UK Penny Stocks To Consider In January 2026

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weaker trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, penny stocks remain an intriguing investment area for those seeking growth opportunities in smaller or newer companies. While the term 'penny stocks' may seem outdated, these investments can still offer potential when backed by strong financial health and a promising outlook.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.665 | £16.71M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.30 | £493.82M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.925 | £155.52M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.06 | £16M | ✅ 2 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.745 | $433.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.52 | £184.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.525 | £73.64M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.46 | £39.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.135 | £182.65M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CyanConnode Holdings (AIM:CYAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CyanConnode Holdings plc designs, develops, and sells narrowband RF mesh and cellular networks for Omni IoT communications globally, with a market cap of £24.10 million.

Operations: The company's revenue is primarily derived from its Semiconductors segment, totaling £15.99 million.

Market Cap: £24.1M

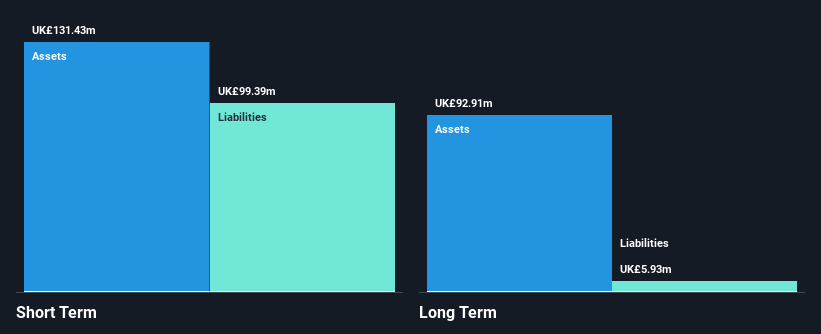

CyanConnode Holdings plc, with a market cap of £24.10 million, operates in the semiconductor sector and reported half-year sales of £7.44 million as of September 2025. Despite its revenue growth from the previous year, it remains unprofitable with a net loss of £3.07 million for the same period. The company's financial structure reveals high net debt to equity at 153.3%, though short-term assets cover both short and long-term liabilities comfortably. Recent capital infusion via a $5.25 million convertible loan note could help extend its brief cash runway beyond one month, providing essential liquidity support amidst ongoing losses.

- Unlock comprehensive insights into our analysis of CyanConnode Holdings stock in this financial health report.

- Learn about CyanConnode Holdings' historical performance here.

Premier Miton Group (AIM:PMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Premier Miton Group plc is a publicly owned investment manager with a market cap of £85.09 million.

Operations: The company generates £63.32 million in revenue from its asset management segment.

