Insider Picks For High Growth In January 2026

As the U.S. markets kick off 2026 with a mixed start following a four-session skid to close out 2025, investors are keenly observing the broader economic landscape shaped by recent advances in AI and fluctuating interest rates. In such an environment, companies with high insider ownership can signal confidence from those who know the business best, making them appealing choices for growth-focused portfolios amidst these market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 59% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.8% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.5% | 44% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

Here's a peek at a few of the choices from the screener.

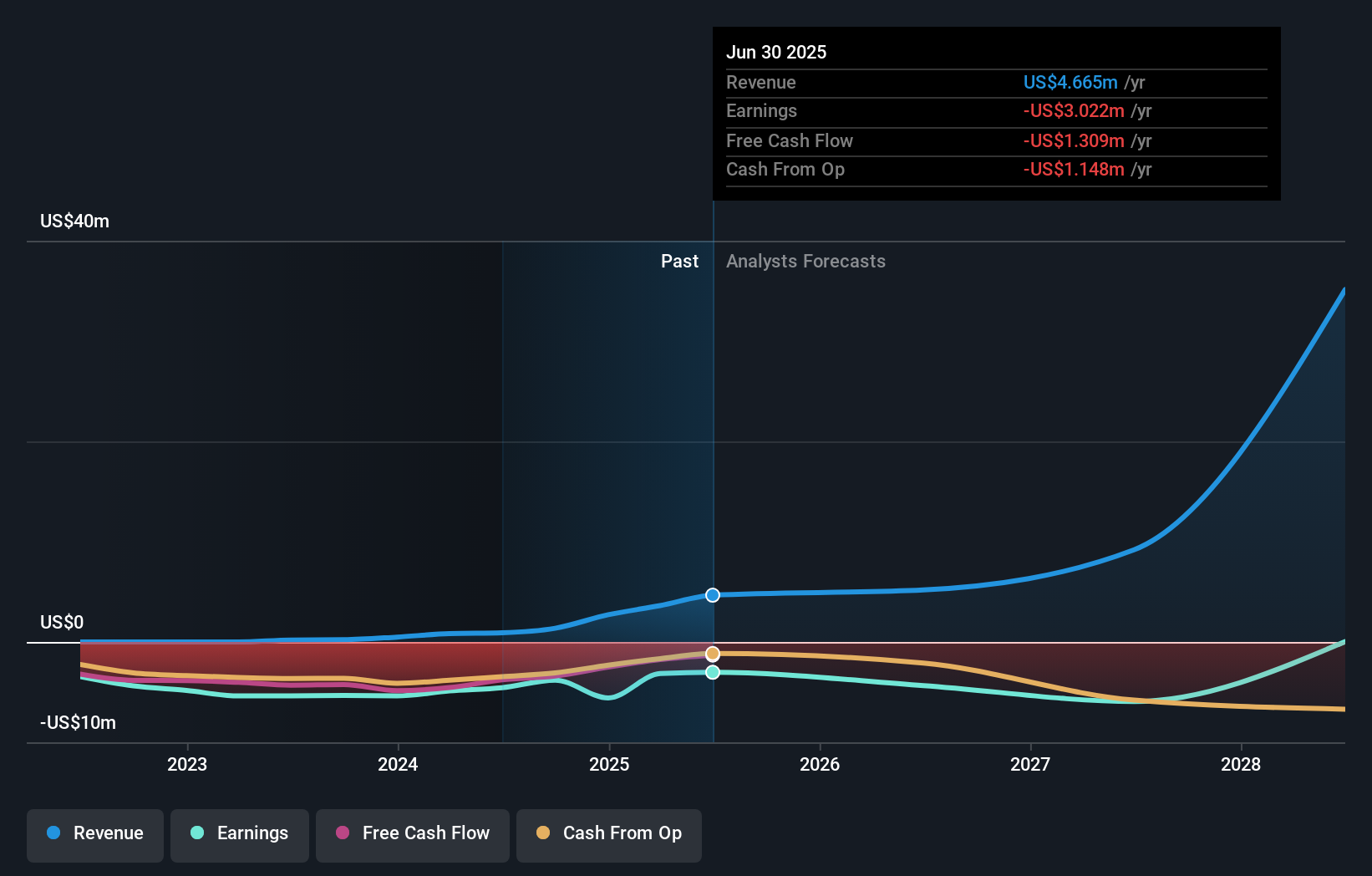

Aeluma (ALMU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aeluma, Inc. develops optoelectronic and electronic devices for sensing, communication, and computing applications in the United States with a market cap of $306.62 million.

