Cyrela Brazil Realty S.A. Empreendimentos e Participações (BVMF:CYRE3) Stock's 35% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Cyrela Brazil Realty S.A. Empreendimentos e Participações (BVMF:CYRE3) shareholders won't be pleased to see that the share price has had a very rough month, dropping 35% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 46%, which is great even in a bull market.

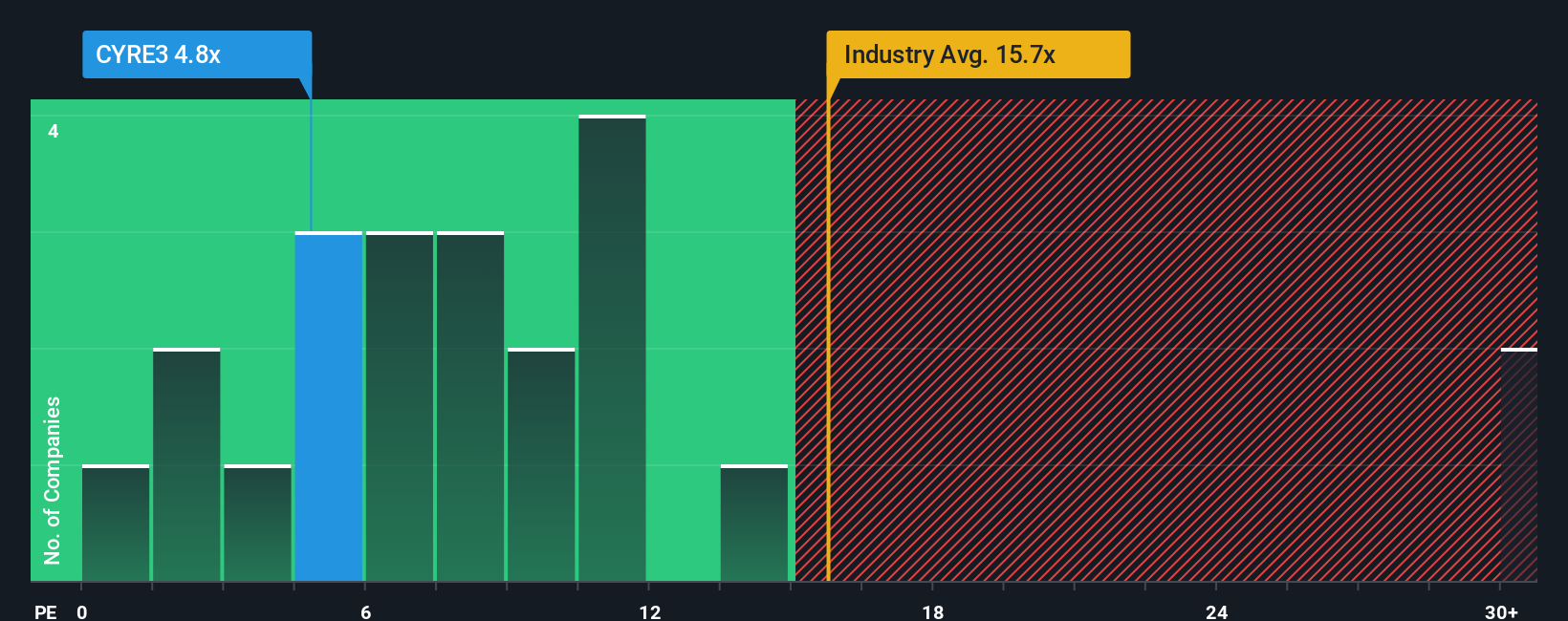

Although its price has dipped substantially, Cyrela Brazil Realty Empreendimentos e Participações' price-to-earnings (or "P/E") ratio of 4.8x might still make it look like a strong buy right now compared to the market in Brazil, where around half of the companies have P/E ratios above 10x and even P/E's above 17x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been advantageous for Cyrela Brazil Realty Empreendimentos e Participações as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Cyrela Brazil Realty Empreendimentos e Participações

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Cyrela Brazil Realty Empreendimentos e Participações' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 35% gain to the company's bottom line. Pleasingly, EPS has also lifted 131% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 15% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 16% each year, which is not materially different.

With this information, we find it odd that Cyrela Brazil Realty Empreendimentos e Participações is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Cyrela Brazil Realty Empreendimentos e Participações' P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Cyrela Brazil Realty Empreendimentos e Participações' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Cyrela Brazil Realty Empreendimentos e Participações that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.