High Growth Tech Stocks in Asia to Watch

As global markets navigate a complex landscape marked by fluctuating indices and economic indicators, Asia's tech sector stands out with its potential for high growth, driven by innovation and strategic positioning in the global supply chain. In this dynamic environment, identifying promising tech stocks involves looking for companies that leverage technological advancements and demonstrate resilience amid broader market shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 36.73% | 37.89% | ★★★★★★ |

| Fositek | 37.11% | 51.61% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

DEAR U (KOSDAQ:A376300)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DEAR U Co., LTD. is a communication platform company serving both South Korea and international markets, with a market capitalization of ₩951.91 billion.

Operations: DEAR U generates revenue primarily through its Bubble segment, which reported ₩77.80 billion. The company's operations are focused on providing communication platform services across South Korea and international markets.

DEAR U, a player in the interactive media and services sector, demonstrates robust growth dynamics despite recent challenges. With an impressive annual revenue growth rate of 16.4%, DEAR U outpaces the broader Korean market's average of 11.3%. However, it's important to note a significant earnings contraction by 44.5% over the past year compared to industry growth of 17.3%. On a brighter note, future projections are optimistic with expected earnings surging at an annual rate of 54.6%, markedly above Korea's market forecast of 31.4%. This financial trajectory is supported by DEAR U's strategic focus on high-quality earnings and maintaining a competitive edge through innovation and client engagement in a rapidly evolving tech landscape.

- Unlock comprehensive insights into our analysis of DEAR U stock in this health report.

Gain insights into DEAR U's historical performance by reviewing our past performance report.

Queclink Wireless Solutions (SZSE:300590)

