Assessing Argan (AGX) After Its Multi‑Year Share Price Surge: What Does the Valuation Say Now?

Argan (AGX) has quietly turned into a serious long term winner, with the stock up roughly 21% over the past year and more than 800% over the past 3 years, far outpacing the broader market.

See our latest analysis for Argan.

Recent trading has reinforced that strength, with a 23.7% 90 day share price return and a 120.6% one year total shareholder return signaling that bullish momentum is still very much in play.

If Argan’s run has you curious about what else might be gathering steam, this could be a good moment to explore fast growing stocks with high insider ownership.

With the shares already near analyst targets after a powerful multi year run, the key question now is whether Argan’s fundamentals still leave room for upside, or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 9.7% Undervalued

With Argan closing at $325.96 against a most popular narrative fair value of $361.00, the story frames today’s price as leaving upside on the table.

Record backlog and continued project wins across gas, renewables, water treatment, and recycling plants provide multi-year revenue visibility, indicating potential for increased operating leverage and higher gross margins as larger projects are executed successfully.

Want to see how sustained double digit growth, margin resilience, and a richer future earnings multiple all intersect in one model, and why that still supports a higher value?

Result: Fair Value of $361.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a heavier tilt toward large gas projects and lumpy margins means that execution slip ups or faster decarbonization could quickly challenge this upside story.

Find out about the key risks to this Argan narrative.

Another Angle on Valuation

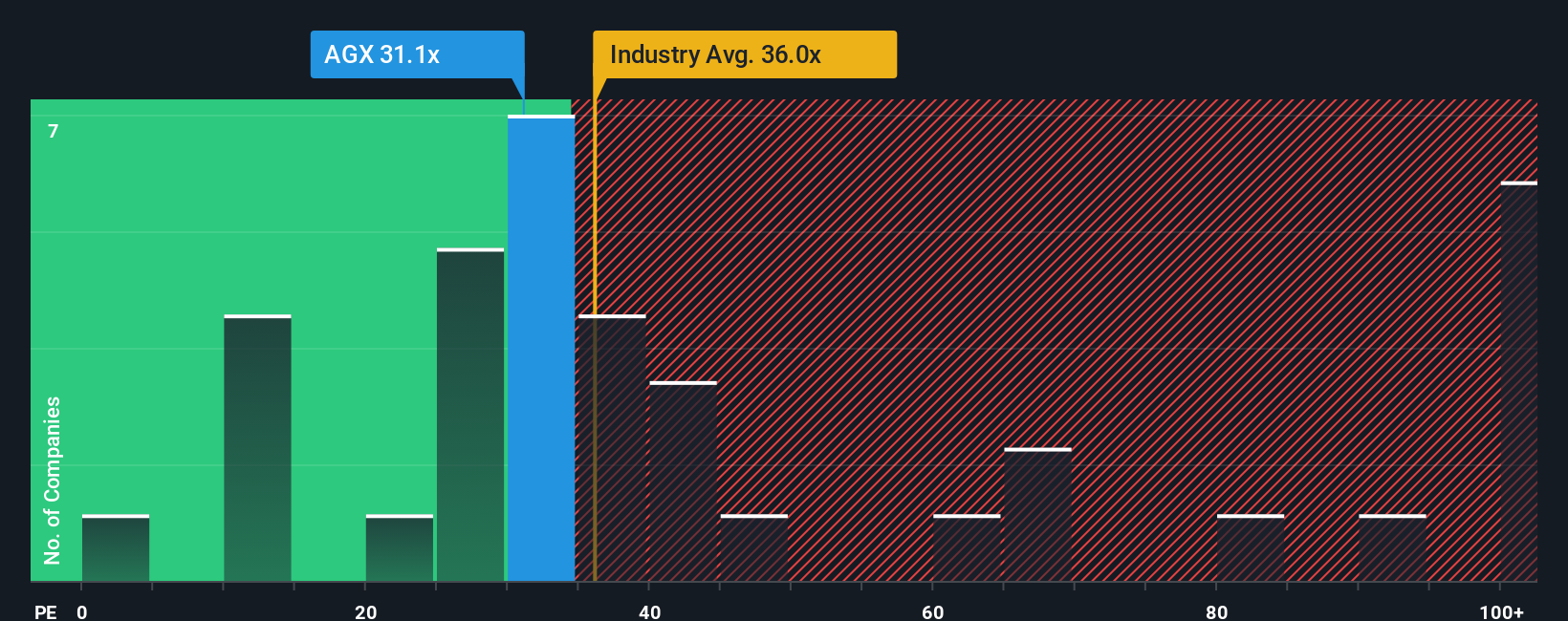

While the narrative fair value points to upside, today’s 37.7x earnings multiple tells a tougher story. Argan trades richer than the US Construction industry at 30.5x and even above its own 31.5x fair ratio, hinting at less margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Argan Narrative

If you see the numbers differently or simply want to dig into the details yourself, you can build a tailored view in minutes with Do it your way.

A great starting point for your Argan research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to uncover fresh, high conviction opportunities other investors may be overlooking.

- Identify potential future breakout opportunities early by scanning these 3571 penny stocks with strong financials that already show signs of financial strength instead of only hype.

- Explore structural trends in automation and data by targeting these 25 AI penny stocks that are closely involved in AI-related spending.

- Focus on quality at a reasonable price by filtering for these 14 dividend stocks with yields > 3% that can provide income and the possibility of capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com