CNX Resources (CNX): Assessing Valuation After Recent Share Price Pullback

CNX Resources stock reaction and recent performance

CNX Resources (CNX) has slipped about 1% in the past week and roughly 11% over the month, even though the stock is still up around 9% over the past year.

See our latest analysis for CNX Resources.

The recent pullback leaves CNX Resources trading at $36.46, and while the 1 month share price return has cooled off, the 1 year and especially 3 year total shareholder returns suggest longer term momentum and improving confidence in its cash generation story.

If CNX’s run has you thinking about where else capital might compound, this is a good moment to explore fast growing stocks with high insider ownership.

With shares drifting below analyst targets but long term returns and cash flows still trending higher, investors now face a key question: is CNX Resources quietly undervalued, or are markets already pricing in its next leg of growth?

Most Popular Narrative: 8.6% Overvalued

With CNX Resources last closing at $36.46 against a narrative fair value of about $33.57, the prevailing view implies modest downside from here.

Analysts are assuming CNX Resources's revenue will grow by 8.9% annually over the next 3 years. Analysts assume that profit margins will increase from 8.6% today to 36.7% in 3 years time.

Curious how steady, mid single digit sales growth can still justify a far richer profit profile ahead? The answer lies in bold margin and earnings upgrades, and a striking reset in the multiple the market may be willing to pay for those future profits.

Result: Fair Value of $33.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak gas realizations or delayed policy support for tax and environmental credits could undermine those ambitious margin and cash flow assumptions.

Find out about the key risks to this CNX Resources narrative.

Another View: Cash Flows Tell a Different Story

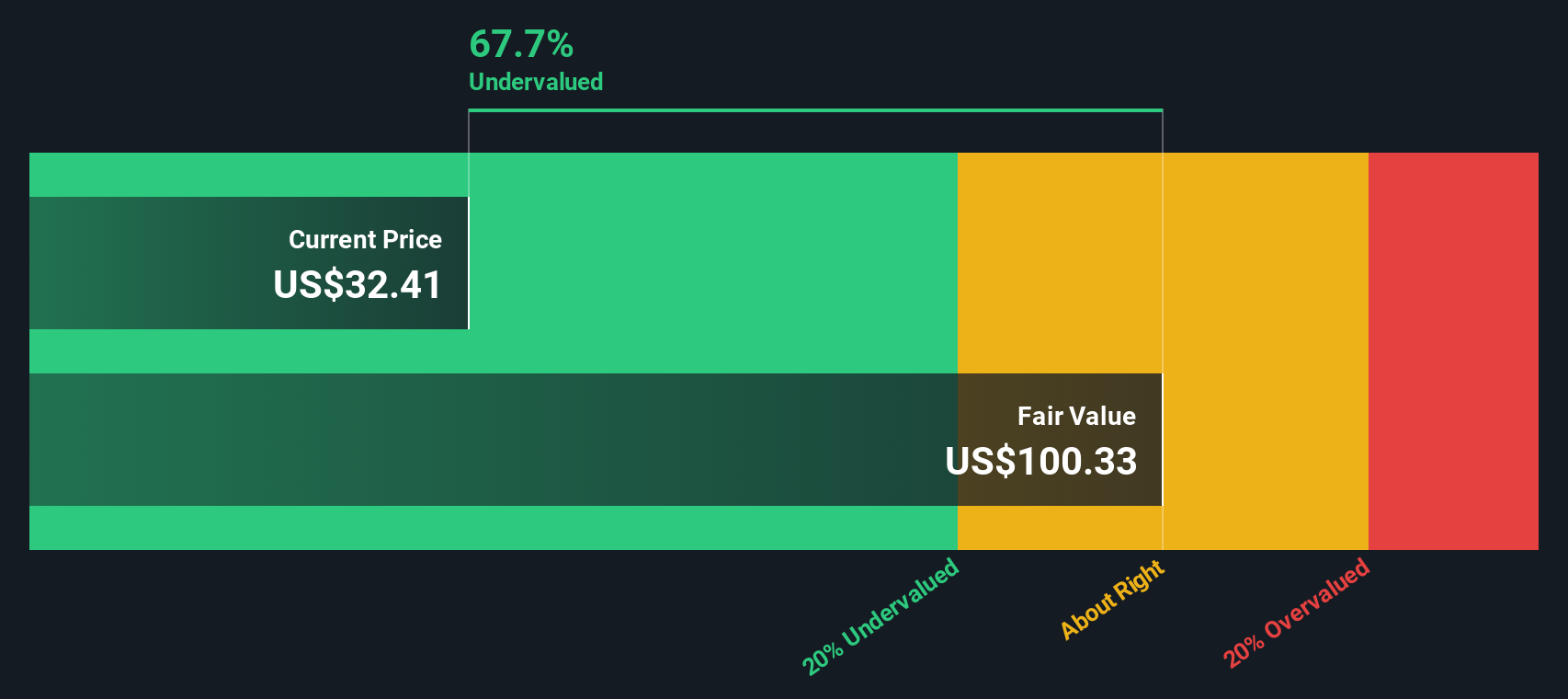

Our DCF model points in the opposite direction, with CNX Resources trading at about 81.5% below its estimated fair value of $197.01. That suggests a much deeper value opportunity than the narrative fair value implies and raises the question: which lens is missing more of the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CNX Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CNX Resources Narrative

If you would rather dive into the numbers yourself and challenge these assumptions, you can craft a personalized view in minutes: Do it your way.

A great starting point for your CNX Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with CNX Resources. Broaden your opportunity set now using the Simply Wall St Screener before the market prices in the best ideas without you.

- Capitalize on underpriced potential by using these 875 undervalued stocks based on cash flows to uncover companies where cash flows hint at far more than the current share price suggests.

- Ride powerful digital trends by targeting innovators in blockchain and decentralized finance through these 80 cryptocurrency and blockchain stocks before mainstream attention fully catches up.

- Strengthen your income stream by focusing on reliable payers and growing distributions via these 14 dividend stocks with yields > 3% while yields remain compelling.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com