Simply Wall St Growth Rating: ★★★★☆☆

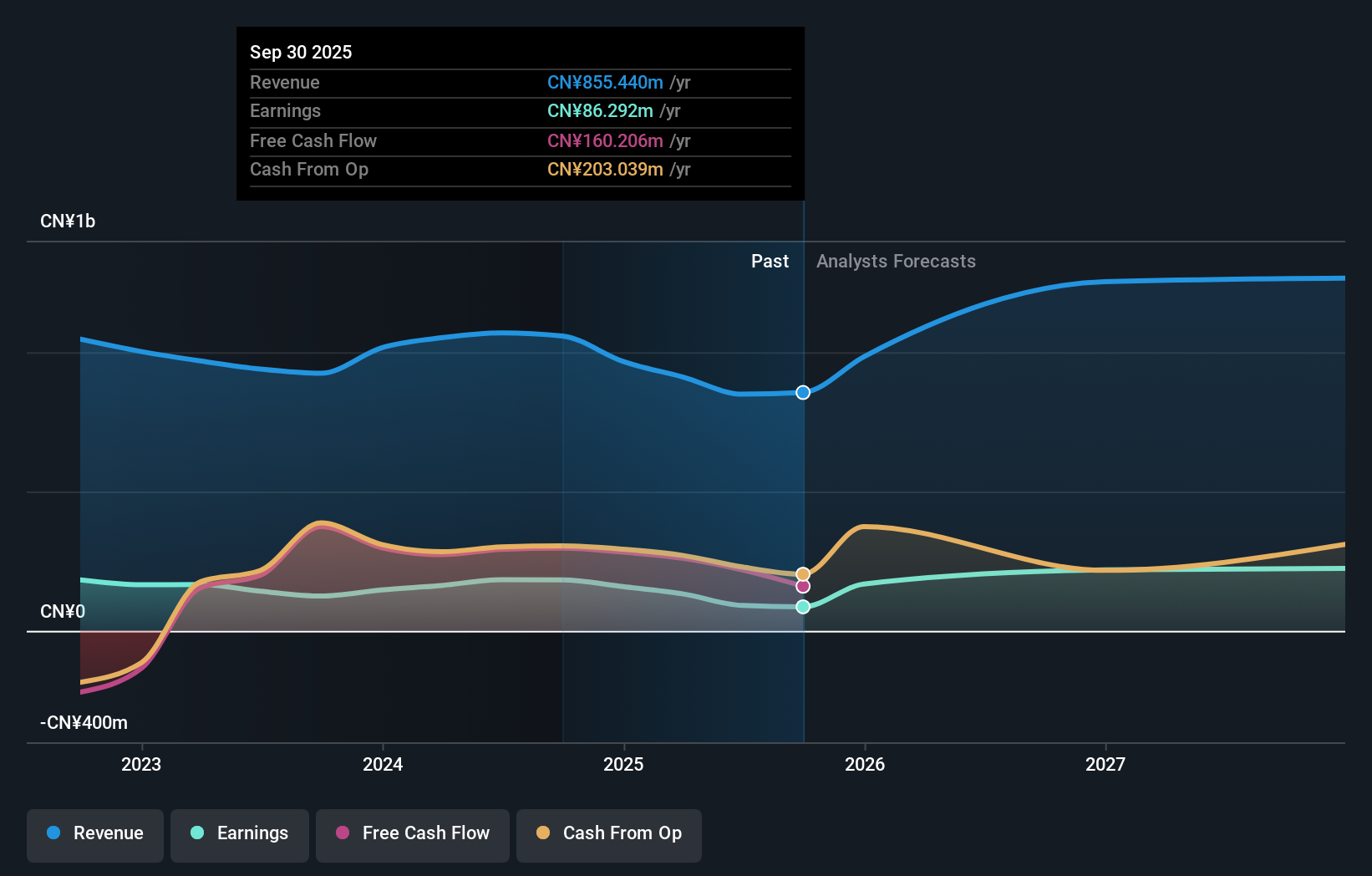

Overview: Queclink Wireless Solutions Co., Ltd. and its subsidiaries focus on the research, development, manufacturing, and sale of wireless IoT equipment and solutions both in China and globally, with a market cap of CN¥5.80 billion.

Operations: Queclink specializes in providing wireless IoT equipment and solutions, catering to both domestic and international markets. The company emphasizes research, development, and manufacturing as key components of its operations.

Queclink Wireless Solutions, amid a challenging fiscal environment, has demonstrated resilience with a 19.5% annual revenue growth. Despite a sharp earnings drop of 52.7% over the past year, projections for future earnings are robust at an anticipated 43% annual increase, outpacing the broader Chinese market's forecast of 27.5%. The company's commitment to R&D is evident from its spending trends, which align closely with its strategic priorities in technology innovation and market expansion. Recent amendments to corporate bylaws and proactive adjustments in company governance also reflect Queclink’s adaptability in navigating regulatory landscapes and enhancing operational efficiencies.

- Get an in-depth perspective on Queclink Wireless Solutions' performance by reading our health report here.

Understand Queclink Wireless Solutions' track record by examining our Past report.

I'LL (TSE:3854)

