January 2026 Penny Stocks With Promising Potential

As 2025 concluded, major U.S. stock indexes posted impressive double-digit gains despite a late-year decline, driven largely by advances in technology firms. For investors looking beyond the well-known giants, penny stocks—typically representing smaller or newer companies—remain an intriguing area of exploration. While the term may seem outdated, these stocks can still offer compelling opportunities when backed by strong financial health and potential for growth.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.49 | $533.62M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8251 | $141.11M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.27 | $550.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.11 | $1.27B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.07 | $528.35M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.95 | $1.05B | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.99105 | $7.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.95 | $89.49M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 343 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Stabilis Solutions (SLNG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Stabilis Solutions, Inc. is an energy transition company that offers turnkey clean energy solutions, focusing on liquefied natural gas (LNG) production, storage, transportation, and fueling for various North American markets with a market cap of $84.61 million.

Operations: The company generates revenue of $72.27 million from its liquefied natural gas (LNG) segment.

Market Cap: $84.61M

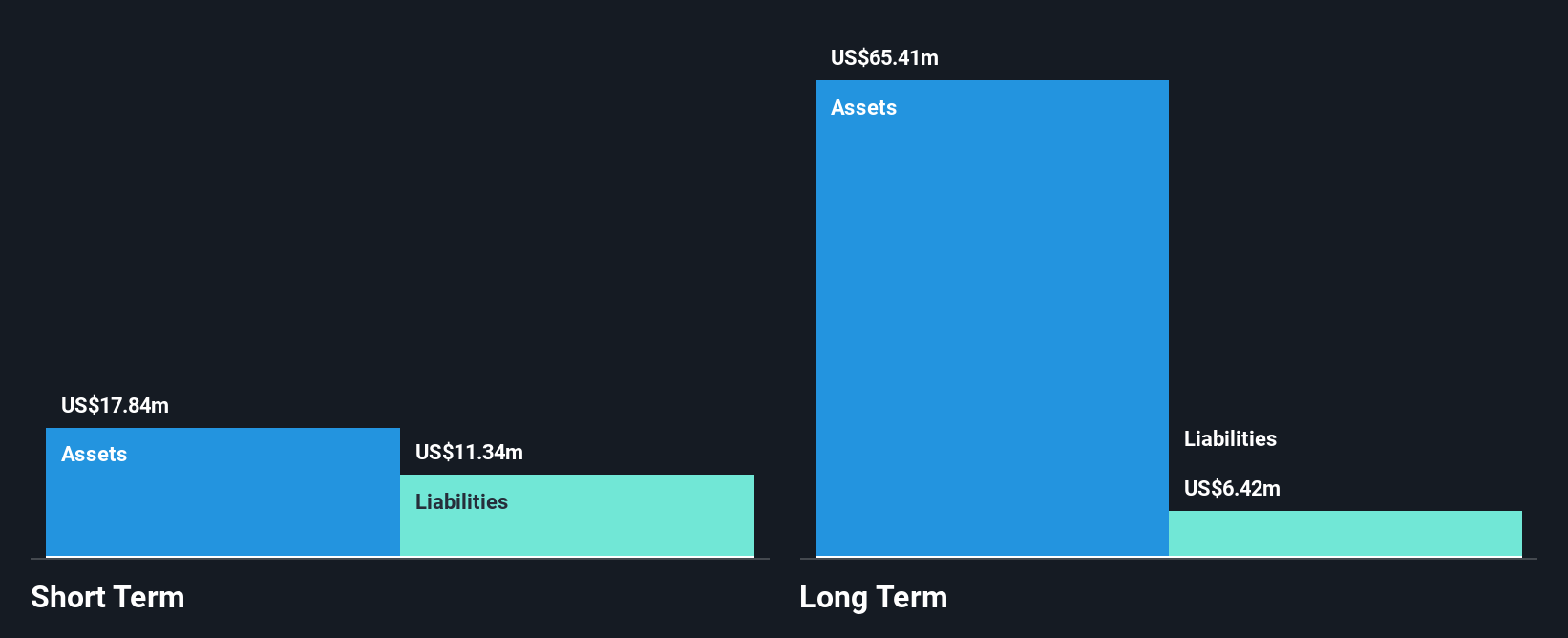

Stabilis Solutions, Inc., with a market cap of US$84.61 million, focuses on LNG solutions and reported third-quarter sales of US$20.33 million, an increase from the previous year. Despite this growth, net income for the nine months ending September 2025 showed a loss of US$1.09 million compared to a profit in the prior year. The company has managed its debt well with cash exceeding total debt and short-term assets covering liabilities effectively. However, earnings are forecasted to decline significantly over the next three years, highlighting potential challenges in maintaining profitability amidst industry volatility.

- Unlock comprehensive insights into our analysis of Stabilis Solutions stock in this financial health report.

