IPO News | Everweft Lithium Energy (300014.SZ) Second Listing Hong Kong Stock Exchange Ranks Third Among Global Consumer Battery Manufacturers

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on January 2, Huizhou Everway Lithium Energy Co., Ltd. (300014.SZ) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CITIC Securities is its sole sponsor. The company submitted a listing application to the Hong Kong Stock Exchange on June 30, 2025.

Company profile

According to the prospectus, Everweft Lithium Energy is one of the few lithium battery platform companies in the world that is leading the world in the fields of consumer batteries, power batteries, and energy storage batteries, and can serve all social and economic scenarios. Everweft Lithium has taken a leading position in the three business fields of consumer batteries, power batteries, and energy storage batteries. It has established a comprehensive R&D platform for covering materials, batteries, BMS, and systems. Its products are widely used in smart living, green transportation, and energy transformation.

As of the last practical date, Everweft Lithium Energy relies on a global development strategy with “global manufacturing, global cooperation, and global service” as the core. Currently, it has eight production bases and two production bases under construction around the world. Sales companies and offices cover 7 countries and regions, and after-sales service outlets cover 24 countries and regions.

Everweft Lithium has strong competitiveness in the fields of consumer batteries, power batteries, and energy storage batteries, and has achieved many impressive achievements - in terms of shipments, the company has grown faster than the industry in the past three years. Consumer batteries are an important part of the Internet of Everything. Everweft Lithium is a global leader in the consumer battery sector and ranks third among global consumer battery manufacturers (based on 2024 shipments), with a market share of 11.7%. Energy storage batteries are the key to creating economic benefits in the new energy era. Everweft Lithium is at the leading level in the field of energy storage batteries and ranks second in the global market (based on 2024 shipments), with a market share of 17.2%.

Financial data

revenue

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company achieved revenue of approximately RMB 36.304 billion, RMB 48.784 billion, RMB 48.615 billion, and RMB 45.2 billion, respectively.

Profit during the year

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded annual profits of approximately RMB 3,672 billion, RMB 4.520 billion, RMB 4.221 billion, and RMB 2,977 billion, respectively.

Mouri

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded gross profit of 5.786 billion yuan, 8.119 billion yuan, 8.465 billion yuan, and 7.18 billion yuan, respectively.

Industry Overview

The global consumer battery market is technology-driven and has the characteristics of diversified demand and favorable policies. From 2020 to 2024, total global consumer battery shipments increased from 9.9 billion to 17.7 billion, with a compound annual growth rate of 15.9%. This growth is due to the expansion of downstream industries such as consumer electronics and automotive electronics, as well as upgrades in battery technology. In the future, the popularity of 5G devices and the low-altitude economy will continue to drive demand. According to estimates, shipments will increase from 21.7 billion units in 2025 to 55.1 billion units in 2029, with a compound annual growth rate of 26.2%, indicating that the market will continue to expand.

Global sales of electric vehicles increased from 5,482.9 thousand units in 2020 to 26,510.2 thousand units in 2024, with a compound annual growth rate of 48.3%. During the forecast period, thanks to technological progress and innovation in electric vehicles, optimization of the industrial chain, policy promotion and support in many countries, and the continuous transition from fossil energy to renewable energy, sales are expected to further increase to 70,214.2 thousand units by 2029, with a compound annual growth rate of 20.1% from 2025 to 2029. In terms of power type, plug-in hybrid vehicle sales grew the fastest from 2020 to 2024. Sales of plug-in hybrid vehicles increased from 983.3 thousand to 6,837.5 thousand units, with a compound annual growth rate of 62.4%. Its sales volume is expected to increase further to 18,566.6 thousand units in 2029, with a compound annual growth rate of 17.1% from 2025 to 2029.

