Shareholders Should Be Pleased With Westinghouse Air Brake Technologies Corporation's (NYSE:WAB) Price

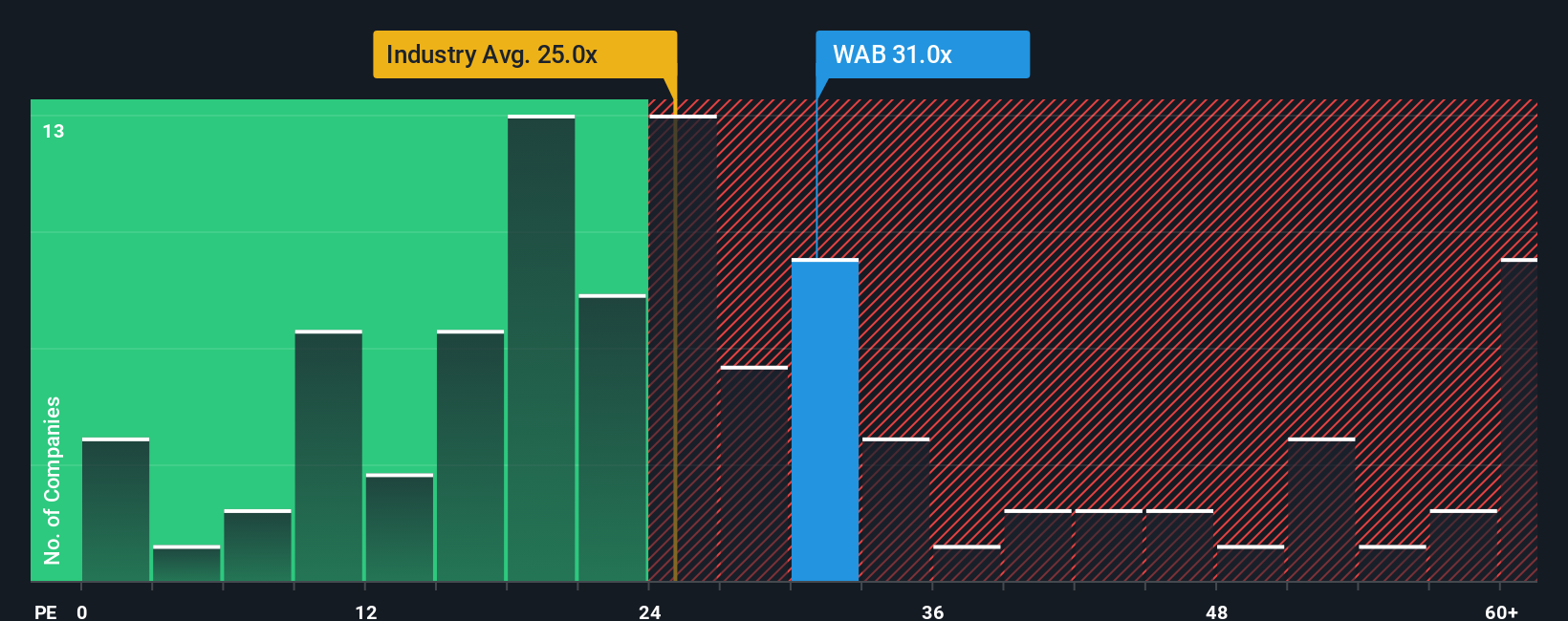

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider Westinghouse Air Brake Technologies Corporation (NYSE:WAB) as a stock to avoid entirely with its 31x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Westinghouse Air Brake Technologies has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Westinghouse Air Brake Technologies

Does Growth Match The High P/E?

Westinghouse Air Brake Technologies' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 15%. This was backed up an excellent period prior to see EPS up by 90% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 24% as estimated by the twelve analysts watching the company. That's shaping up to be materially higher than the 16% growth forecast for the broader market.

In light of this, it's understandable that Westinghouse Air Brake Technologies' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Westinghouse Air Brake Technologies' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Westinghouse Air Brake Technologies maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Westinghouse Air Brake Technologies that you should be aware of.

If you're unsure about the strength of Westinghouse Air Brake Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.