Growth trajectory intact

PETALING JAYA: Malaysia has the right economic policy mix to face global headwinds in 2026.

However, medium and long-term measures, economists said, should be adopted to ensure it has sufficient ammunition to weather the challenges in the event the global economy worsens.

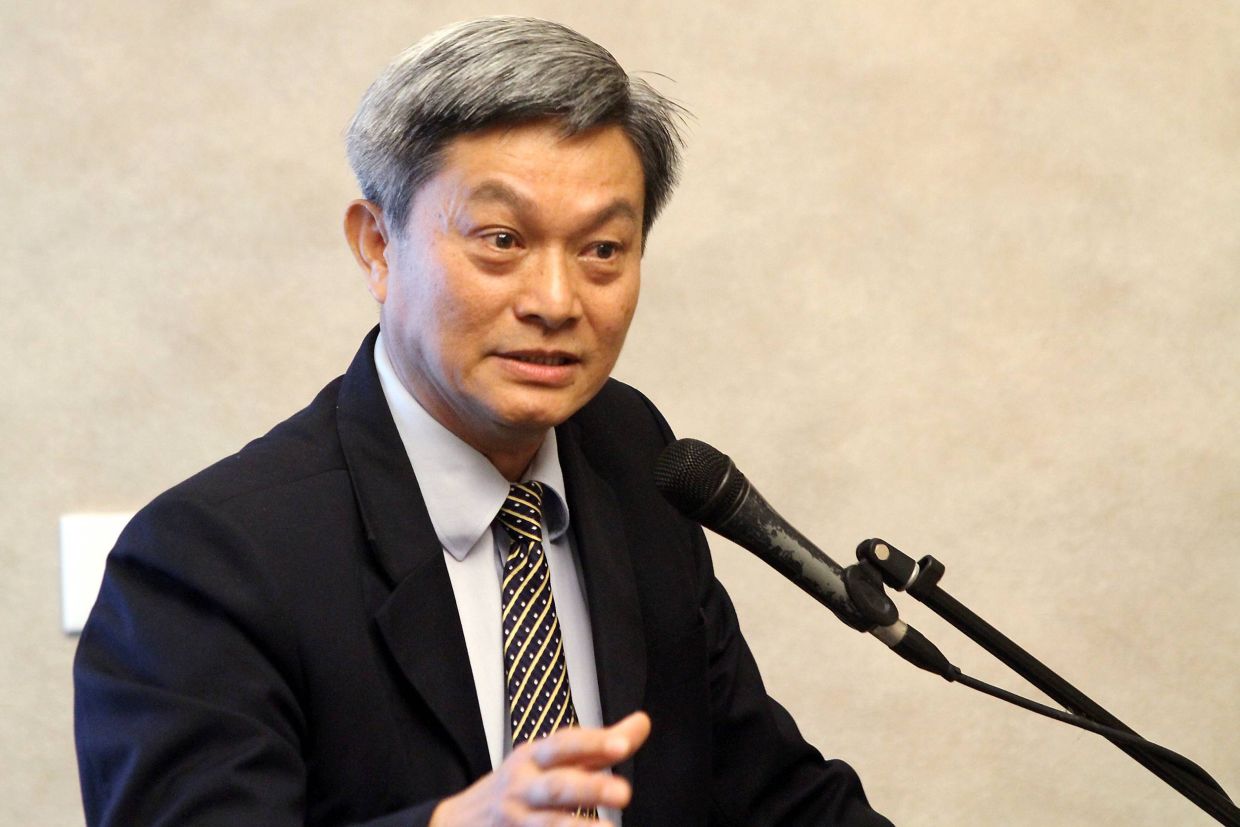

Sunway University economics professor Yeah Kim Leng, who is also an adviser to the government, told StarBiz that Malaysia’s economic policy mix so far has delivered commendable results in 2025, as evidenced by around 5% gross domestic product (GDP) growth, low consumer price index (CPI) inflation of below 2% and a further drop in the unemployment rate to 3%.

“The performance is more impressive when viewed against a challenging global environment marked by geopolitical conflicts and an unprecedented global tariff war unleashed by the US Trump administration,” he noted.

“Internally, the absence of economic slack or overheating signs, a positive savings-investment gap and mostly stable sectoral supply-demand balances indicate that the country’s short-term economic policy mix is appropriate.”

He said there is also adequate monetary and fiscal flexibility for the government to navigate a poly-crisis world that could become more turbulent in 2026.

“The main risk is that the current gradual fiscal consolidation trajectory could be derailed by a sharper-than-expected global slowdown that may necessitate higher government deficit spending, in addition to rolling back subsidies less aggressively.

“There is also monetary policy space to increase liquidity and reduce interest rates should domestic demand weaken substantially in the event the global economy takes a turn for the worse.

“To face longer-term challenges, the policy mix across industrial, trade, labour market, competition, productivity and education dimensions requires sustained and innovative reforms with a stronger focus on implementation, monitoring and evaluation,” Yeah said.

Economic policy mix refers to a combination of monetary policy and fiscal policy tools that are used by the government appropriately to address specific economic issues.

Juwai IQI global chief economist Shan Saeed said with inflation comfortably contained below 1.5% and the 2025 budget deficit held at approximately 3.8% of GDP, Malaysia stands out as a model of fiscal discipline, institutional credibility and structural ringgit stability amid a global landscape still marked by instability and uncertainty.

“Crucially, the nation’s debt-to-GDP ratio remains on a clear downward trajectory, poised to fall below 60% in 2026, reinforcing long-term sovereign stability, policy credibility and investor confidence.”

Looking ahead, Shan said robust domestic demand remains the primary engine of growth, underpinned by rising investment activity, targeted fiscal support and sustained infrastructure development.

He said public and private capital formation continues to generate strong multiplier effects across output, employment and productivity.

Citing statistics, he said, “In the first half of financial year 2025 alone, total approved investments surged by approximately 18.7%, with capital increasingly allocated toward digital infrastructure, renewable energy, logistics networks and industrial upgrading.

“This strategic deployment of capital not only supports near-term expansion, but also strengthens Malaysia’s structural competitiveness and economic resilience over the medium term.”

Over the medium term, Shan said the country’s accelerating integration of artificial intelligence across manufacturing, information and communication technology (including semiconductors) and services value chains, combined with a growing emphasis on environmental, social and governance aligned investment frameworks, would further enhance productivity and reinforce long-term competitiveness.

Ultimately, he said Malaysia’s path toward 2026 is underpinned by sound sovereign macro fundamentals.

“In a world defined by policy fragmentation and volatility, Malaysia’s advantage lies not in speed, but in stability, anchored by credible institutions, disciplined macro management and a forward-looking investment strategy,” Shan noted.

Shan said regionally, Malaysia is also well positioned to benefit from the next phase of South-East Asia’s growth cycle.

“The Asean ‘Fabulous Five’ – Malaysia, Indonesia, Thailand, the Philippines and Vietnam – are set to drive regional expansion in 2026 and beyond, supported by favourable demographics, accelerating industrialisation, digital adoption, macroeconomic stability and rising intra-regional trade,” Shan noted.

“Within this cohort, Malaysia’s policy coherence, sovereign macro-stability and depth of investment place it in a particularly advantageous competitive position.”