With the widespread application of energy storage batteries in the fields of electricity consumption, power generation, transmission and distribution, from 2020 to 2024, global annual energy storage battery shipments increased from 23.7 GWh to 292.2 GWh, with a compound annual growth rate of 87.4%. As large-scale renewable energy projects around the world continue to advance, global centralized energy storage battery shipments will increase to 183.4 GWh in 2024, and are expected to rise to 656.6 GWh by 2029, with a compound annual growth rate of 23.1% from 2025 to 2029. Furthermore, in order to improve electricity efficiency in commercial and lifestyle scenarios and improve the stability and sustainability of urban electricity use, distributed energy storage battery shipments are expected to reach 444.7 GWh in 2029, with a compound annual growth rate of 25.5% from 2025 to 2029. Annual global energy storage battery shipments are expected to reach 1,101.3 GWh by 2029, with a compound annual growth rate of 23.1% from 2025 to 2029.

Board Information

The board of directors will be composed of eight directors, including four executive directors, one non-executive director and three independent non-executive directors. Directors serve for a term of three years and are eligible for re-election after their term expires.

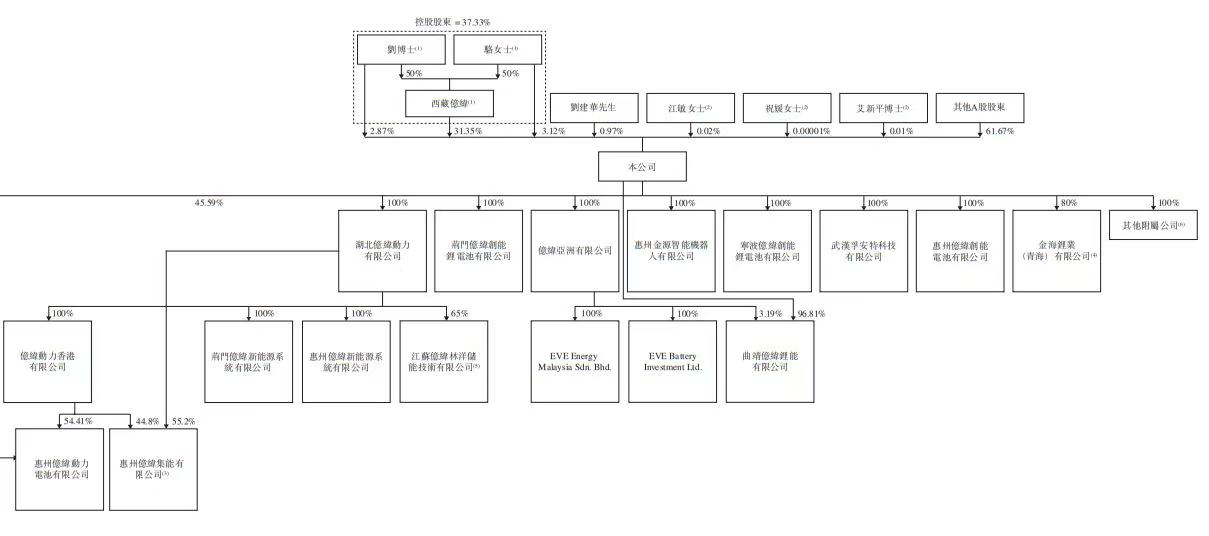

Shareholding structure

As of the last practical date, of the total issued share capital of the company, Dr. Liu Jincheng held about 2.87%, Ms. Luo Jinhong (the spouse of Dr. Liu) held about 3.12%, while Tibet Yiwei held about 31.35%, and Dr. Liu and Ms. Luo each held 50% of the total issued share capital of the company. As a result, as of the last practical date, Dr. Liu, Ms. Luo, and Tibet Yiwei Joint Control Company have issued voting rights of about 37.33% of the total share capital.

Intermediary team

Sole sponsor: CITIC Securities (Hong Kong) Limited

Company Legal Advisors: Davis Polk & Wardwell, Beijing Deheng Law Firm

Sole sponsor legal advisors: Gao Weishen Law Firm, JunHe Law Firm

Auditor and reporting accountant: Luo Shenmei Certified Public Accountants

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Compliance Advisor: Zibo Capital Co., Ltd.