Market Might Still Lack Some Conviction On Amper, S.A. (BME:AMP) Even After 29% Share Price Boost

Amper, S.A. (BME:AMP) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 58%.

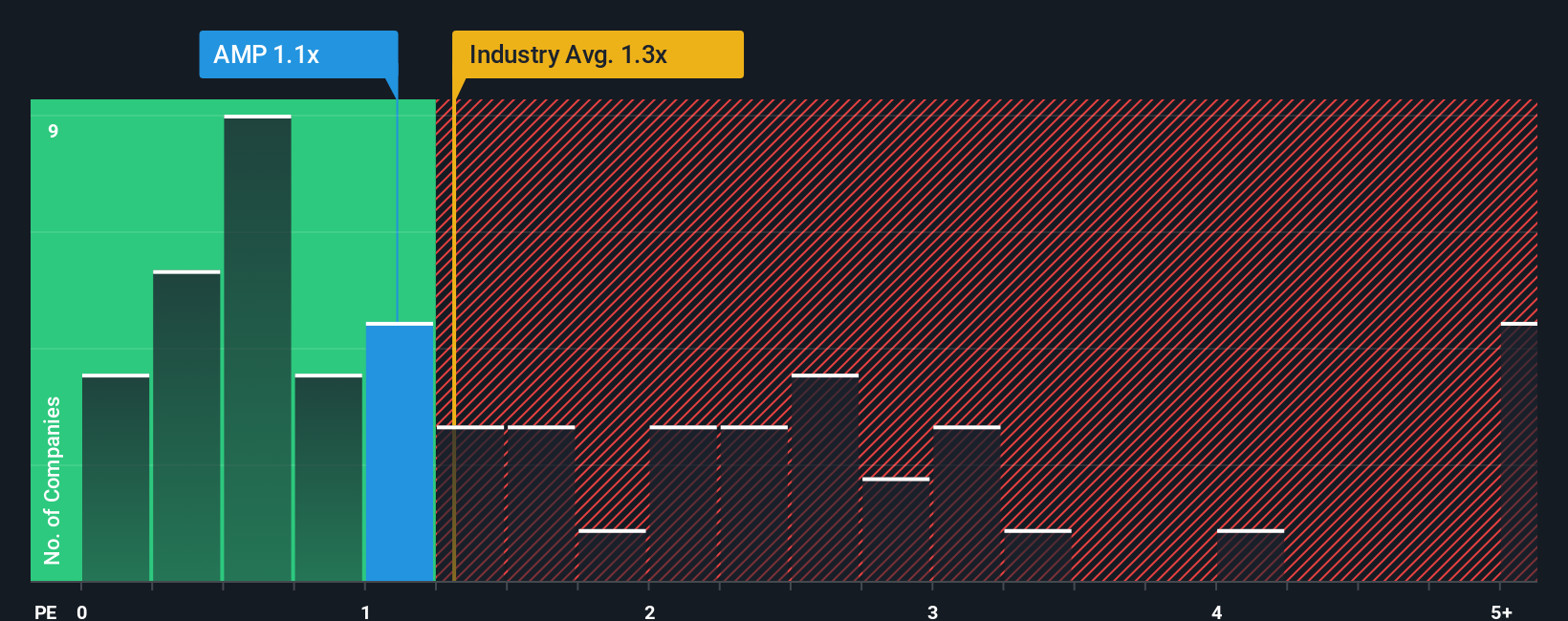

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Amper's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Communications industry in Spain is also close to 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Amper

What Does Amper's P/S Mean For Shareholders?

Amper hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Amper's future stacks up against the industry? In that case, our free report is a great place to start.How Is Amper's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Amper's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.7% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 15% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 11% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 2.2% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Amper's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Amper's P/S Mean For Investors?

Amper's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Amper's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Amper is showing 4 warning signs in our investment analysis, and 3 of those shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.