Exploring 3 High Growth Tech Stocks In The US Market

As the U.S. market rings in the new year with mixed performances across major indices, including a four-session skid to close out 2025, investors are closely watching the tech sector for signs of resilience and growth potential. In this environment, identifying high-growth tech stocks requires careful consideration of factors such as innovation capabilities and market adaptability, which can be crucial in navigating both challenges and opportunities presented by current economic conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 62.86% | 62.39% | ★★★★★★ |

| Sanmina | 31.01% | 33.24% | ★★★★★☆ |

| Palantir Technologies | 26.25% | 30.13% | ★★★★★★ |

| Workday | 11.13% | 32.18% | ★★★★★☆ |

| Kiniksa Pharmaceuticals International | 15.16% | 31.60% | ★★★★★☆ |

| Circle Internet Group | 20.75% | 84.58% | ★★★★★☆ |

| RenovoRx | 59.12% | 64.21% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Procore Technologies | 11.70% | 116.48% | ★★★★★☆ |

| Duos Technologies Group | 53.76% | 155.11% | ★★★★★☆ |

Click here to see the full list of 71 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Natera (NTRA)

Simply Wall St Growth Rating: ★★★★☆☆

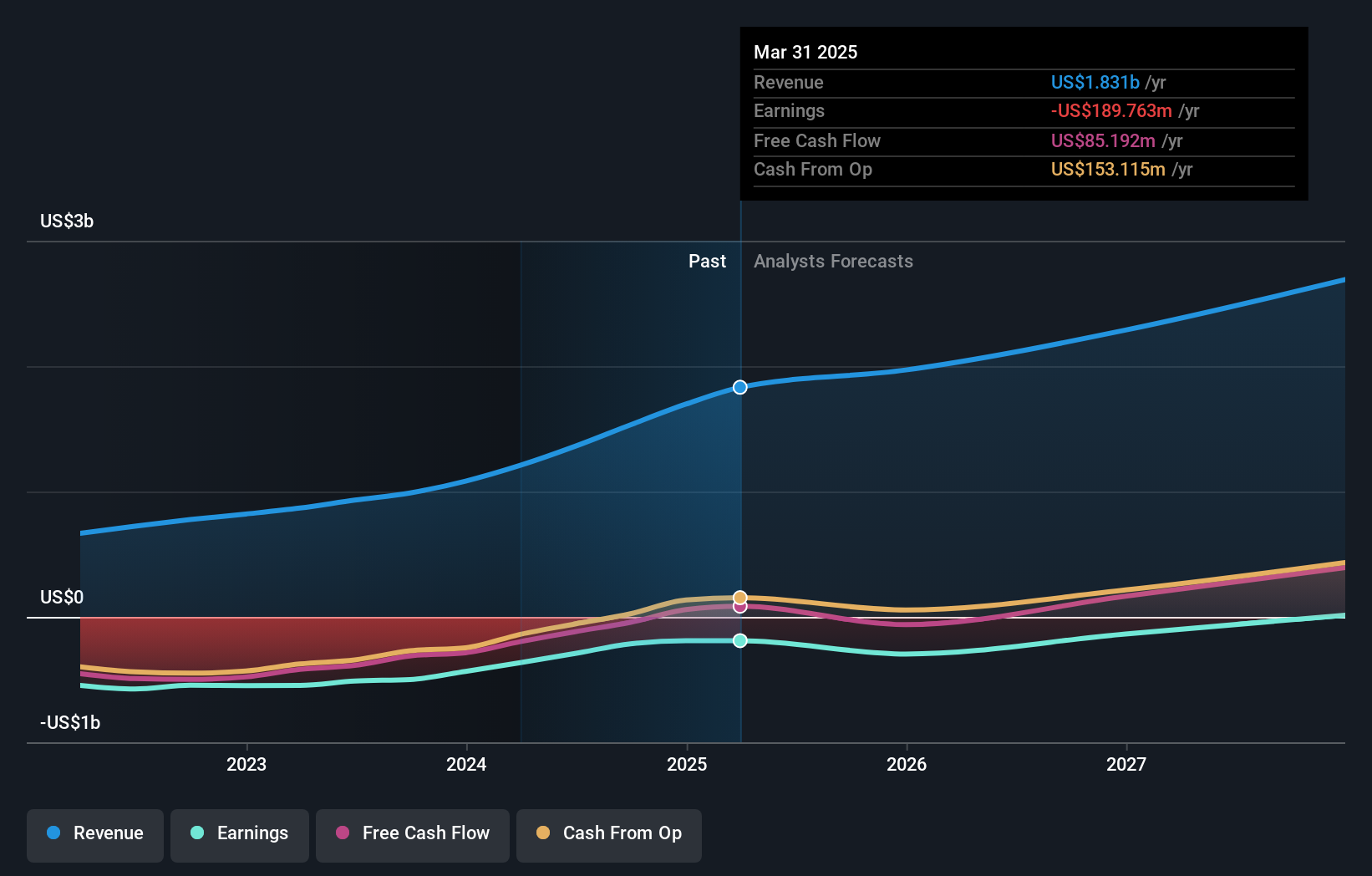

Overview: Natera, Inc. is a diagnostics company that offers molecular testing services globally and has a market cap of $31.69 billion.

Operations: The company generates revenue primarily through the development and commercialization of molecular testing services, amounting to $2.12 billion.

Natera's recent advancements underscore its commitment to enhancing cancer treatment precision. The company announced significant findings from the CALGB study, showing a 40% reduction in cancer recurrence with celecoxib post-surgery for colorectal cancer patients, spotlighting its Signatera test's capability in personalizing adjuvant therapy. Additionally, Natera's collaboration on the MiRaDoR study aims to refine breast cancer treatment further by monitoring ctDNA levels to predict therapeutic efficacy. These initiatives not only enhance patient outcomes but also position Natera at the forefront of targeted cancer therapies, leveraging molecular diagnostics to guide treatment decisions effectively.

Sanmina (SANM)

