IPO News | Hebei Lianji Technology Industry Development Co., Ltd. submits Hong Kong Stock Exchange GEM as a comprehensive property management service provider for industrial parks

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange disclosure on January 2, Hebei Lianji Technology Industry Development Co., Ltd. submitted a listing application to GEM on the Hong Kong Stock Exchange, and Chuangsheng Finance is the sole sponsor.

Company profile:

According to the prospectus, the company is a comprehensive property management service provider focusing on industrial parks in China. Since its establishment in 2019, the company has been deeply involved in Zhejiang Province (particularly the Jinhua-Yiwu region, the world's largest small commodity market). Differentiation is achieved through strategic expertise in industrial park management, which differentiates the company from other competitors that focus mainly on residential properties.

The company provides a comprehensive range of basic property management services aimed at maintaining the safety, functionality and appearance of the public areas of managed properties. These services cover the entire life cycle of occupancy, from check-in to move-out, including repair and maintenance, security and safety management, and cleaning and gardening services in all public areas.

The company provides a variety of optional value-added services to meet the specific needs of property developers, owners, tenants and resident enterprises, and enhance the value of the commercial asset portfolio managed by the company. The company provides value-added services through its own employees or through a network of selected service providers. The company's value-added services include (i) operational support services; (ii) park supporting services; and (iii) energy-related services.

As of September 30, 2025, the company's property portfolio covered 24 projects under management, including 23 industrial parks, with a total construction area of about 4.3 million square meters. This shows that projects under management have achieved steady growth, driven by the company's strategic expansion in the industrial sector.

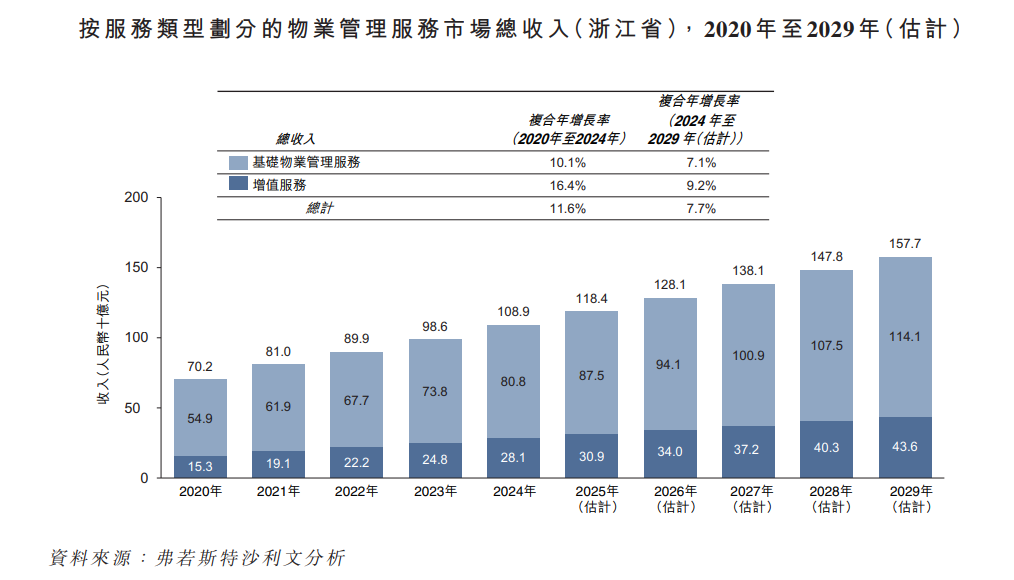

According to Frost & Sullivan, in 2024, the market size (in terms of revenue) of the non-residential property management service market in Zhejiang Province will be 45.8 billion yuan. Property management services are divided into two divisions, namely basic property management services and value-added property management services. Property management services have recorded growth in recent years.

In 2024, the total revenue from basic property management services and value-added services in the Zhejiang property management service market reached RMB 80.8 billion and RMB 28.1 billion respectively, with compound annual growth rates of 10.1% and 16.4% respectively from 2020 to 2024. In Jinhua City, Zhejiang Province, the total construction area under management of the industrial park property management service market in 2024 is about 31.3 million square meters. According to the total floor area of property management services in Jinhua Industrial Park in 2024, the top three suppliers of property management services accounted for about 28.6%. Among them, the company ranked second, with a market share of about 9.3%.

