DoorDash (DASH): Rethinking Valuation After Recent Share Price Pullback and Strong Growth Metrics

DoorDash (DASH) shares have slipped over the past week and month, but the bigger story is how this food delivery leader looks after a strong year of revenue and profit growth.

See our latest analysis for DoorDash.

Despite the recent pullback, DoorDash still trades at a share price of $219.79, with a 1 year total shareholder return of 25.62% that reflects solid underlying confidence. However, the 3 month share price return of negative 21.99% signals cooling momentum after a strong multi year run, highlighted by a 3 year total shareholder return of 357.9%.

If DoorDash’s ride has you rethinking where growth might show up next, it could be worth scanning other high growth tech and platform plays through high growth tech and AI stocks.

With revenue and profits still climbing, yet shares well off recent highs and trading at a discount to analyst targets, investors must now ask: Is DoorDash undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 20.5% Undervalued

With DoorDash closing at $219.79 versus a narrative fair value near $276, the current price reflects a sizable valuation gap investors are weighing.

Strategic investments in AI and automation such as enhanced search, personalization, logistics optimization, and autonomous or robotic delivery are expected to lower fulfillment costs per order over time. This is anticipated to drive sustained improvements in operating leverage and net margins. Accelerating growth of high margin revenue streams, including platform advertising and emerging SaaS offerings like the SevenRooms acquisition, is expanding DoorDash's profit pool beyond core delivery and supporting further earnings upside.

Curious how those efficiency bets and new revenue streams add up to this higher value? The narrative focuses on powerful growth, richer margins, and a bold future earnings multiple. Want to see the precise assumptions and how they compare over the next few years?

Result: Fair Value of $276.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising labor and regulatory costs, plus potential U.S. saturation if new verticals misfire, could quickly challenge those upbeat growth and margin assumptions.

Find out about the key risks to this DoorDash narrative.

Another Angle on Valuation

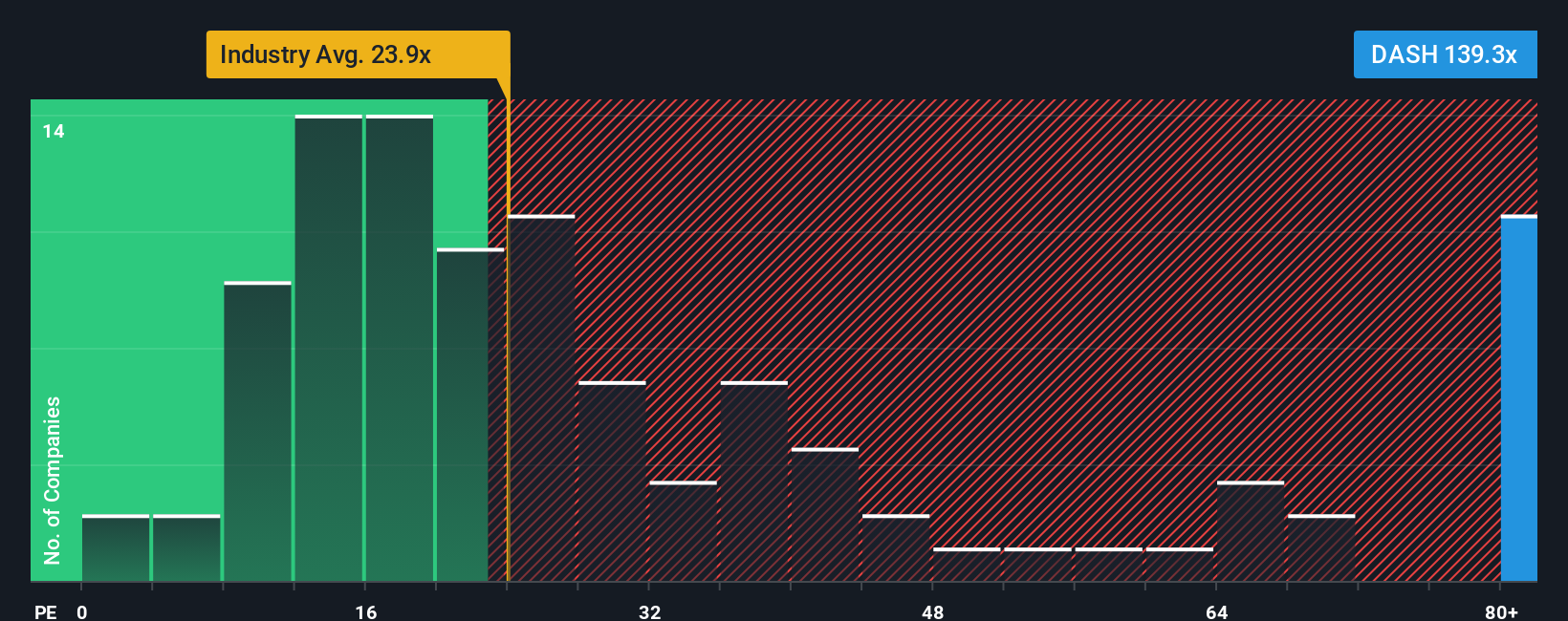

On earnings, the picture flips. DoorDash trades on a steep 109.8 times earnings, compared with a 21.7 times average for the US hospitality sector and a 34.6 times peer average. Our fair ratio is closer to 50.2 times. Is the market banking on flawless execution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoorDash Narrative

If you see things differently or want to dive into the numbers yourself, you can build a personal thesis in just minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding DoorDash.

Ready for more investing opportunities?

Before you move on, put your research momentum to work by checking live stock ideas from our screeners so you never leave potential returns on the table.

- Explore your growth strategy with these 875 undervalued stocks based on cash flows that may offer opportunities as the market reassesses their cash flow strength.

- Focus on innovation by targeting these 25 AI penny stocks at the intersection of algorithms, data advantages, and real world adoption.

- Seek potential income streams with these 14 dividend stocks with yields > 3% that combine current yields with underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com