Market Cap: £85.09M

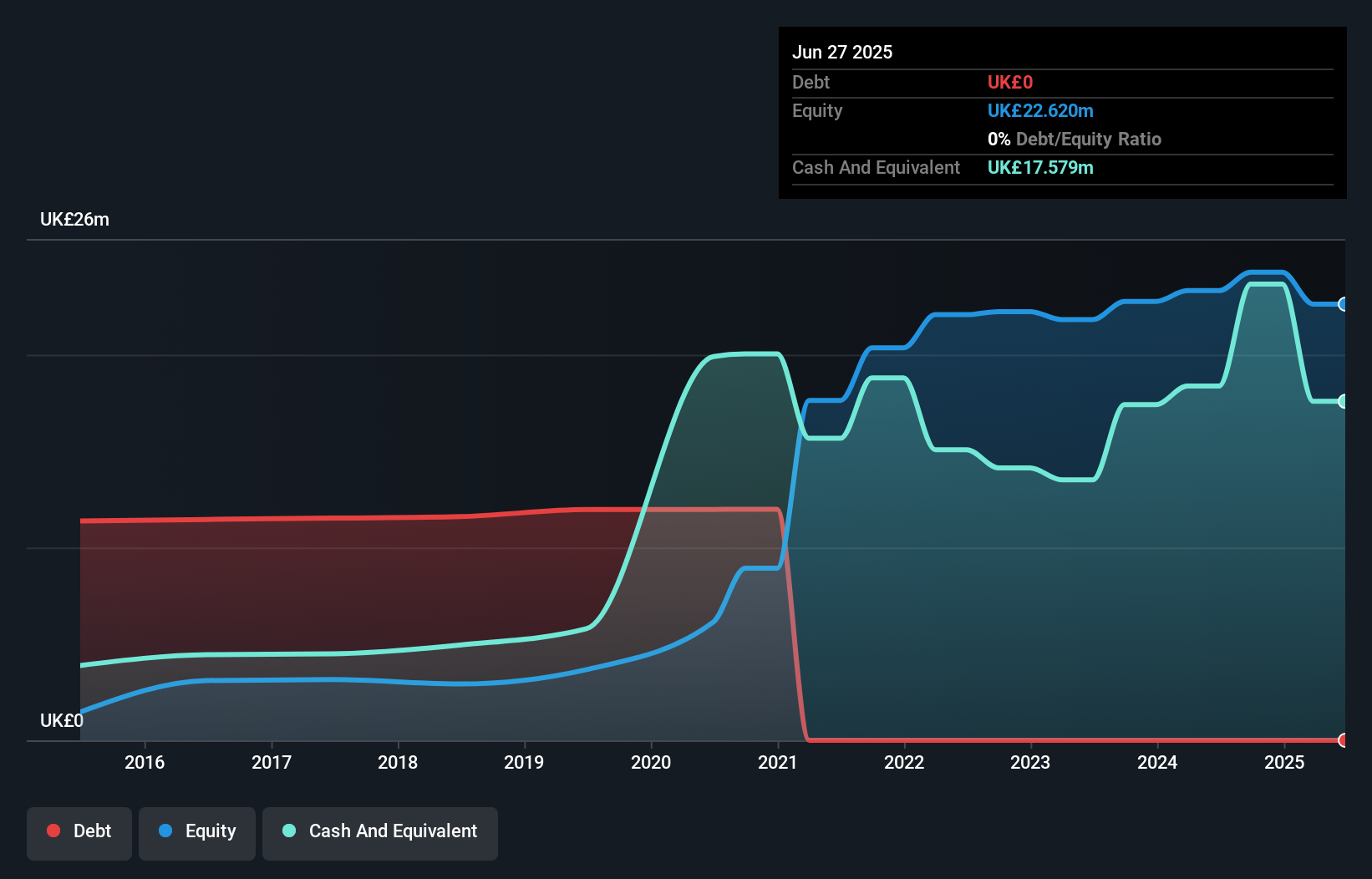

Premier Miton Group plc, with a market cap of £85.09 million, reported annual revenue of £63.32 million and net income of £1.22 million for the year ending September 2025, indicating a decline from the previous year. The company remains debt-free and its short-term assets exceed both short- and long-term liabilities, providing financial stability despite lower profit margins impacted by a significant one-off loss of £1.9 million. While earnings are forecast to grow significantly at 58.31% per year, the current dividend yield is not well supported by earnings or free cash flows, posing sustainability concerns amidst recent executive changes on the board.

- Click here to discover the nuances of Premier Miton Group with our detailed analytical financial health report.

- Learn about Premier Miton Group's future growth trajectory here.

Virgin Wines UK (AIM:VINO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Virgin Wines UK PLC is a direct-to-consumer online wine retailer in the United Kingdom with a market cap of £30.97 million.

Operations: The company generates revenue primarily from the sale of alcohol, amounting to £59.02 million.

Market Cap: £30.97M

Virgin Wines UK PLC, with a market cap of £30.97 million, maintains financial stability by having short-term assets (£27.8M) that exceed both its short- and long-term liabilities (£16.4M and £2.1M respectively). Despite being debt-free, the company faces challenges with declining earnings over the past five years and negative growth in recent periods compared to industry averages. Revenue is forecasted to grow at 9.23% annually; however, earnings are expected to decline by 4.1% per year over the next three years. The company trades significantly below estimated fair value but offers low return on equity (5.8%).

- Take a closer look at Virgin Wines UK's potential here in our financial health report.

- Assess Virgin Wines UK's future earnings estimates with our detailed growth reports.

Taking Advantage

- Get an in-depth perspective on all 295 UK Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com