Operations: Aeluma focuses on creating advanced devices for sensing, communication, and computing within the U.S. market.

Insider Ownership: 28.0%

Revenue Growth Forecast: 67.1% p.a.

Aeluma, Inc. has shown impressive revenue growth, with a recent quarterly increase to US$1.39 million from US$0.48 million year-on-year, and is expected to grow 67.1% annually, outpacing the market average. Despite high volatility in its share price and substantial shareholder dilution over the past year, insider activity shows more buying than selling recently. The company anticipates becoming profitable within three years, indicating strong growth potential despite current net losses.

- Dive into the specifics of Aeluma here with our thorough growth forecast report.

- Our expertly prepared valuation report Aeluma implies its share price may be too high.

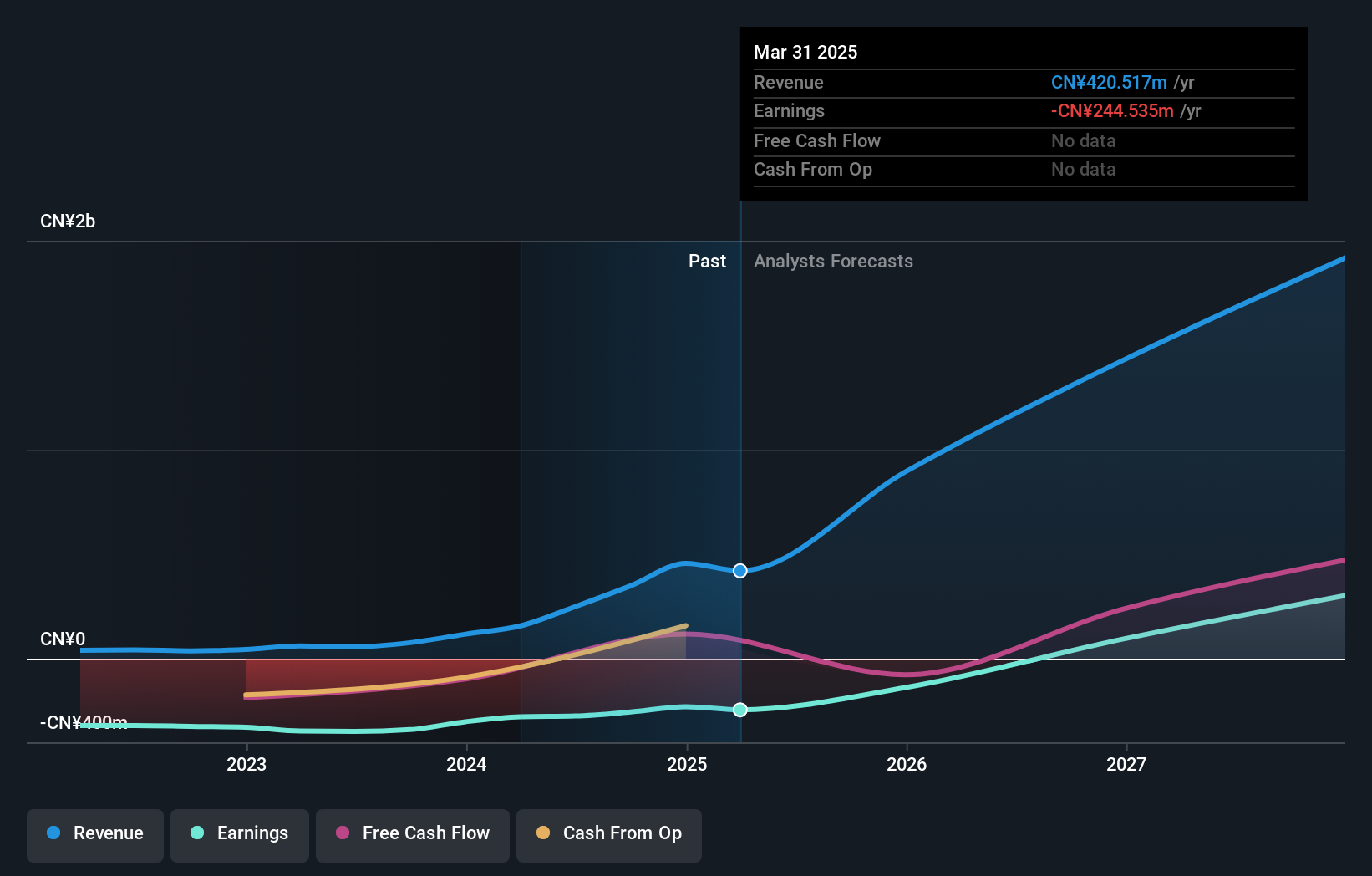

EHang Holdings (EH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EHang Holdings Limited is a technology platform company specializing in urban air mobility solutions across various regions, with a market cap of approximately $948 million.

Operations: The company's revenue primarily comes from its Aerospace & Defense segment, which generated CN¥430 million.

Insider Ownership: 27.8%

Revenue Growth Forecast: 34.4% p.a.

EHang Holdings is experiencing rapid revenue growth, forecasted at 34.4% annually, outpacing the US market. Despite recent quarterly sales declines to CNY 92.47 million and increased net losses, EHang's strategic initiatives in Thailand and Qatar highlight its commitment to advancing urban air mobility (UAM). The company aims for profitability within three years and maintains a strong insider ownership structure, which aligns with its long-term vision of global UAM expansion despite ongoing legal challenges in the US.

