Assessing OneMain Holdings’ Valuation After a 41% One-Year Rally in the Share Price

OneMain Holdings (OMF) has quietly delivered a strong run, with the stock up about 7% over the past month and roughly 41% over the past year, far outpacing the broader market.

See our latest analysis for OneMain Holdings.

With the share price now around $69.07 and a 90 day share price return of roughly 24.5 percent powering a 1 year total shareholder return of about 40.9 percent, momentum still looks firmly on OneMain Holdings side as investors reassess its growth prospects and risk profile.

If OneMain Holdings renewed your interest in financials, it might be worth hunting for other lenders showing strong execution and insider confidence via fast growing stocks with high insider ownership.

Yet with shares edging above Wall Street price targets while models still flag a hefty intrinsic discount, investors face a crucial question: is OneMain still trading below its true value, or is the market already baking in future growth?

Most Popular Narrative: 1% Overvalued

Compared with OneMain Holdings last close at $69.07, the most widely followed narrative points to a fair value of about $68.40. This implies only a slim valuation gap and a finely balanced outlook on future cash generation.

Fair Value: risen slightly from approximately $66.29 to $68.40 per share, reflecting a modestly higher intrinsic value estimate.

Revenue Growth: edged down slightly from about 33.85% to 33.41%, signaling a marginally more conservative top line outlook.

Curious how a higher profit margin forecast can coexist with more cautious growth assumptions and a lower future earnings multiple, yet still lift fair value? The full narrative unpacks a tight web of revenue expansion, margin discipline and capital returns that support this price tag, and the details are not what most investors expect.

Result: Fair Value of $68.40 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharper consumer downturn or tighter funding conditions could quickly erode credit quality, squeeze margins and undermine those carefully modeled earnings paths.

Find out about the key risks to this OneMain Holdings narrative.

Another Angle on Value

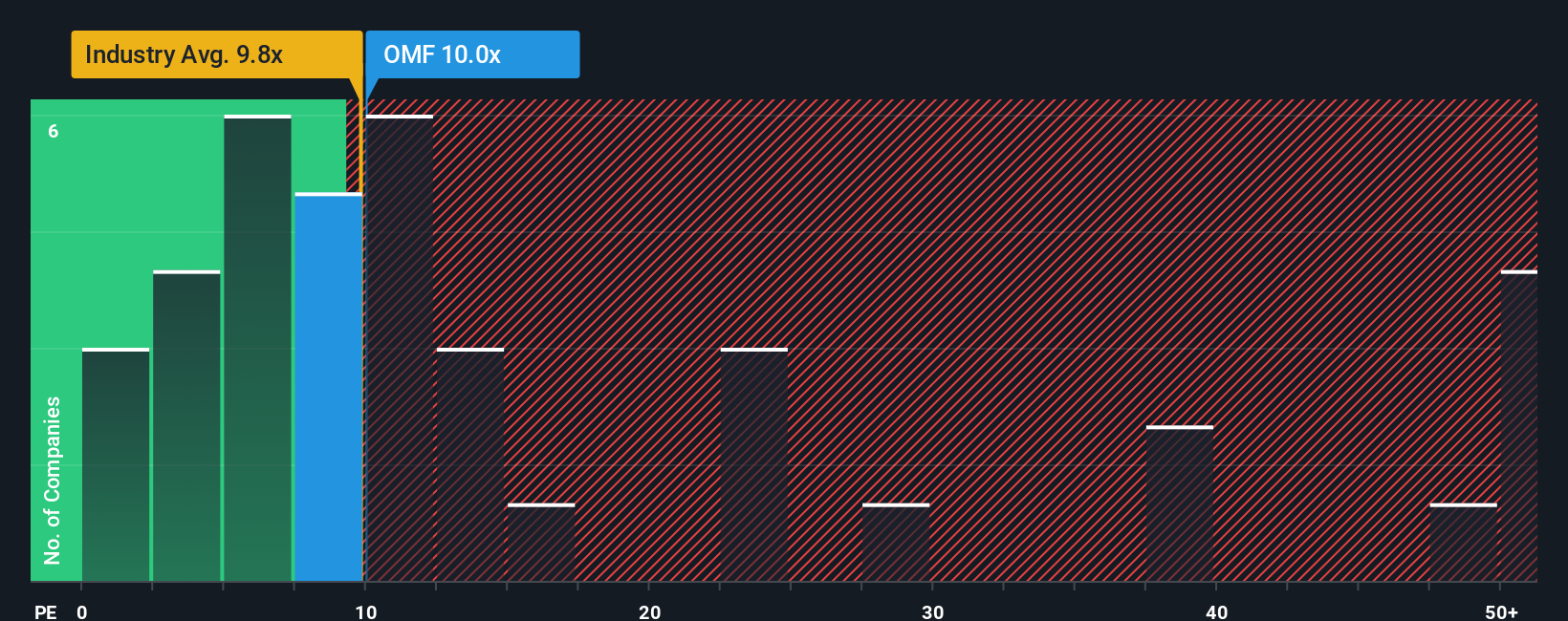

On headline numbers, OneMain looks cheap with a price to earnings ratio of 11.5 times, far below peers at 52.3 times and under its own 17.8 times fair ratio. This hints at potential upside if sentiment normalizes. However, are investors underestimating credit and funding risk, or over penalizing it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OneMain Holdings Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a customized view in minutes using Do it your way.

A great starting point for your OneMain Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with OneMain, use the Simply Wall Street Screener now to uncover fresh opportunities before the crowd spots them and prices them in.

- Capture potential bargains early by checking out these 875 undervalued stocks based on cash flows that still look cheap based on their future cash flows and growth outlook.

- Ride powerful structural themes by focusing on these 29 healthcare AI stocks shaping the next wave of innovation in medicine and diagnostics.

- Supercharge your search for income by targeting these 14 dividend stocks with yields > 3% that can support your portfolio with stronger, more reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com