Reassessing GlobalFoundries (GFS) Valuation After Wedbush’s Downgrade on Prolonged Chip Downturn

Wedbush Securities has downgraded its rating on GlobalFoundries (GFS) to Neutral, citing a prolonged chip downturn that is lasting longer than expected and weighing on demand in key smartphone, industrial, and automotive markets.

See our latest analysis for GlobalFoundries.

The downgrade lands after a choppy stretch for the stock, with a 90 day share price return of 2.59 percent but a 1 year total shareholder return of negative 14.61 percent, suggesting near term momentum is fragile even as longer term sentiment slowly resets.

If this cautious setup around GlobalFoundries has you rethinking your semiconductor exposure, it could be worth scanning high growth tech and AI stocks for other chip and AI names with different growth and risk profiles.

With shares trading modestly below Wedbush’s trimmed target and the stock already digesting years of underperformance, the key question now is whether GlobalFoundries is quietly undervalued or if the market has already priced in its eventual recovery.

Most Popular Narrative: 6.5% Undervalued

With GlobalFoundries closing at $36.87 against a narrative fair value in the low 40s, the current pricing implies investors are underestimating its longer term earnings power.

The company's focus on differentiated technologies (such as FD SOI, RF, and power management platforms) and recent MIPS acquisition strengthens its value proposition in edge AI, automotive, and data center markets, deepening customer partnerships and enabling premium pricing, which is likely to drive sustained improvements in revenue visibility and margin stability.

Curious how a loss making foundry gets marked for robust profits, richer margins, and a premium multiple, all within a few short years, without chasing bleeding edge nodes? The full narrative breaks down the revenue glide path, margin reset, and valuation bridge that justify that gap to fair value.

Result: Fair Value of $39.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering worries around GlobalFoundries' limited exposure to cutting edge nodes and heavy capital needs could still derail that upbeat earnings and valuation roadmap.

Find out about the key risks to this GlobalFoundries narrative.

Another View: Cash Flows Paint a Tougher Picture

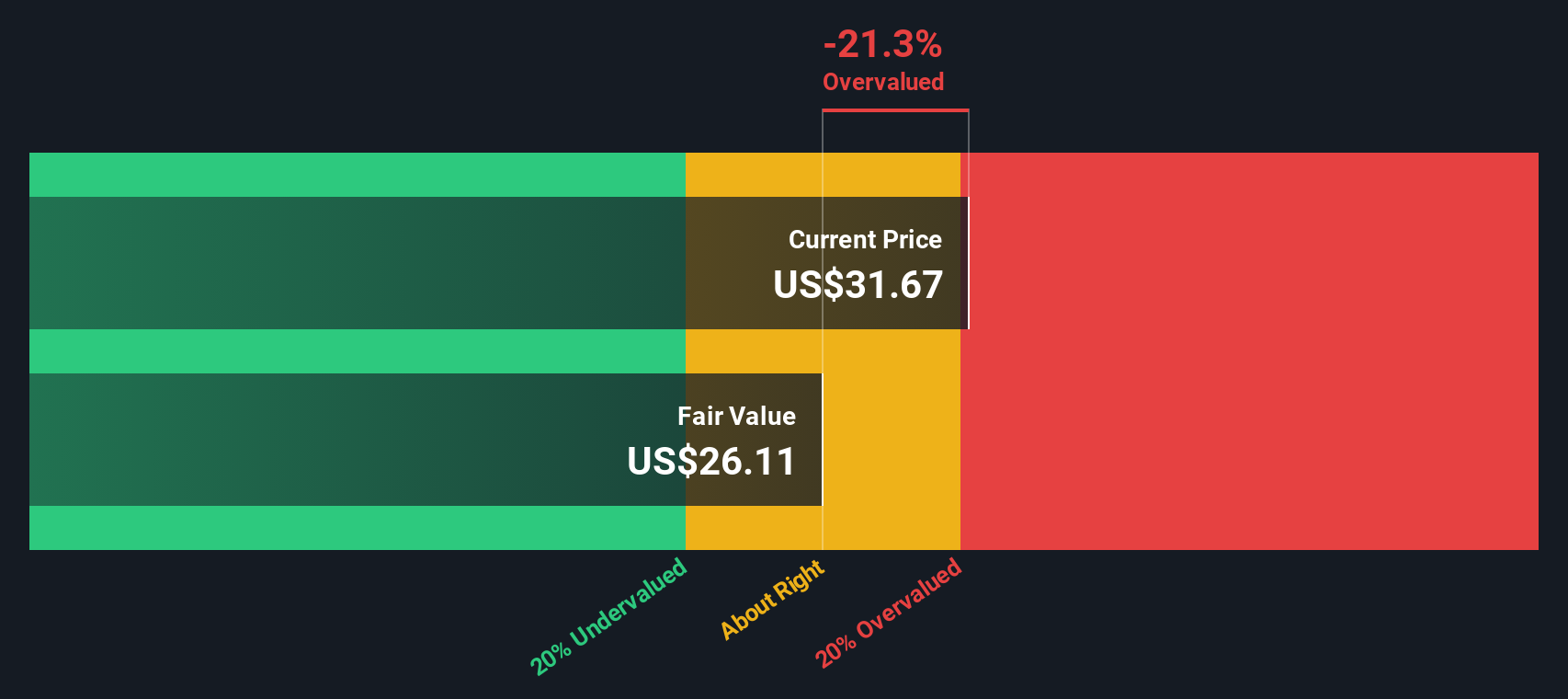

While the narrative fair value suggests upside, our DCF model is more conservative. It puts fair value closer to $29.84, which would make today’s $36.87 share price look overvalued. Is the market rightly pricing long term risk or underestimating GlobalFoundries’ turnaround?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GlobalFoundries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GlobalFoundries Narrative

If you see the story unfolding differently or want to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding GlobalFoundries.

Ready for more investment ideas?

If you stop at GlobalFoundries, you could miss stronger opportunities. Use the Simply Wall St Screener to uncover sharper risk reward trade offs tailored to your style.

- Capture potential multi baggers early by reviewing these 3571 penny stocks with strong financials built on solid balance sheets and real, growing cash flows.

- Target the next wave of intelligent automation by focusing on these 25 AI penny stocks powering software, chips, and infrastructure behind AI adoption.

- Lock in quality at sensible prices by concentrating on these 14 dividend stocks with yields > 3% that combine meaningful income with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com