IBM (IBM) Valuation Check After Recent Pullback and Strong 1-Year Run

International Business Machines (IBM) is coming off a softer stretch, with the stock down about 5% over the past month even as its one year return still sits north of 30%.

See our latest analysis for International Business Machines.

That pullback comes after a strong run, with the share price now at $291.5 and a 1 year total shareholder return of 34.31%, signalling that longer term momentum is still firmly intact despite the recent wobble.

If IBM's shift toward hybrid cloud and AI has caught your eye, it is also worth exploring other innovative tech names using our screener for high growth tech and AI stocks.

With IBM now trading just shy of analyst targets after a powerful multi year run, investors face a key question: is there still upside left in the hybrid cloud and AI story, or is future growth already priced in?

Most Popular Narrative Narrative: 1% Undervalued

With IBM closing at $291.5 against a narrative fair value near $293.9, the storyline assumes only a slim remaining upside from here.

The analysts have a consensus price target of $281.316 for International Business Machines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $350.0, and the most bearish reporting a price target of just $198.0.

Curious how modest revenue growth, rising margins and a rich future earnings multiple can still point to upside from today’s price, despite tight projections?

Result: Fair Value of $293.89 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could fray if macro uncertainty slows consulting demand or if Red Hat’s consumption growth undershoots, which would challenge IBM’s mid single digit revenue ambitions.

Find out about the key risks to this International Business Machines narrative.

Another Angle on Valuation

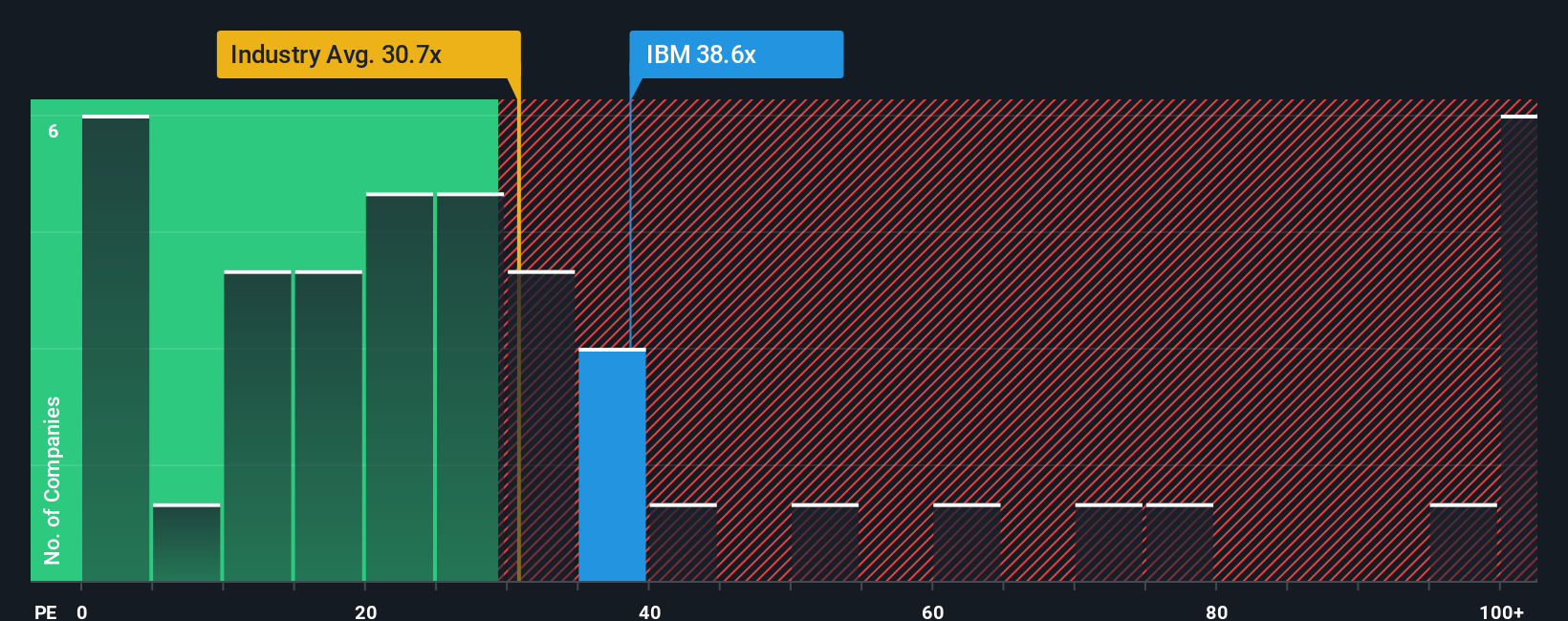

On earnings, IBM screens pricey, trading on a 34.4x price to earnings ratio versus 21.3x for peers and 28.8x for the broader US IT group. Yet Simply Wall St’s fair ratio of 37.9x hints the market might still edge higher, leaving investors to weigh upside against the risk of de rating.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own International Business Machines Narrative

If you see the numbers differently, or would rather dive into the drivers yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your International Business Machines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Put your research momentum to work and use the Simply Wall St Screener to uncover fresh opportunities before everyone else is talking about them.

- Target resilient income by scanning these 14 dividend stocks with yields > 3% that can help strengthen your portfolio’s cash flow through changing markets.

- Capture tomorrow’s technology leaders early by filtering for these 25 AI penny stocks before their growth is fully recognized by the market.

- Position for a potential valuation reset by focusing on these 875 undervalued stocks based on cash flows that may be trading at meaningful discounts to their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com