Applied Digital (APLD): Valuation Check as New Loan and Cloud Spinoff Refocus AI Data Center Growth

Applied Digital (APLD) heads into its Q2 report with fresh momentum, after securing a flexible Macquarie backed loan facility and spinning off its cloud arm to sharpen focus on AI centric data center development.

See our latest analysis for Applied Digital.

Those deals seem to be resonating, with a 1 day share price return of 14.64 percent and a 7 day share price return of 16.88 percent, while the 1 year total shareholder return above 200 percent suggests momentum is still firmly building rather than fading.

If Applied Digital has your attention, it could be worth seeing what else is shaping the AI build out story by exploring high growth tech and AI stocks.

With shares up sharply and revenue growing faster than profits, the stock trades at a steep discount to analyst targets but sits on mounting debt. Is this a mispriced AI infrastructure play, or is future growth already baked in?

Most Popular Narrative Narrative: 35.7% Undervalued

With the most followed narrative pointing to a fair value well above Applied Digital's last close of $28.11, the focus shifts squarely to how long term AI leasing transforms its cash flows.

The company has recently secured long term (15 year) leasing agreements with CoreWeave a major AI hyperscaler for its purpose built AI/HPC data center campus, Polaris Forge 1, representing a total of $7 billion in contracted revenue and a multi year, recurring, and predictable revenue stream that directly supports future revenue growth and cash flow stability.

Investors may want to understand how those large leases could affect profitability and valuation. The narrative focuses on potential growth, margin expansion, and a long term earnings framework to evaluate whether the current price reflects the underlying fundamentals.

Result: Fair Value of $43.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy leverage and reliance on a concentrated set of hyperscale and crypto related customers mean that any contract stumble could rapidly challenge this undervaluation case.

Find out about the key risks to this Applied Digital narrative.

Another Lens on Valuation

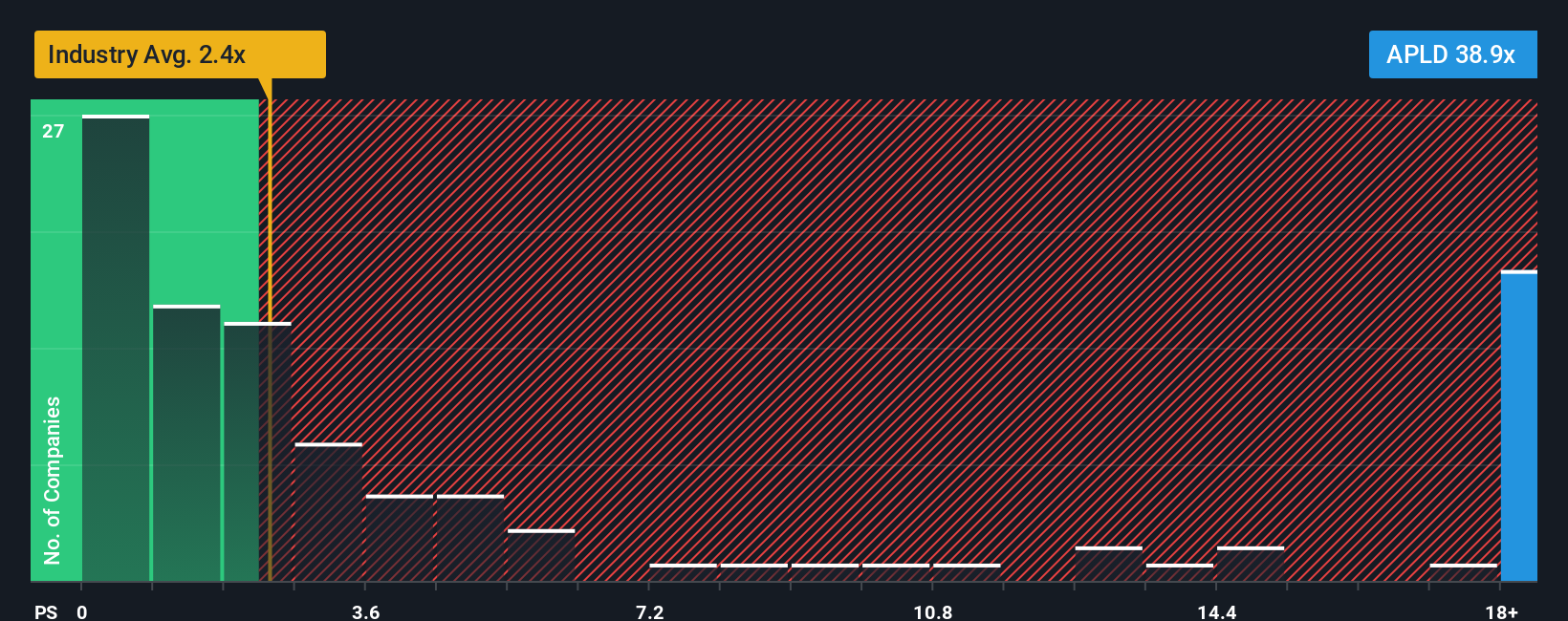

While the narrative model points to a fair value of $43.70, Applied Digital's current price to sales ratio of 46.3 times looks stretched against the US IT industry at 2.2 times, peers at 4.5 times, and even its own 12.4 times fair ratio, leaving little room for missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Digital Narrative

If you want to dig into the numbers yourself, challenge these assumptions, and shape a custom view in just a few minutes, Do it your way.

A great starting point for your Applied Digital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more smart investment ideas?

Do not stop at a single opportunity. Use the Simply Wall St Screener to uncover high conviction ideas other investors may only notice after a significant move.

- Target potential market mispricings by scanning these 875 undervalued stocks based on cash flows grounded in strong cash flow projections and fundamentals.

- Explore the next wave of innovation by tracking these 25 AI penny stocks positioned at the heart of accelerating AI adoption.

- Assess potential income streams by reviewing these 14 dividend stocks with yields > 3% that combine yield strength with underlying business resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com