Rocket Companies (RKT): Reassessing Valuation After Fed Rate Pause and Optimistic Growth Outlook

Rocket Companies (RKT) just caught a tailwind from the Federal Reserve’s decision to pause further rate moves after its latest cut, a backdrop that is drawing fresh attention to the lender’s improving earnings profile.

See our latest analysis for Rocket Companies.

Investors have been leaning into that story, with the share price now at $19.88 and a strong 90 day share price return of 17.36 percent backing up a 1 year total shareholder return of 91.33 percent. This suggests momentum is building rather than fading.

If this rate driven rebound has you thinking more broadly about opportunities, it could be a good moment to explore auto manufacturers for other cyclical names potentially resetting for the next leg higher.

With the stock trading close to analyst targets after a stunning multi year run and rapid earnings momentum, the key question now is simple: Is Rocket still mispriced, or are markets already baking in the next wave of growth?

Most Popular Narrative: 20% Undervalued

With Rocket Companies last closing at $19.88 against a narrative fair value of $19.92, the current setup hinges on upbeat long term growth and margin projections rather than a big headline discount.

The market may be ascribing premium value to Rocket's data ecosystem and cross-sell capabilities from the expanded "FinTech ecosystem," but this could prove overly optimistic if younger demographic cohorts delay home-buying due to persistent affordability problems, thus dampening anticipated growth in customer lifetime value and overall revenues.

Want to see the full math behind this call? The story leans on rapid revenue compounding, a sharp margin reset and a future earnings multiple that rivals sector leaders. Curious which assumptions power that fair value and how sensitive the outcome is to even small changes in growth expectations? Read on to unpack the narrative in depth.

Result: Fair Value of $19.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on flawless execution, as integration missteps or slower than expected AI driven efficiency gains could potentially derail those ambitious margin and earnings targets.

Find out about the key risks to this Rocket Companies narrative.

Another Way To Look At Valuation

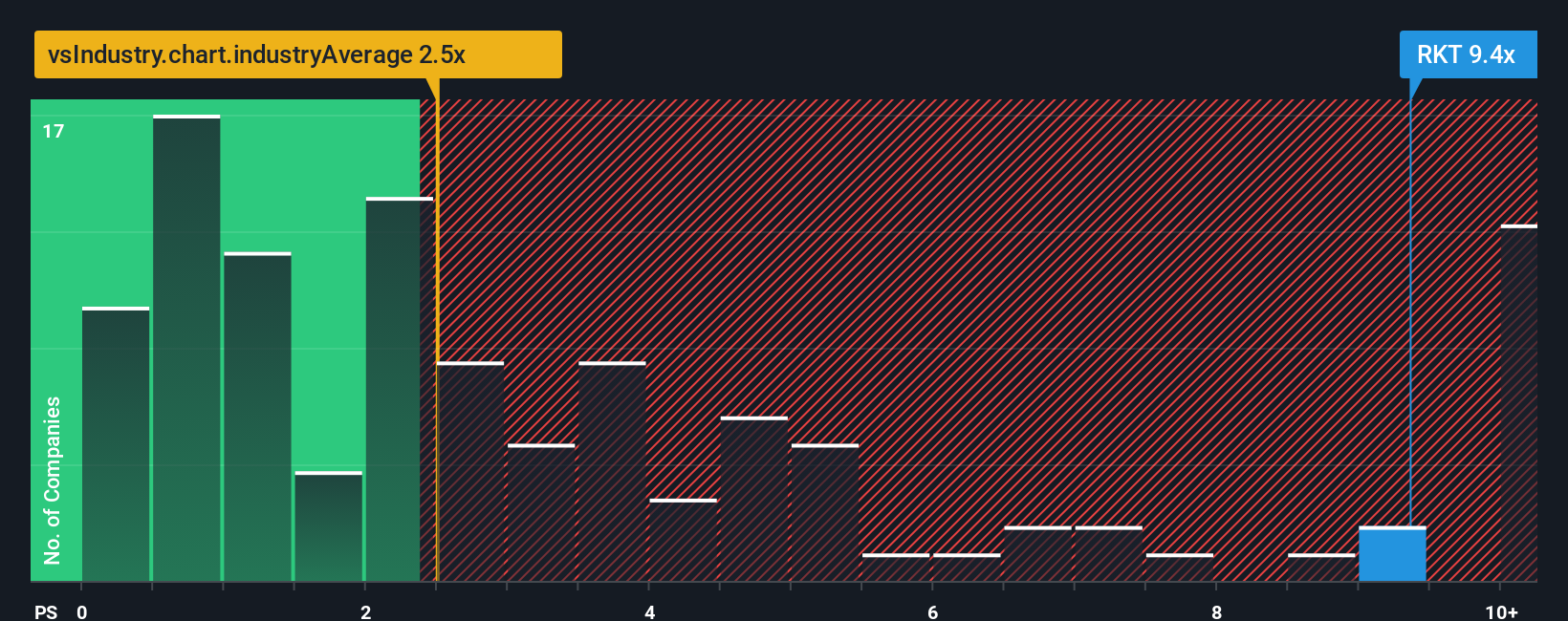

On a simple sales based lens, Rocket looks stretched. The stock trades at a 9.2 times price to sales ratio versus 2.5 times for the US diversified financials group and a 9 times fair ratio, which narrows the upside and raises the bar for execution led surprises.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Companies Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a fresh view in minutes: Do it your way.

A great starting point for your Rocket Companies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investing angles?

Before momentum shifts again, put Simply Wall Street’s Screener to work and line up your next moves across themes most investors only notice after the rally starts.

- Capture potential mispricing early by reviewing these 875 undervalued stocks based on cash flows identified through rigorous cash flow based analysis.

- Ride structural innovation trends as you scan these 25 AI penny stocks targeting real world applications of artificial intelligence.

- Lock in income focused opportunities by assessing these 14 dividend stocks with yields > 3% that combine solid yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com