TransDigm (TDG): Revisiting Valuation After a Solid Multi‑Year Shareholder Return Run

TransDigm Group (TDG) has been quietly grinding higher, with the stock up about 2% in the past week and 5% over the past 3 months as investors revisit aerospace exposure.

See our latest analysis for TransDigm Group.

Zooming out, that steady grind has added up to a solid 1 year total shareholder return of about 14%, while a 3 year total shareholder return above 140% signals strong, ongoing momentum behind the story.

Given renewed interest in aerospace suppliers, this could be a good moment to see what else is moving in the sector and explore aerospace and defense stocks.

With TransDigm still delivering double digit earnings growth and trading at a sizable discount to analyst targets, the key question now is whether upside remains for new buyers or if the market has already priced in future gains.

Most Popular Narrative: 14.4% Undervalued

With TransDigm last closing at $1358.55 against a narrative fair value of about $1586, the valuation debate centers on how durable its cash generation really is.

Ongoing industry trends toward outsourcing parts manufacturing by major OEMs are creating opportunities for specialized suppliers like TransDigm to capture additional content per aircraft, ultimately boosting long term revenue growth, EBITDA margins, and free cash flow generation.

Want to see what powers that cash flow story, beyond the headline multiple? The narrative leans on a tight blend of steady growth, rising margins, and a bold future earnings profile that usually belongs in a different sector. Curious which specific profit assumptions are doing the heavy lifting in that fair value math, and how far the market would need to stretch to meet them? Read on and unpack the full set of projections behind this price tag.

Result: Fair Value of $1586 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could be challenged if aftermarket growth slows faster than expected, and TransDigm’s high leverage magnifies any downturn in aerospace demand.

Find out about the key risks to this TransDigm Group narrative.

Another Angle on Valuation

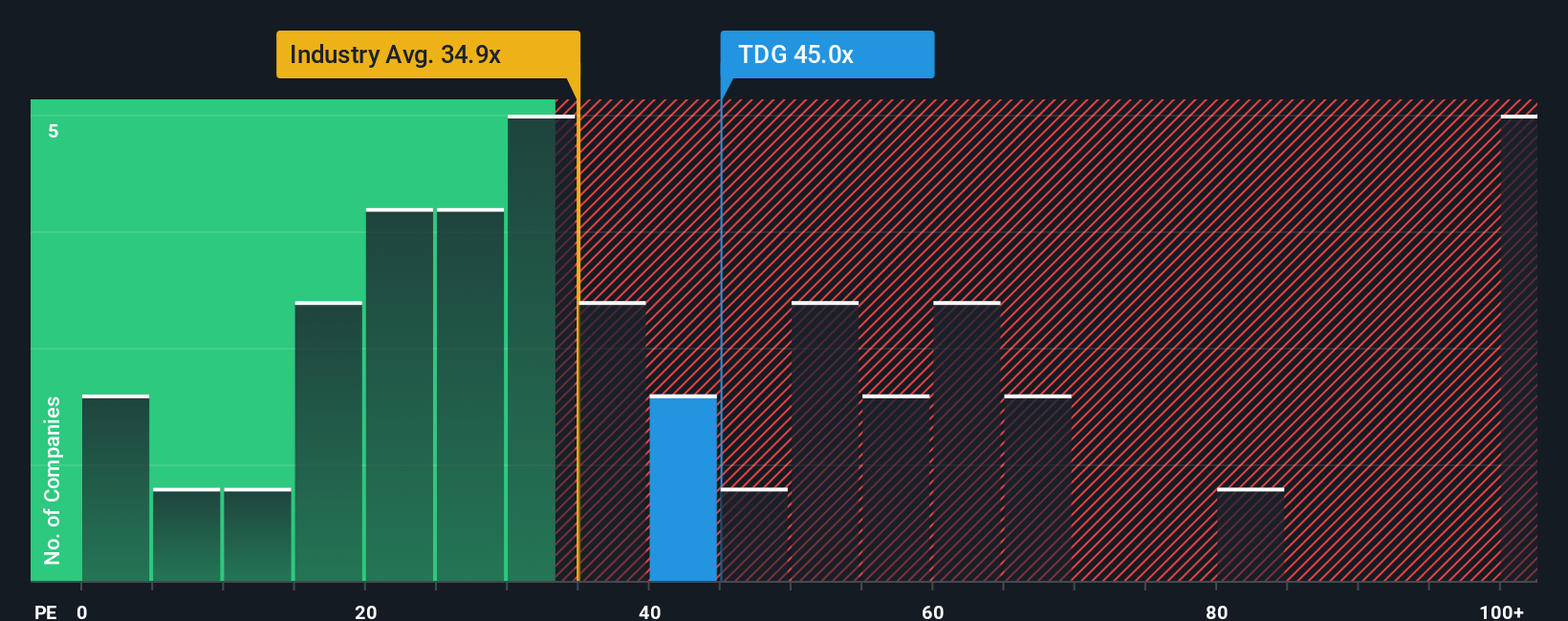

On earnings, TransDigm looks anything but cheap. The stock trades at about 41 times earnings, versus 39.3 times for the broader US Aerospace and Defense group and 33.5 times for close peers, while our fair ratio sits nearer 32.9 times.

That premium suggests investors are already paying up for execution and capital allocation skill. This raises a practical question: are you comfortable betting that growth and margins can stay strong enough to stop that multiple from drifting back toward the fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransDigm Group Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your TransDigm Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss some of the market’s most compelling setups. Consider using Simply Wall Street’s Screener to do the heavy lifting.

- Explore early-stage growth potential by scanning these 3571 penny stocks with strong financials that already show real financial strength instead of just hype.

- Align your portfolio with the AI transformation by targeting these 25 AI penny stocks involved in automation, analytics, and intelligent software.

- Look for value-focused opportunities with these 875 undervalued stocks based on cash flows where cash flows may indicate upside that the market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com