Is Upstart Still Attractive After Its 250% Jump And Recent Share Price Slide?

- Wondering whether Upstart Holdings is a bargain or a bubble at around $45.84? You are not alone. This stock keeps popping up on watchlists from value hunters and momentum traders alike.

- Despite a hefty 250.2% gain over three years, the share price is down 3.4% in the last week, 1.9% over the past month, and 28.5% over the past year, which signals shifting sentiment and a reset in expectations.

- Those swings have come as investors continually reassess Upstart's role in using AI driven underwriting for consumer credit and debate how scalable and defensible its platform really is. Broader market volatility around high growth, higher risk fintech names has only amplified each new headline and analyst take on the stock.

- On our framework, Upstart currently scores just 1/6 on undervaluation checks. In the sections ahead we will break down what that means across discounted cash flow, multiples, and peer comparisons, then finish with a more intuitive way to think about what the market is really willing to pay for this story.

Upstart Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Upstart Holdings Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the return that investors demand for the risk they are taking, then capitalizes those surplus profits into an intrinsic value per share.

For Upstart Holdings, the model starts with a Book Value of $7.65 per share and a Stable EPS of $3.24 per share, based on weighted future Return on Equity estimates from 5 analysts. With an Average Return on Equity of 27.88% and a Cost of Equity of $1.03 per share, the company is expected to generate an Excess Return of $2.20 per share, indicating its investments are projected to earn more than the required shareholder return.

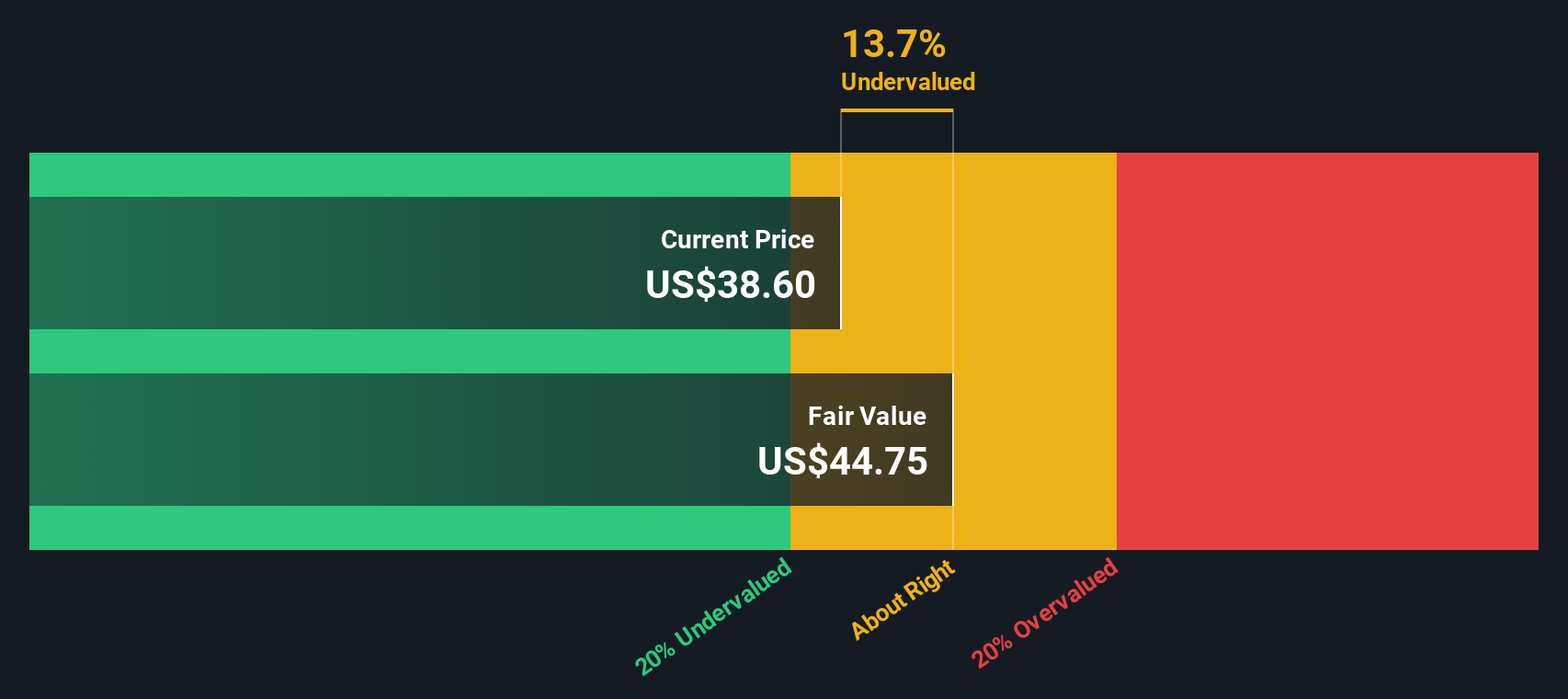

These excess returns are applied to a higher Stable Book Value of $11.61 per share, sourced from weighted future Book Value estimates from 3 analysts, to arrive at an intrinsic value of about $50.74 per share. Against the current market price near $45.84, this implies roughly a 9.7% undervaluation, which is close enough to treat as within a reasonable margin of error.

Result: ABOUT RIGHT

Upstart Holdings is fairly valued according to our Excess Returns, but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Upstart Holdings Price vs Earnings

For profitable companies like Upstart, the price to earnings ratio is a useful yardstick because it links what investors pay directly to the earnings the business is generating today. The higher the growth runway and the more predictable those earnings, the more investors are usually willing to pay in terms of a higher PE ratio, while higher risk or more cyclical earnings typically warrant a lower multiple.

Upstart currently trades on a lofty PE of about 138.5x, far above the Consumer Finance industry average of roughly 9.5x and the broader peer group around 11.1x. On those simple comparisons, the stock looks extremely expensive. However, Simply Wall St’s Fair Ratio framework goes a step further. It estimates what an appropriate PE should be for Upstart, at about 37.7x, after accounting for its earnings growth profile, profitability, industry, market cap, and specific risk factors.

Because this Fair Ratio incorporates both upside potential and downside risk, it is a more tailored anchor than broad peer or industry averages. Comparing the current 138.5x PE to the 37.7x Fair Ratio suggests the market is paying a significant premium over what fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1464 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Upstart Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Upstart Holdings with concrete forecasts and a fair value estimate.

A Narrative is your story about the company, expressed through assumptions for future revenue, earnings and margins. The Simply Wall St platform turns these assumptions into a financial forecast and then into a fair value you can compare directly with today’s share price.

Available on the Community page used by millions of investors, Narratives are easy to set up and can help you understand how your view compares to the current market price by showing whether your Fair Value is above or below the current Price. They also automatically update as new information such as news or earnings is released.

For example, one Upstart Holdings Narrative might assume strong loan growth and improving margins and arrive at a fair value near $105 per share. A more cautious Narrative that focuses on credit risk and macro uncertainty might point to a fair value closer to $20, illustrating how different perspectives can coexist and helping you choose the story that best aligns with your own view.

Do you think there's more to the story for Upstart Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com