Asian Growth Leaders With Insider Ownership For January 2026

As we enter 2026, the Asian markets are navigating a complex landscape shaped by evolving economic policies and fluctuating global demand, with China's manufacturing sector showing signs of stabilization and South Korea's export-driven growth continuing to impress. In this environment, identifying growth companies with significant insider ownership can be particularly compelling, as such ownership often aligns management interests with those of shareholders and may indicate confidence in the company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.8% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's explore several standout options from the results in the screener.

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★☆☆

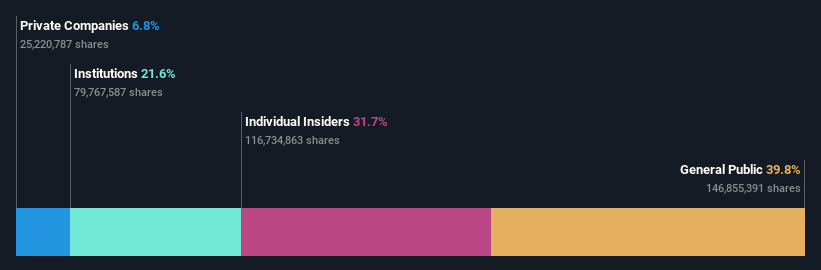

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment in South Korea, with a market cap of ₩17.18 trillion.

Operations: The company's revenue primarily comes from its Heavy Industry segment, contributing ₩4.97 billion, and its Construction segment, which adds ₩1.77 billion.

Insider Ownership: 21.5%

Earnings Growth Forecast: 29.9% p.a.

Hyosung Heavy Industries is experiencing substantial growth, with earnings having increased by 177.9% over the past year and expected to grow significantly over the next three years. Despite a forecasted earnings growth slower than the KR market, its revenue is projected to outpace it. Recent investments include US$157 million in expanding its Memphis power transformer plant, enhancing production capacity and technological competitiveness in the AI-era power infrastructure market.

- Click here and access our complete growth analysis report to understand the dynamics of Hyosung Heavy Industries.

- Our expertly prepared valuation report Hyosung Heavy Industries implies its share price may be too high.

Servyou Software Group (SHSE:603171)

Simply Wall St Growth Rating: ★★★★★☆

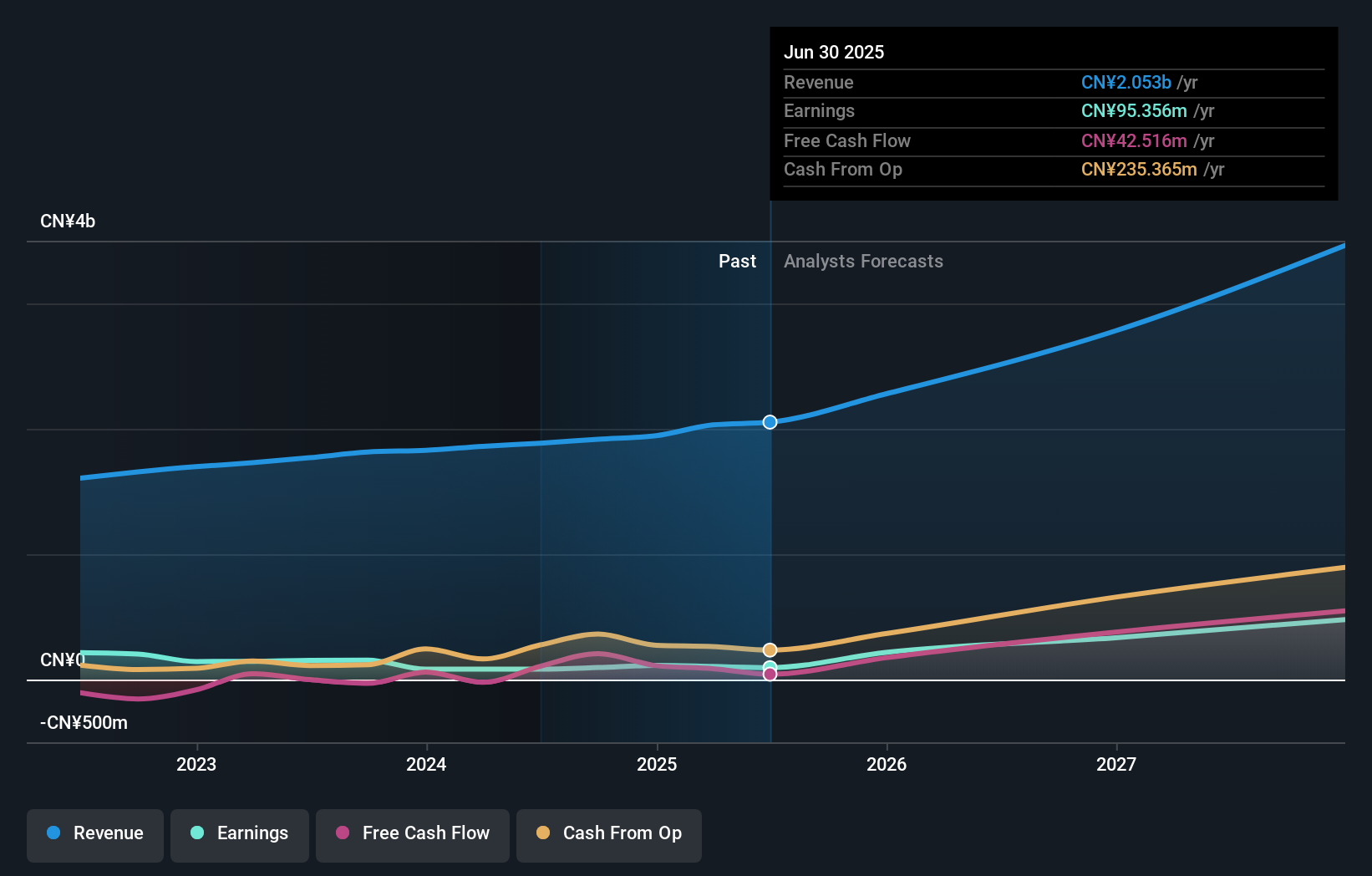

Overview: Servyou Software Group Co., Ltd. and its subsidiaries offer financial and tax information services in China, with a market cap of CN¥22.40 billion.

