Assessing Burlington Stores (BURL) Valuation After Spotlight on High ROE Driven by Leverage

Fresh attention on Burlington Stores (BURL) has zeroed in on its 37% return on equity, far above specialty retail peers and heavily supported by leverage, a mix that naturally raises risk reward questions for investors.

See our latest analysis for Burlington Stores.

That backdrop helps explain why the share price has climbed to about $298, with a 1 month share price return near 10% and a solid 3 year total shareholder return above 30%. This may signal momentum that investors are starting to lean into rather than fade.

If Burlington’s momentum has you rethinking where the next leg of growth might come from, now is a good time to explore fast growing stocks with high insider ownership as potential fresh ideas.

With earnings still growing briskly and the share price sitting about 13% below analyst targets but well above recent lows, the key question now is clear: Is Burlington undervalued or already pricing in its next phase of growth?

Most Popular Narrative: 11.2% Undervalued

With Burlington Stores last closing at $298.39 against a most popular narrative fair value of about $336, the story leans toward upside grounded in growth and margin expansion expectations.

The ongoing upgrades to merchandising and store operations (Burlington 2.0 initiatives), including modernized layouts and improved associate engagement, have produced measurable improvements in sales productivity and margin control, indicating potential for further net margin expansion as these initiatives scale across the chain.

Want to see what powers that upside call? The narrative leans on brisk earnings growth, climbing margins, and a punchy future earnings multiple. Curious how those pieces fit together? Click through to see the full playbook behind that fair value.

Result: Fair Value of $336 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and any misstep in Burlington’s aggressive store expansion could quickly sap margin gains and challenge today’s upbeat valuation narrative.

Find out about the key risks to this Burlington Stores narrative.

Another Take On Valuation

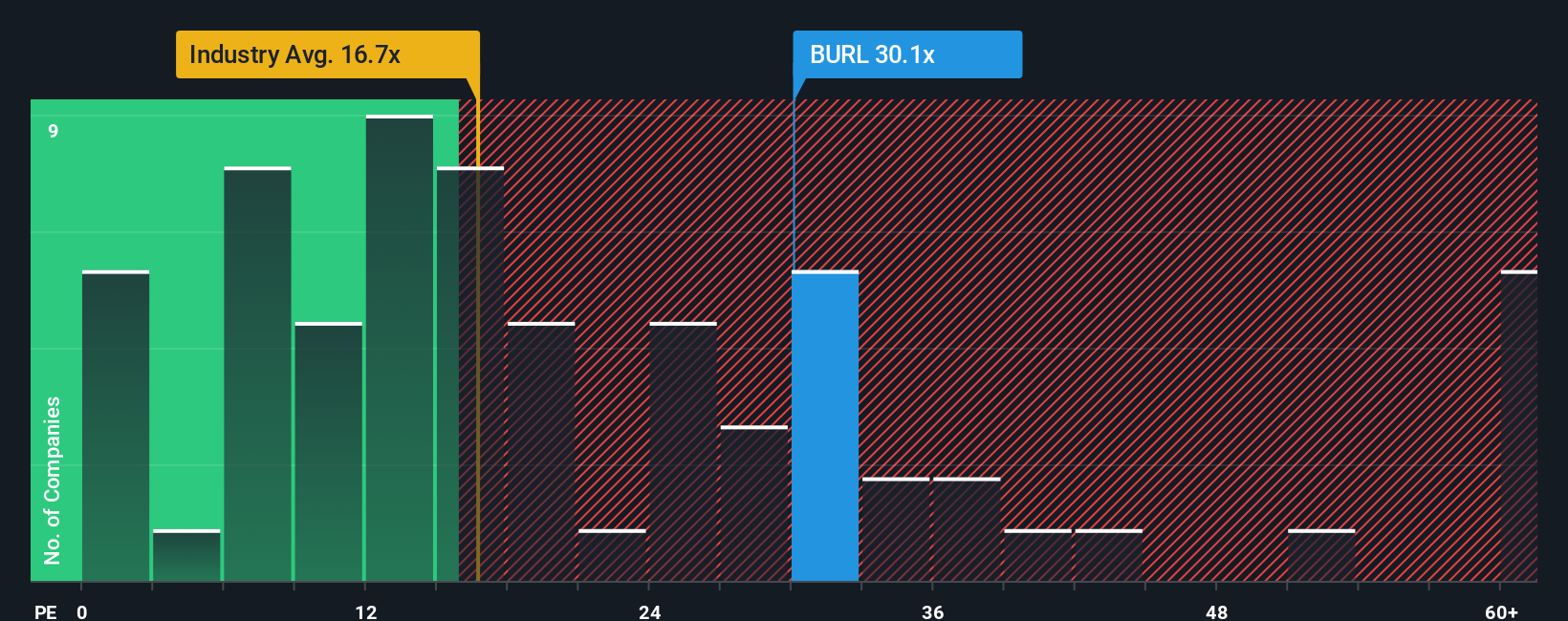

On simple earnings multiples, Burlington looks stretched rather than cheap. The stock trades at about 33 times earnings, compared with roughly 20 times for the US specialty retail industry and about 16 times for peers. This is also above a fair ratio near 23 times, which points to meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Burlington Stores Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your Burlington Stores research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

If Burlington looks compelling, do not stop there. Use the Simply Wall St screener to uncover other opportunities before the market fully catches on.

- Capture potential market mispricing by targeting these 875 undervalued stocks based on cash flows that may offer strong upside relative to their cash flow prospects.

- Capitalize on the surging digital revolution through these 80 cryptocurrency and blockchain stocks positioned at the intersection of blockchain and listed equities.

- Strengthen your income strategy by focusing on these 14 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com