FTAI Aviation (FTAI): Revisiting Valuation After Strong Earnings, Guidance Hike, Dividend Increase and FTAI Power Launch

FTAI Aviation (FTAI) just delivered a quarter that combined faster revenue growth with higher EBITDA guidance and a dividend bump. At the same time, the new FTAI Power platform signaled a strategic push into data center focused power solutions.

See our latest analysis for FTAI Aviation.

Those catalysts have helped push FTAI Aviation’s share price to about $210.35, with a 7 day share price return above 20% and a one year total shareholder return above 40%, signaling that momentum is still firmly building rather than fading.

If FTAI’s run has you rethinking where growth could come from next, this is a good moment to explore aerospace and defense stocks as potential companions to your watchlist.

With the stock already near record highs, trading only modestly below analyst targets and at a premium to many industrial peers, investors now face a key question: is this still a buying opportunity, or has the market already priced in FTAI’s next leg of growth?

Most Popular Narrative Narrative: 7.4% Undervalued

With FTAI Aviation closing at $210.35 against a narrative fair value of $227.10, the story frames upside as still on the table.

Significant operational leverage is expected from FTAI's ramp in vertical integration, as evidenced by recent acquisitions (e.g., Pacific Aerodynamic) and in-house repair/production capabilities. These moves are driving cost efficiencies, increased margin per shop visit, and expanded gross/EBITDA margins, all of which are likely to boost future EPS growth.

Want to see the earnings engine behind that upside? The narrative leans on accelerating revenue, climbing margins and a rich future multiple. Curious how those pieces fit?

Result: Fair Value of $227.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on legacy engine demand and successful scaling of capital light partnerships, leaving execution missteps or faster tech shifts as meaningful risks.

Find out about the key risks to this FTAI Aviation narrative.

Another Lens on Value

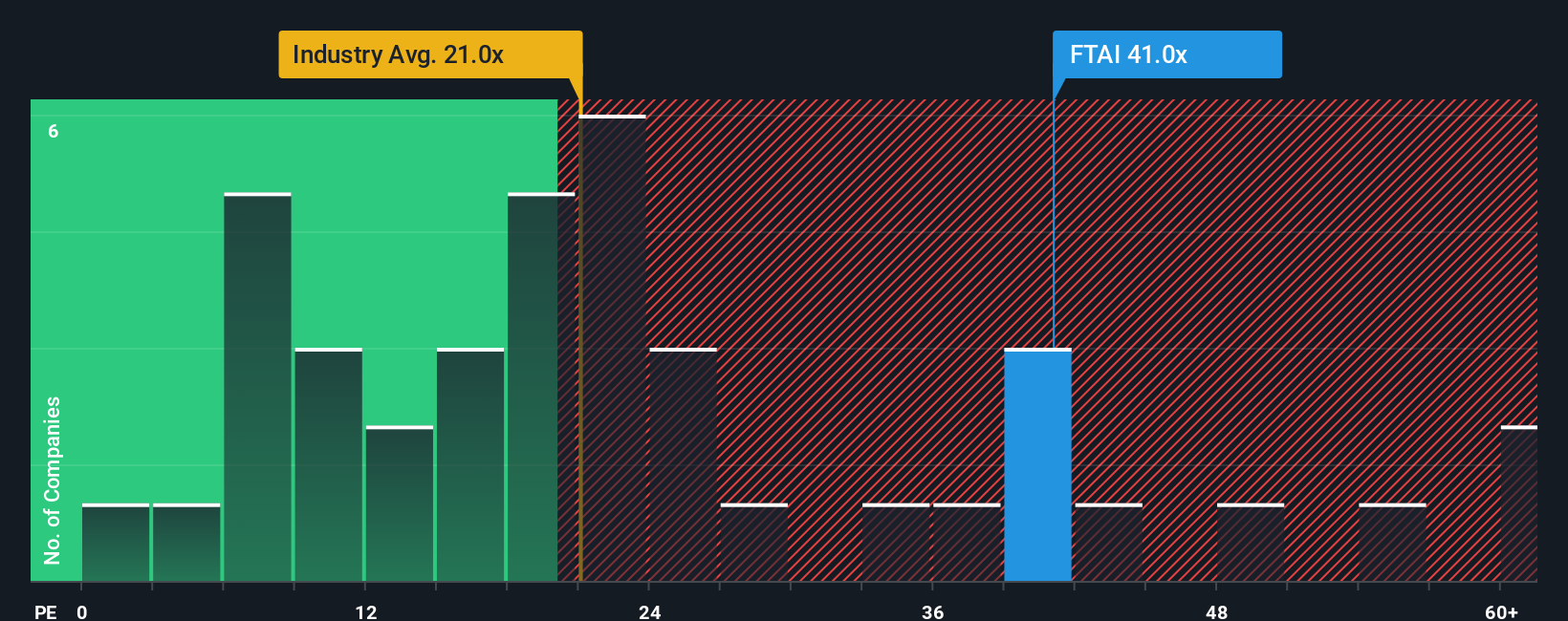

That 7.4% narrative upside looks appealing, but a simple price to earnings check tells a sharper story. FTAI trades at 47.7 times earnings, more than double peers at about 20 times and only slightly below a fair ratio of 50.4 times, suggesting limited margin for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FTAI Aviation Narrative

If you see the numbers differently or prefer your own deep dive, you can build a fresh narrative in just minutes, Do it your way.

A great starting point for your FTAI Aviation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing edge?

Do not stop with a single stock. Use the Simply Wall St Screener to uncover targeted, high conviction opportunities that could reshape your portfolio and future returns.

- Capture potential value plays early by targeting companies trading below intrinsic worth through these 875 undervalued stocks based on cash flows before the broader market reacts.

- Explore the growth potential of intelligent automation by filtering for innovators in machine learning and neural networks via these 25 AI penny stocks.

- Strengthen your income stream by focusing on reliable payouts and attractive yields using these 14 dividend stocks with yields > 3% to pinpoint stand-out candidates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com