National Bank Holdings (NBHC): Reassessing Valuation After Recent Share Price Pullback

National Bank Holdings (NBHC) has been drifting lower over the past week and month, and that kind of quiet pullback often opens the door for investors to revisit the bank’s earnings power and valuation.

See our latest analysis for National Bank Holdings.

At around $37.90, the latest share price pullback sits against a one year total shareholder return of negative 8.67 percent and a five year total shareholder return of 22.10 percent. This suggests near term momentum has cooled even as the longer term story still looks constructive.

If this kind of pause in a regional bank has you rethinking your opportunities, it could be a good moment to scan for fast growing stocks with high insider ownership as potential next ideas.

With earnings still growing double digits and the share price trading at a sizable discount to Wall Street targets and intrinsic value estimates, is National Bank Holdings quietly undervalued, or are markets already discounting its future growth?

Most Popular Narrative Narrative: 17.2% Undervalued

With National Bank Holdings last closing at $37.90 against a narrative fair value of $45.75, the spread points to a meaningful potential upside rooted in specific growth and margin assumptions.

The revenue growth assumption has risen significantly from 7.79% to 18.04%, driven by higher expected contribution from the Texas expansion.

The net profit margin forecast has improved from 28.45% to 30.84%, indicating expectations for stronger operating leverage and efficiency gains.

Curious how a regional bank earns a premium growth label while its future earnings multiple is marked down? The narrative leans on bolder revenue, fatter margins, and a surprisingly restrained valuation bar. Want to see the exact financial runway behind that disconnect?

Result: Fair Value of $45.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case hinges on smooth Vista integration and successful 2UniFi adoption, where missteps could pressure growth, margins, and the bank’s premium narrative.

Find out about the key risks to this National Bank Holdings narrative.

Another View: Market Multiple Sends a Caution Flag

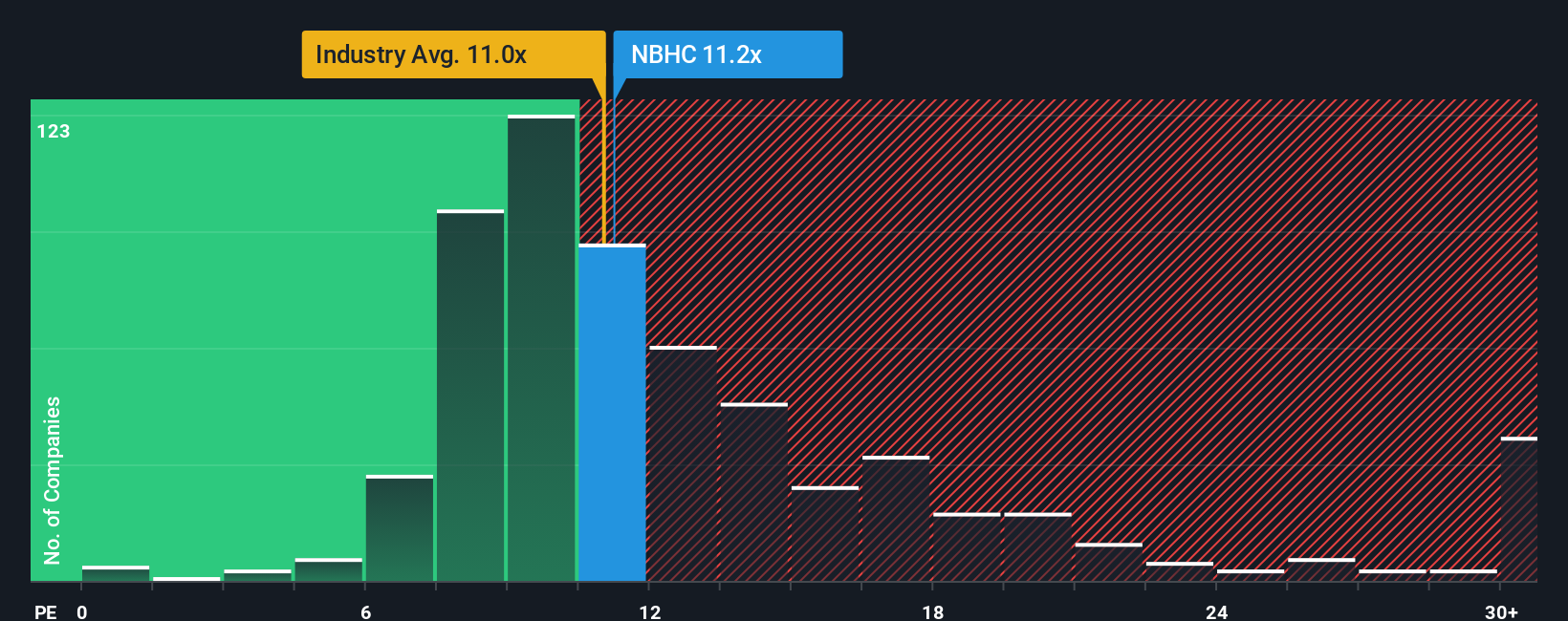

On earnings, National Bank Holdings looks less obviously cheap. The shares trade on about 11.9 times earnings versus 11.1 times for peers and 11.8 times for the wider US banks group. Our fair ratio sits higher at 13.7 times, suggesting scope, but not certainty, for re rating.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Bank Holdings Narrative

If this framework does not quite match your view or you prefer to dig into the numbers yourself, you can build a personalized thesis in just a few minutes: Do it your way.

A great starting point for your National Bank Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investment move?

If you stop at National Bank Holdings, you could miss compelling opportunities the Simply Wall Street Screener surfaces across growth, income, and innovation focused stocks.

- Capitalize on mispriced quality by targeting stocks trading below their estimated cash flow value through these 875 undervalued stocks based on cash flows.

- Ride structural growth in automation and machine learning with carefully filtered opportunities from these 25 AI penny stocks.

- Strengthen your income stream by finding companies with reliable payouts using these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com