Simply Wall St Growth Rating: ★★★★★☆

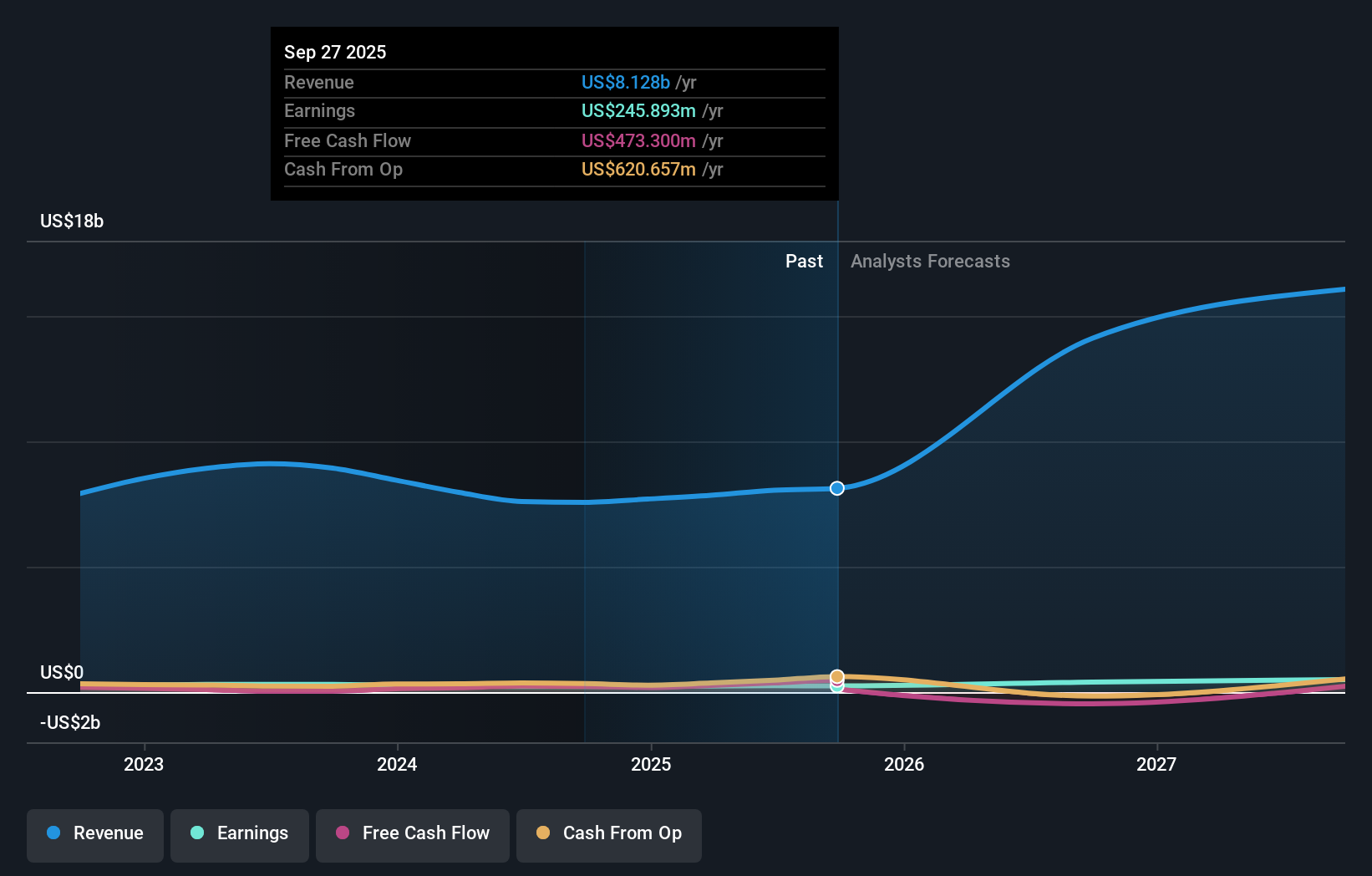

Overview: Sanmina Corporation offers integrated manufacturing solutions and a range of services including components, products, repair, logistics, and after-market support across the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of approximately $8.19 billion.

Operations: Sanmina generates revenue primarily from its Integrated Manufacturing Solutions (IMS) segment, contributing $6.56 billion, and the Components, Products and Services (CPS) segment, which adds $1.70 billion. The company's operations span multiple regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa.

Sanmina's strategic expansion into the energy sector with a new facility in Houston and collaboration with Koncar highlights its proactive approach to capturing growth in the U.S. energy market. This move, coupled with an impressive revenue forecast growth of 31% per year, positions Sanmina to leverage increasing demand for energy solutions. Additionally, its recent financial performance shows a robust annual earnings growth of 33.2%, underscoring its operational efficiency and market adaptability despite a highly volatile share price in recent months. These developments not only enhance Sanmina's portfolio but also align it with evolving industry needs, promising significant future prospects as it continues to innovate and expand its market footprint.

- Click here to discover the nuances of Sanmina with our detailed analytical health report.

Explore historical data to track Sanmina's performance over time in our Past section.

Procore Technologies (PCOR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Procore Technologies, Inc. offers a cloud-based construction management platform and related services globally, with a market cap of approximately $11.31 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $1.28 billion. Its cloud-based platform supports construction management needs across various regions, contributing significantly to its financial performance.

Procore Technologies has demonstrated resilience and adaptability in a dynamic market, with a notable revenue forecast of $1.31 billion for 2025, marking a robust growth of 14% year-over-year. The company's strategic focus on AI through its Procore Helix platform underscores its commitment to innovation, particularly with the introduction of new features like multilingual support and mobile capabilities that enhance user engagement and operational efficiency. Recent board changes and an aggressive share buyback program, repurchasing shares worth $128.82 million, reflect proactive governance and confidence in its financial strategy. As Procore continues to integrate cutting-edge technology into its offerings, it remains well-positioned to capitalize on evolving industry trends despite facing challenges in achieving profitability.

Taking Advantage

- Navigate through the entire inventory of 71 US High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com