Financial data

Revenue:

In 2024, 2024, and 2025 for the nine months ending September 30, the company achieved revenue of 71.683 million yuan, 50.808 million yuan, and 56.566 million yuan, respectively.

Profit:

In 2024, 2024, and 2025 for the nine months ending September 30, the company achieved annual/term profit of 7.896 million yuan, -1,226 million yuan, and 8.522 million yuan, respectively.

Industry Overview

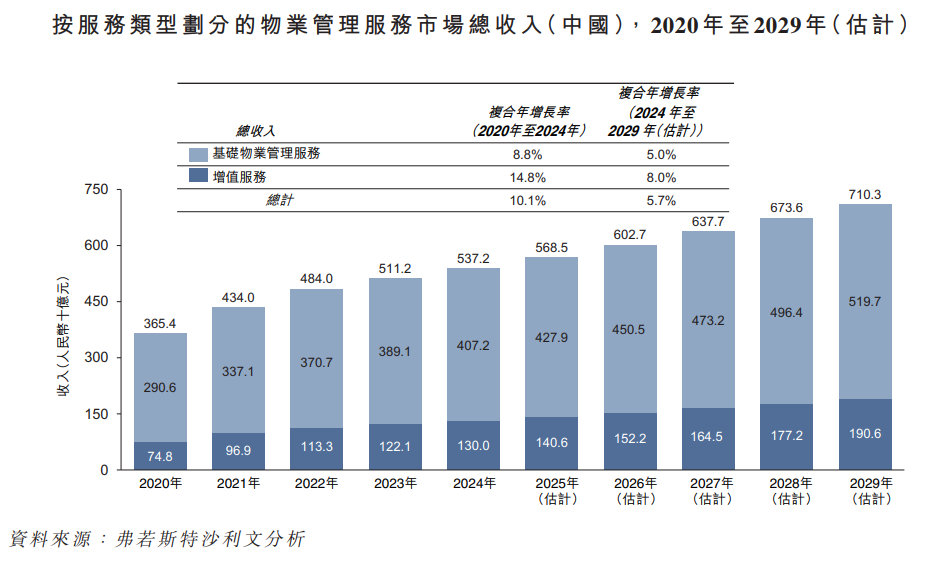

In 2024, the total revenue from basic property management services and value-added services in the Chinese property management service market reached 407.2 billion yuan and 130 billion yuan respectively, with compound annual growth rates of 8.8% and 14.8% respectively from 2020 to 2024. In 2029, the total revenue from basic property management services and value-added services in China's property management services market is expected to reach 519.7 billion yuan and 19.6 billion yuan respectively, with compound annual growth rates of 5.0% and 8.0% respectively from 2024 to 2029.

