After Leaping 29% Wonik IPS Co., Ltd. (KOSDAQ:240810) Shares Are Not Flying Under The Radar

Despite an already strong run, Wonik IPS Co., Ltd. (KOSDAQ:240810) shares have been powering on, with a gain of 29% in the last thirty days. The last month tops off a massive increase of 245% in the last year.

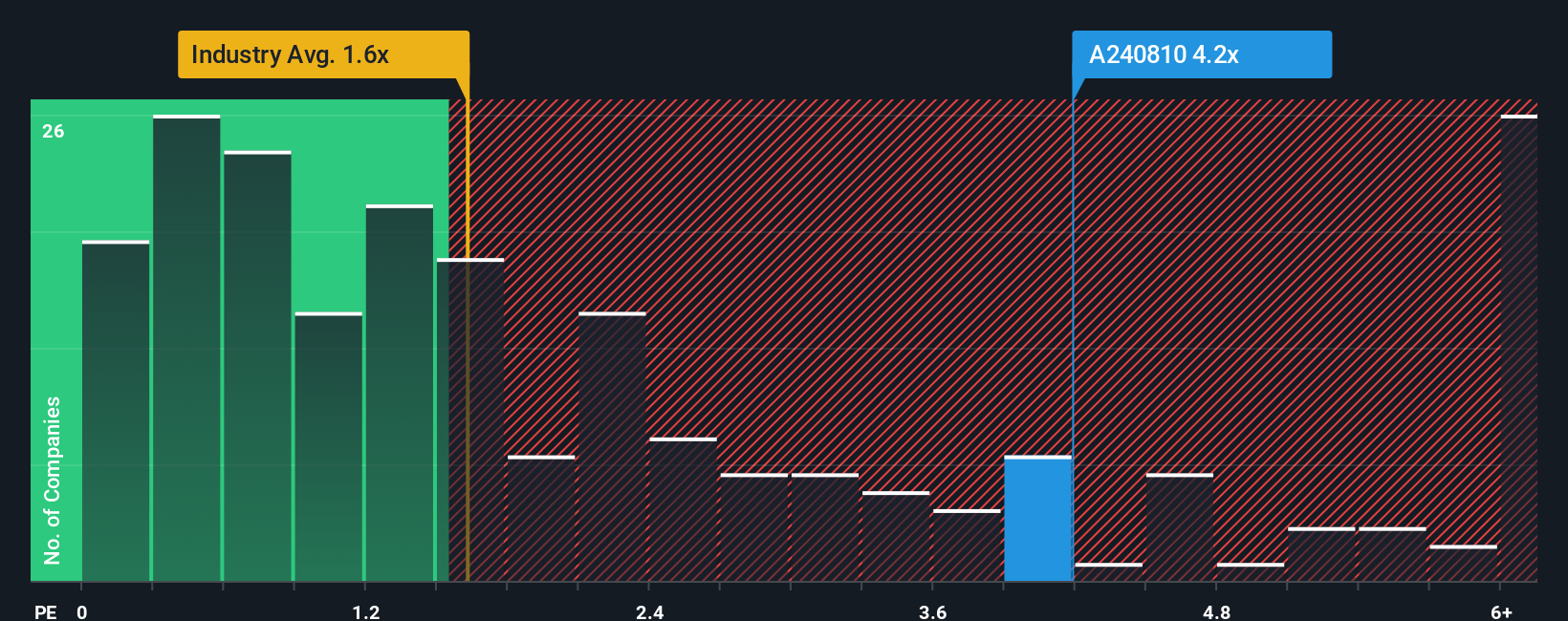

After such a large jump in price, when almost half of the companies in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Wonik IPS as a stock not worth researching with its 4.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Wonik IPS

What Does Wonik IPS' Recent Performance Look Like?

Wonik IPS could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Wonik IPS' future stacks up against the industry? In that case, our free report is a great place to start.How Is Wonik IPS' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Wonik IPS' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. As a result, it also grew revenue by 7.7% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 16% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 8.4% per year, which is noticeably less attractive.

In light of this, it's understandable that Wonik IPS' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Wonik IPS' P/S?

Wonik IPS' P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Wonik IPS maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Wonik IPS you should be aware of.

If you're unsure about the strength of Wonik IPS' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.