Operations: The company generates revenue primarily through its provision of financial and tax information services within China.

Insider Ownership: 22.7%

Earnings Growth Forecast: 53.7% p.a.

Servyou Software Group, with high insider ownership, is positioned for substantial growth in Asia. The company reported CNY 1.43 billion in sales for the first nine months of 2025, reflecting revenue growth compared to the previous year. Despite a slight decline in net income, earnings are forecasted to grow significantly at 53.7% annually over the next three years, outpacing market expectations. However, recent volatility and large one-off items have impacted financial results.

- Click here to discover the nuances of Servyou Software Group with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Servyou Software Group is trading beyond its estimated value.

Zhejiang XCC GroupLtd (SHSE:603667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang XCC Group Co., Ltd is involved in the research, development, manufacture, and sale of bearings across various international markets including the United States, Japan, Korea, and Brazil with a market cap of CN¥25.63 billion.

Operations: Zhejiang XCC Group Co., Ltd generates revenue primarily through the research, development, manufacture, and sale of bearings across diverse global markets such as the United States, Japan, Korea, and Brazil.

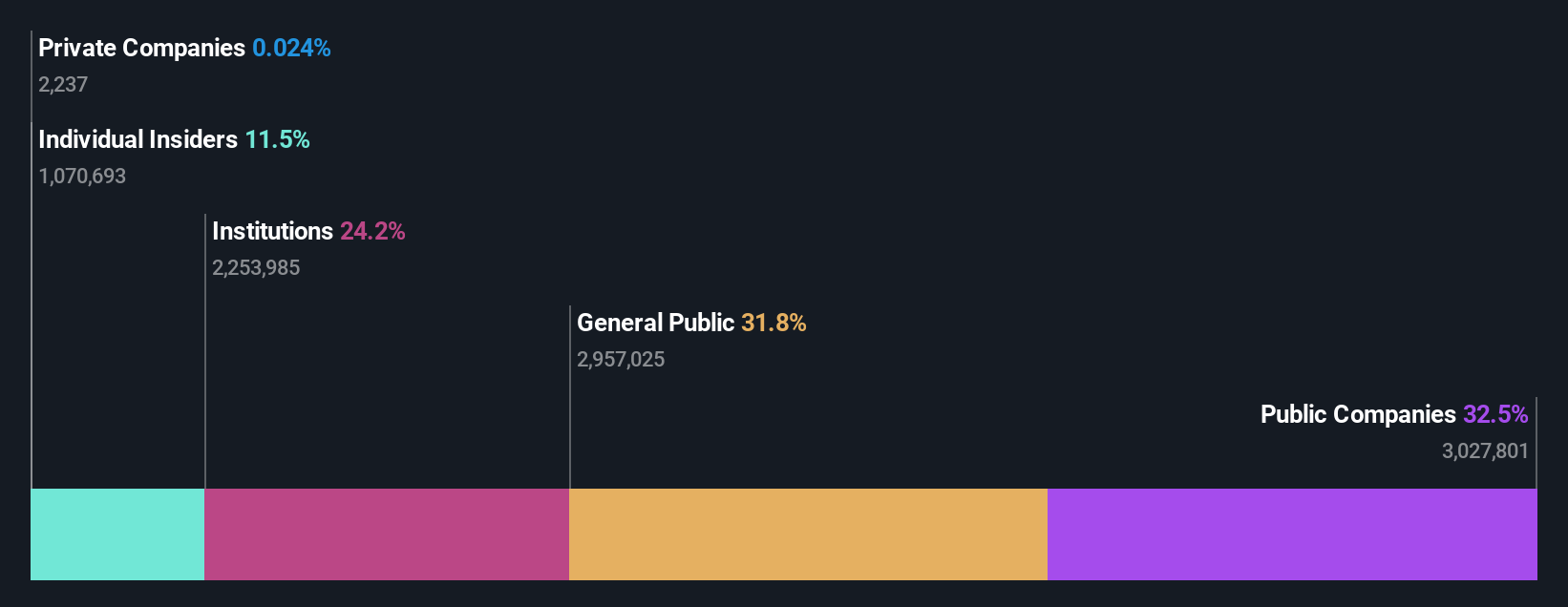

Insider Ownership: 31.7%

Earnings Growth Forecast: 52.4% p.a.

Zhejiang XCC Group Ltd exhibits high insider ownership, contributing to its growth potential in Asia. The company reported CNY 2.66 billion in sales for the first nine months of 2025, showing revenue growth from the previous year. Earnings are forecasted to grow significantly at 52.4% annually, surpassing market expectations despite recent share price volatility and large one-off items affecting financial results. No substantial insider trading activity was noted over the past three months.

- Get an in-depth perspective on Zhejiang XCC GroupLtd's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Zhejiang XCC GroupLtd's shares may be trading at a premium.

Summing It All Up

- Delve into our full catalog of 635 Fast Growing Asian Companies With High Insider Ownership here.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com