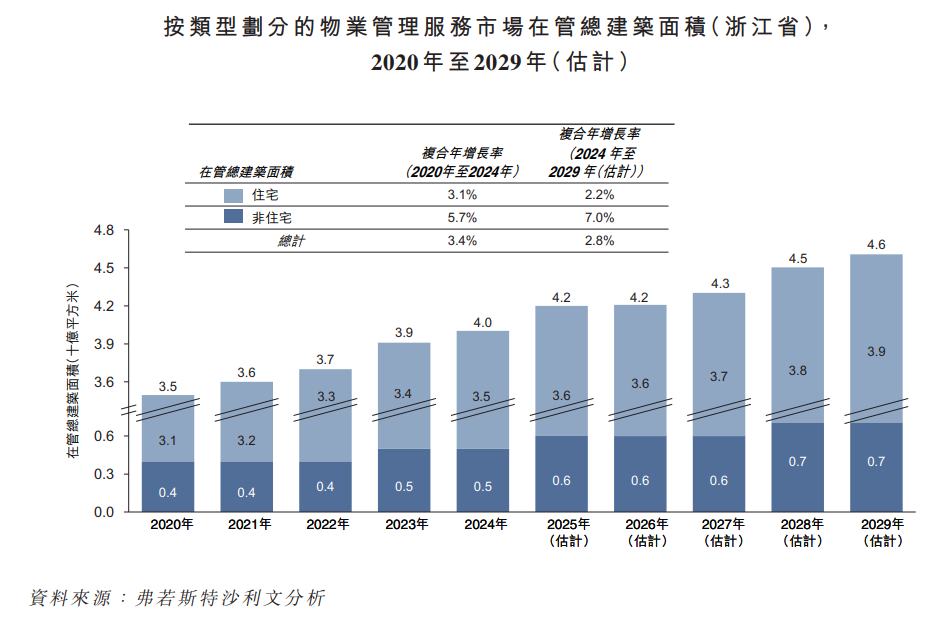

The total construction area under management in the property management service market in Zhejiang Province grew from 3.5 billion square meters in 2020 to 4 billion square meters in 2024, with a compound annual growth rate of 3.4%. Specifically, in 2024, the residential and non-residential property management service markets in Zhejiang Province reached 3.5 billion square meters and 500 million square meters respectively, with compound annual growth rates of 3.1% and 5.7% respectively from 2020 to 2024. In 2029, the total construction area under management of the property management service market in Zhejiang Province is expected to reach 4.6 billion square meters, with a compound annual growth rate of 2.8% from 2024 to 2029. The total construction area under management in the residential and non-residential property management services market in Zhejiang Province is expected to reach 3.9 billion square meters and 700 million square meters respectively in 2029, with compound annual growth rates of 2.2% and 7.0% respectively from 2024 to 2029.

The total construction area under management in the property management service market in Zhejiang Province grew from 3.5 billion square meters in 2020 to 4 billion square meters in 2024, with a compound annual growth rate of 3.4%. Specifically, in 2024, the residential and non-residential property management service markets in Zhejiang Province reached 3.5 billion square meters and 500 million square meters respectively, with compound annual growth rates of 3.1% and 5.7% respectively from 2020 to 2024. In 2029, the total construction area under management of the property management service market in Zhejiang Province is expected to reach 4.6 billion square meters, with a compound annual growth rate of 2.8% from 2024 to 2029. The total construction area under management in the residential and non-residential property management services market in Zhejiang Province is expected to reach 3.9 billion square meters and 700 million square meters respectively in 2029, with compound annual growth rates of 2.2% and 7.0% respectively from 2024 to 2029.

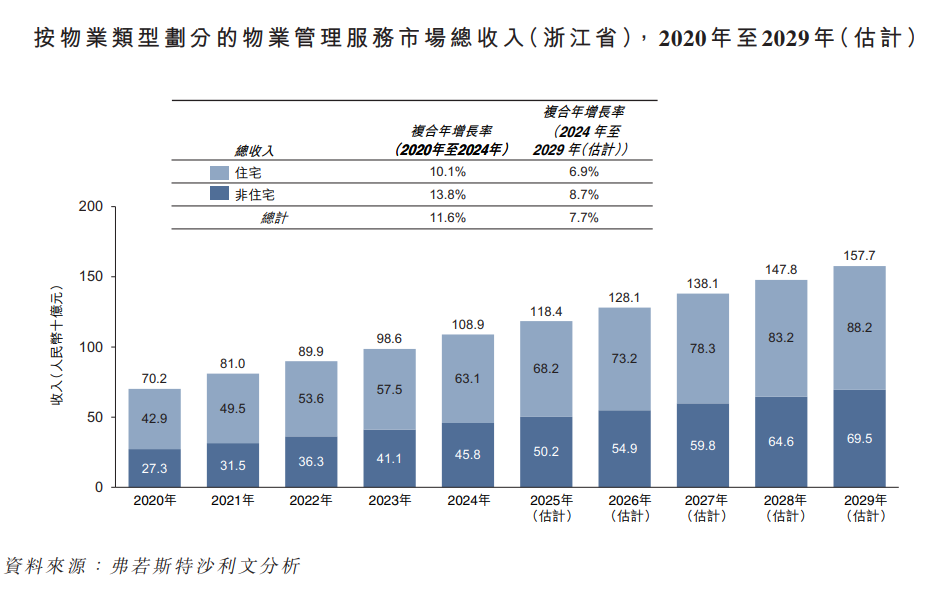

From 2020 to 2024, the total revenue of the property management services market in Zhejiang Province increased from RMB 70.2 billion to RMB 108.9 billion, with a CAGR of 11.6%. In 2029, the total revenue of the property management services market in Zhejiang Province is expected to reach RMB 157.7 billion, with a compound annual growth rate of 7.7% from 2024 to 2029. Specifically, in 2024, the total revenue of the residential and non-residential property management services market in Zhejiang Province reached RMB 63.1 billion and RMB 45.8 billion respectively, with compound annual growth rates of 10.1% and 13.8% respectively from 2020 to 2024. In 2029, the total revenue of the residential and non-residential property management services market in Zhejiang Province is expected to reach RMB 88.2 billion and RMB 69.5 billion respectively, with compound annual growth rates of 6.9% and 8.7% respectively from 2024 to 2029.