- Gain insights into Stabilis Solutions' outlook and expected performance with our report on the company's earnings estimates.

VAALCO Energy (EGY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VAALCO Energy, Inc. is an independent energy company focused on the acquisition, exploration, development, and production of crude oil, natural gas, and natural gas liquids across Gabon, Egypt, Equatorial Guinea, Cote d'Ivoire, and Canada with a market cap of $379.50 million.

Operations: The company's revenue is primarily derived from its activities in the exploration and production of hydrocarbons, totaling $389.95 million.

Market Cap: $379.5M

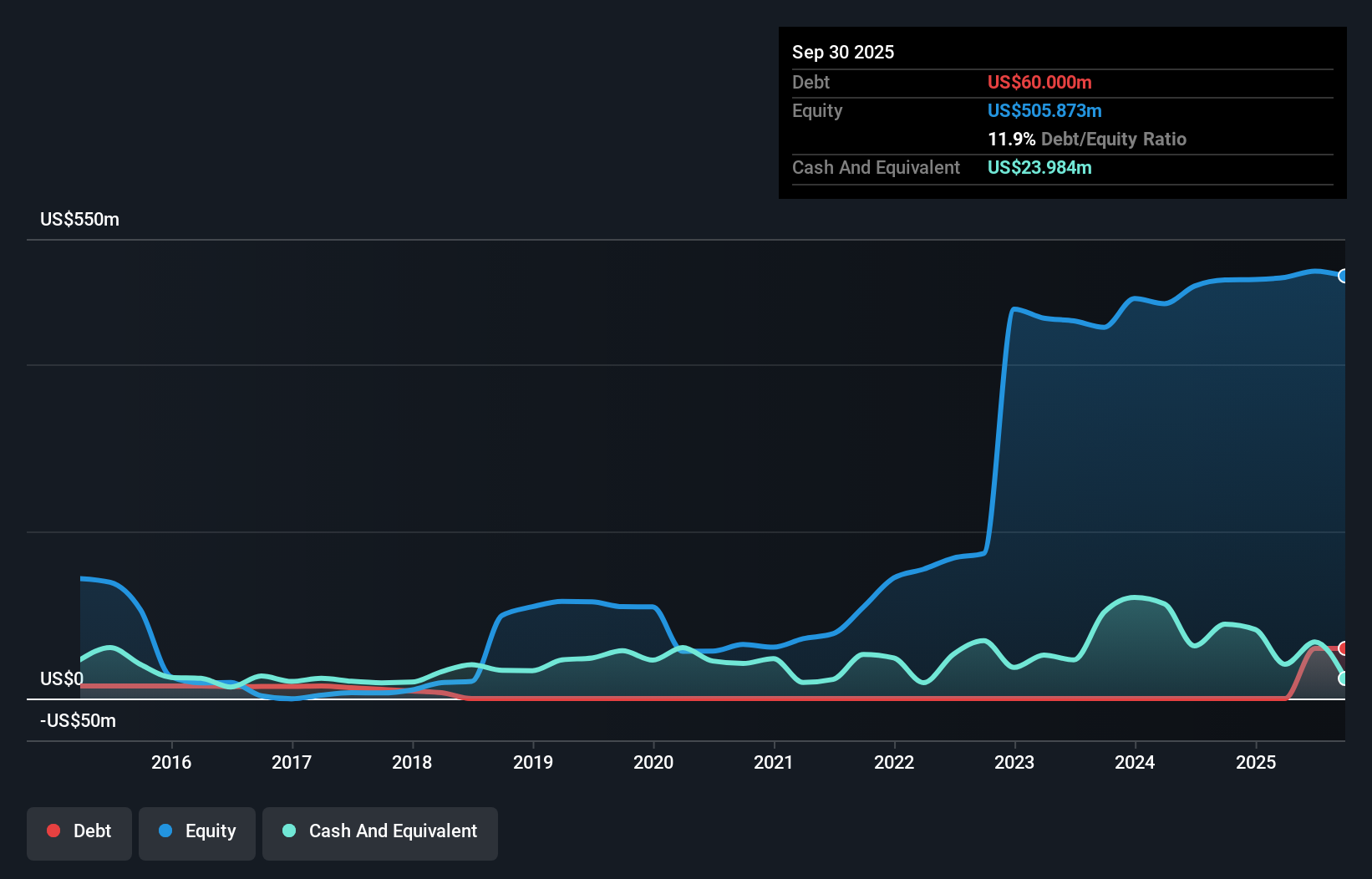

VAALCO Energy, Inc. has faced challenges with reduced net profit margins, dropping from 17.7% to 7.3% over the past year, and negative earnings growth of -68.5%. Despite this, the company maintains a satisfactory net debt to equity ratio of 7.1%, with its debt well covered by operating cash flow (186.7%). Recent activities include the commencement of its Phase Three Drilling Program offshore Gabon and a quarterly dividend declaration of $0.0625 per share for Q4 2025, indicating ongoing operational efforts and shareholder returns amidst financial pressures and industry volatility.

- Get an in-depth perspective on VAALCO Energy's performance by reading our balance sheet health report here.

- Evaluate VAALCO Energy's prospects by accessing our earnings growth report.

Tilly's (TLYS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tilly's, Inc. is a specialty retailer in the United States offering casual apparel, footwear, accessories, and hardgoods for young men and women as well as boys and girls, with a market cap of $60.64 million.

Operations: The company's revenue is primarily generated from its retail apparel segment, totaling $545.74 million.

Market Cap: $60.64M

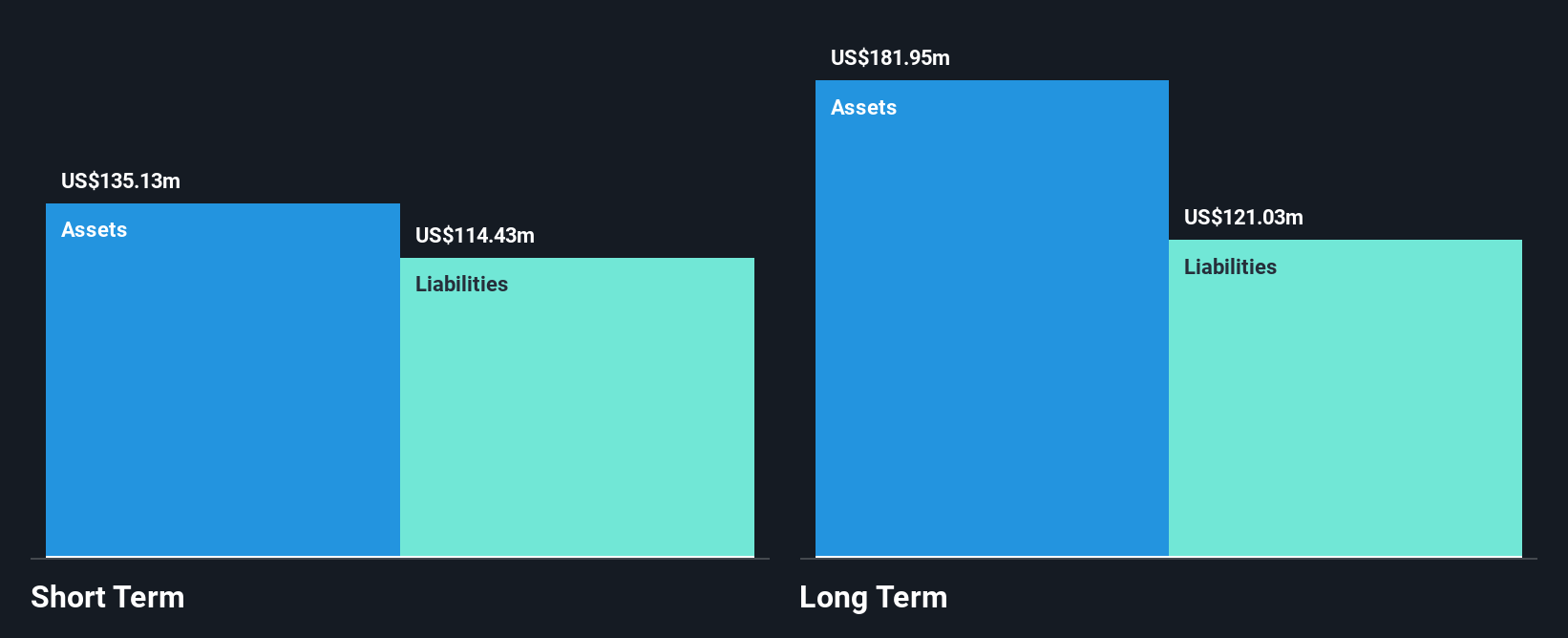

Tilly's, Inc., a specialty retailer, has shown financial challenges with an unprofitable status and increasing losses over the past five years. Despite having no debt and stable short-term assets exceeding liabilities, the company faces high volatility in its stock price. Recent earnings guidance for Q4 2026 anticipates net sales between US$146 million to US$151 million but projects a net loss of US$3.5 million to US$5.6 million. The third quarter results showed a reduced net loss of US$1.41 million compared to last year's larger deficit, indicating slight improvement amidst ongoing financial hurdles.

- Click here and access our complete financial health analysis report to understand the dynamics of Tilly's.

- Learn about Tilly's future growth trajectory here.

Key Takeaways

- Unlock our comprehensive list of 343 US Penny Stocks by clicking here.

- Searching for a Fresh Perspective? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com