Simply Wall St Growth Rating: ★★★★☆☆

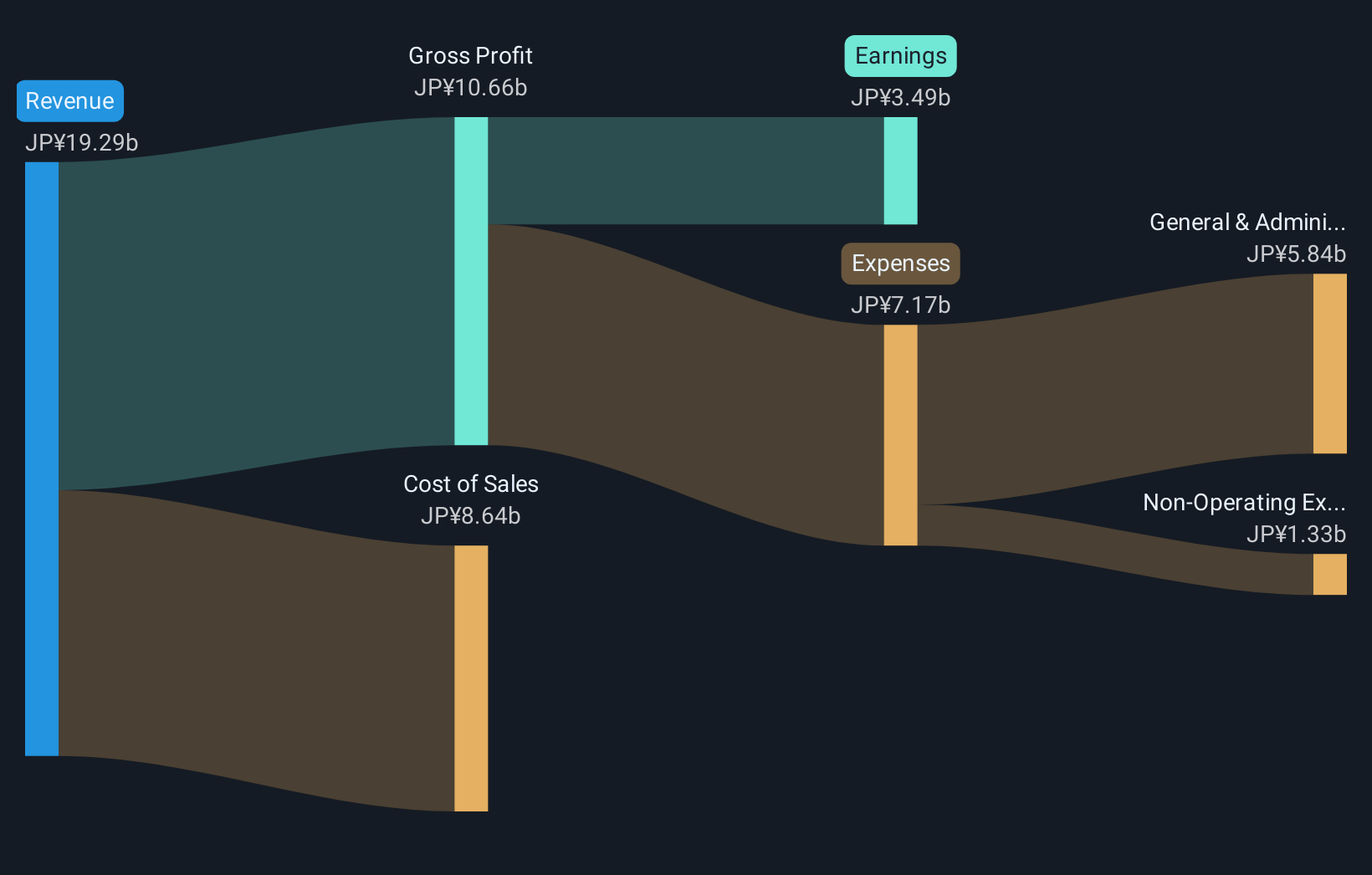

Overview: I'LL Inc. operates as a system solution business in Japan with a market cap of ¥63.62 billion.

Operations: The company generates revenue primarily from its Computer Services segment, amounting to ¥19.81 billion.

I'LL Inc., amid rapid changes in the tech landscape, has positioned itself effectively within Asia's high-growth sectors. With a robust annual revenue growth of 8.4%, the company outpaces the Japanese market average of 4.6%. Notably, its earnings have surged by 26.7% over the past year, significantly outperforming the software industry's growth of 22.5%. This financial vigor is supported by strategic R&D investments which are crucial for maintaining competitive advantage and fostering innovation in emerging technologies. As I'LL continues to adapt and evolve, its future prospects remain promising in a region that is increasingly becoming a hub for technological advancements.

- Dive into the specifics of I'LL here with our thorough health report.

Explore historical data to track I'LL's performance over time in our Past section.

Make It Happen

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 185 more companies for you to explore.Click here to unveil our expertly curated list of 188 Asian High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com