In 2024, the total revenue from basic property management services and value-added services in the Zhejiang property management service market reached RMB 80.8 billion and RMB 28.1 billion respectively, with compound annual growth rates of 10.1% and 16.4% respectively from 2020 to 2024. In 2029, the total revenue from basic property management services and value-added services in the Zhejiang property management service market is expected to reach RMB 114.1 billion and RMB 43.6 billion respectively, with compound annual growth rates of 7.1% and 9.2% respectively from 2024 to 2029.

Board Information

The company's board of directors consists of six directors, including three executive directors and three independent non-executive directors.

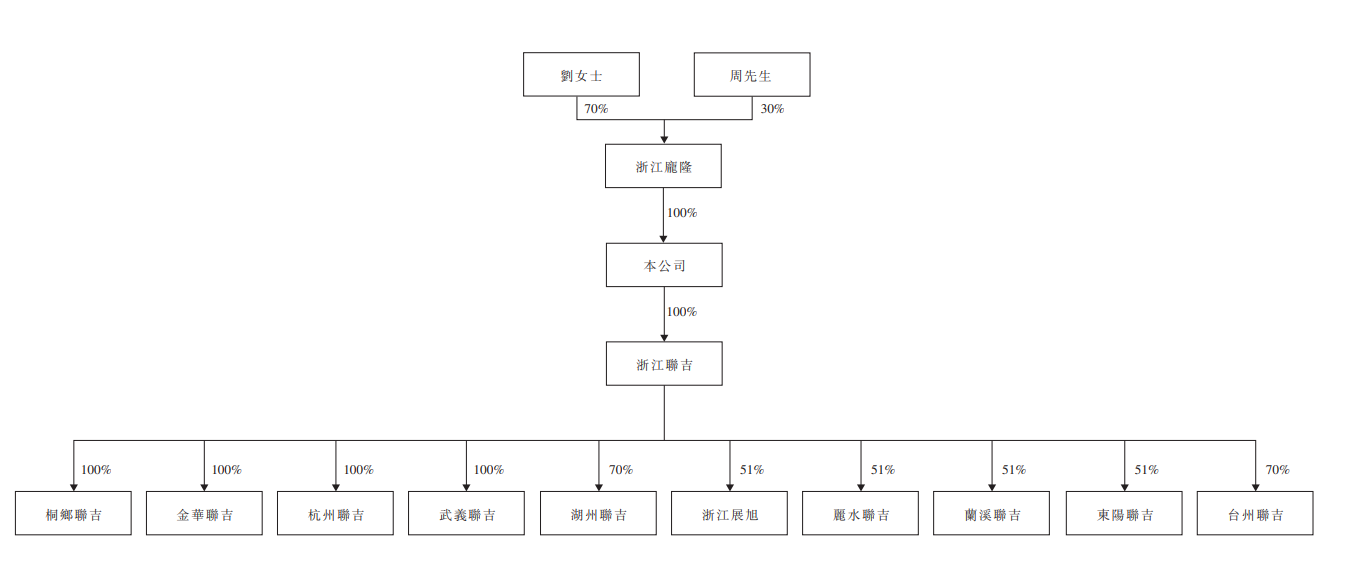

Shareholding structure

Zhejiang Panglong holds 100% of the company's shares, while Ms. Liu and Mr. Zhou hold 70% and 30% of Zhejiang Panglong's shares respectively.

Intermediary team

Sole sponsor: Chuangsheng Finance Co., Ltd

Our legal advisors: Hong Kong Law: Jingtian Gongcheng Law Firm Limited Liability Partnership; Related Chinese Law: Jingtian Gongcheng Law Firm

Sole Sponsor's Legal Adviser: Relevant Chinese Law: Tianze Law Firm

Auditors and reporting accountants: Ernst & Young

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch