496.03 billion.

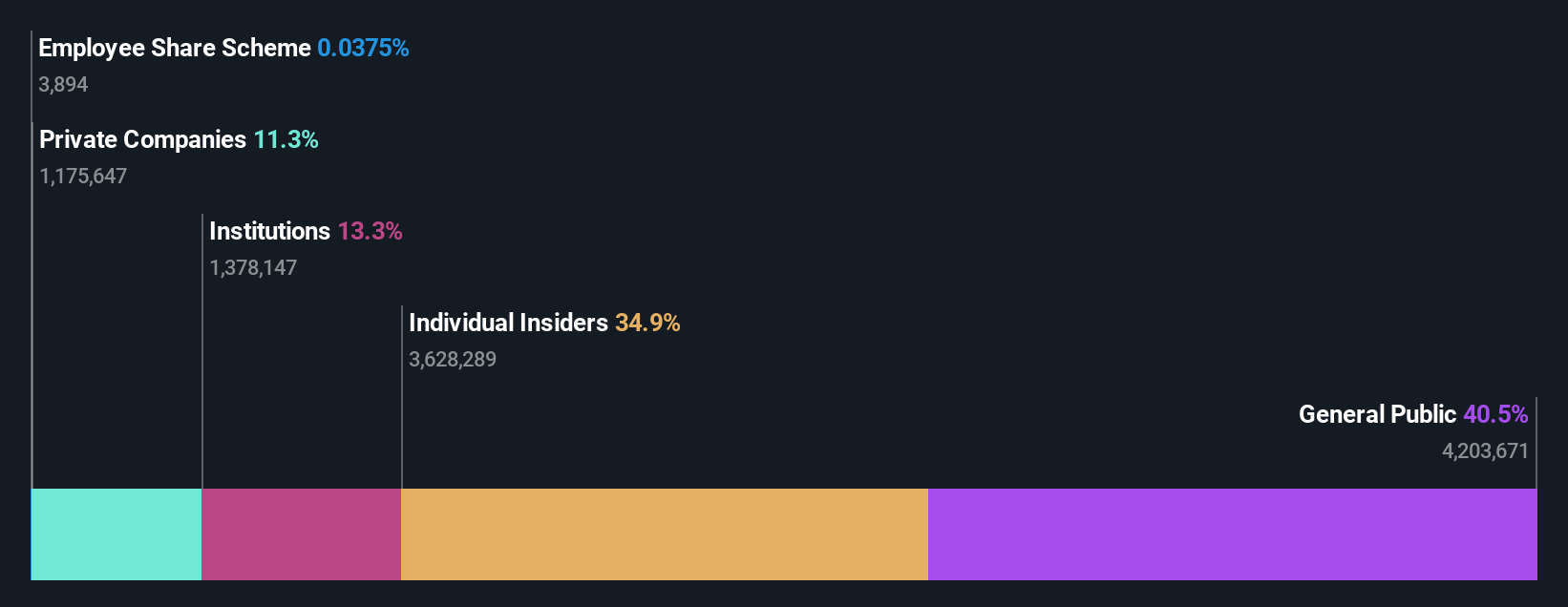

Insider Ownership: 34.9%

Earnings Growth Forecast: 28.7% p.a.

PharmaResearch's earnings are forecast to grow 28.73% annually, with revenue expected to increase at 25.6% per year, surpassing the Korean market growth rate. Despite a volatile share price recently, the stock is trading at 50.3% below its estimated fair value and analysts anticipate a potential price rise of 72.7%. The company has been actively participating in multiple corporate conferences but there is no recent insider trading activity reported over the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of PharmaResearch.

- Upon reviewing our latest valuation report, PharmaResearch's share price might be too pessimistic.

Make It Happen

- Embark on your investment journey to our 854 Fast Growing Global Companies With High Insider Ownership selection here.

- Want To Explore Some Alternatives? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com