- Delve into the full analysis future growth report here for a deeper understanding of EHang Holdings.

- The valuation report we've compiled suggests that EHang Holdings' current price could be inflated.

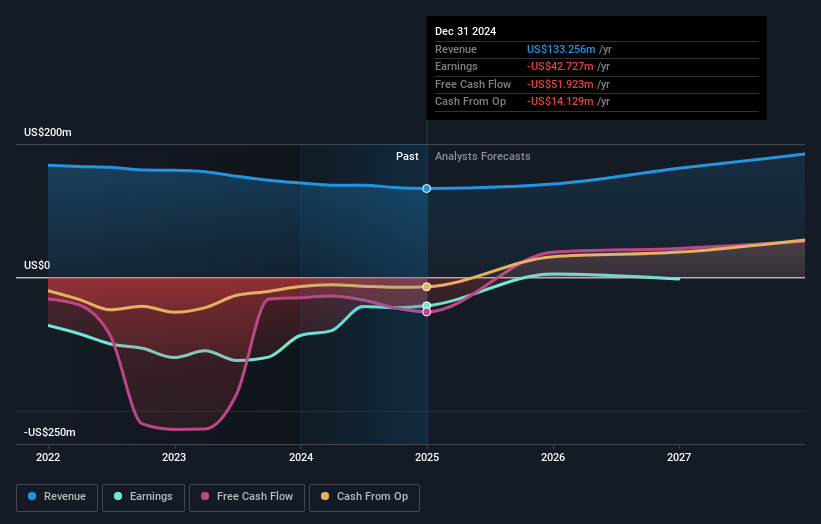

Agora (API)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service across the United States, China, and internationally, with a market cap of approximately $365.59 million.

Operations: The company generates revenue through its Internet Telephone segment, which accounted for $137.36 million.

Insider Ownership: 25%

Revenue Growth Forecast: 10.5% p.a.

Agora's earnings are expected to grow significantly at 62.71% annually, outpacing the US market. Recently, Agora announced its integration with Agnes AI, enhancing real-time collaboration through its ultra-low-latency SDRTN® technology. This partnership supports Agora's growth trajectory and global reach in AI-enhanced communication. The company has shown financial improvement with a net income of US$2.74 million for Q3 2025 compared to a loss last year and completed substantial share buybacks worth US$132.1 million since 2022.

- Click here and access our complete growth analysis report to understand the dynamics of Agora.

- The analysis detailed in our Agora valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Reveal the 213 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Seeking Other Investments? Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com