Japanese retail investors ignored the Japanese bull market and “fled”! Capital outflows exacerbate the long-term weakness of the yen

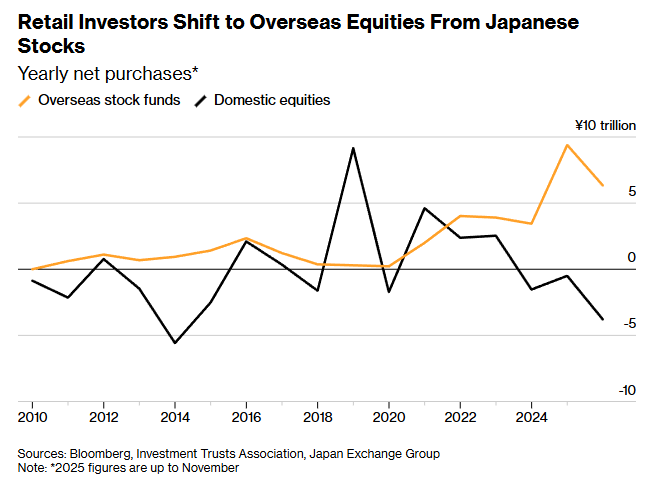

The Zhitong Finance App learned that Japanese retail investors ignored the rising trend in the domestic stock market and instead pinned their confidence on overseas stocks. According to data compiled by the Japan Exchange Group and the Japan Investment Trust Association, as of November 2025, net sales of Japanese stocks and related investment trusts by Japanese retail investors reached 3.8 trillion yen (about 24.3 billion US dollars), the highest level in more than 10 years. Meanwhile, net purchases of overseas stocks by Japanese retail investors through investment trusts hovered around 9.4 trillion yen, a record in 2024, showing retail investors' willingness to maintain strong allocation of foreign assets. This was mainly driven by the weakening of the yen — when denominated in yen, the value of overseas stocks was amplified.

Japanese retail investors are switching from Japanese stocks to overseas stocks

Some retail investors said, “I just think US stocks have more potential.” “Especially now, big tech companies such as the 'Big Seven' are likely to dominate the growth in the field of artificial intelligence.”

The outflow of funds has put pressure on the yen to depreciate. The Bank of Japan's interest rate hike and more government spending to stimulate the economy may also have an impact on the yen. Notably, capital outflows run counter to the goals of Japanese policymakers, which are driving households to shift from savings to investments to improve returns and channel more cash to domestic companies to boost growth.

Adarsh Sinha, global head of G10 interest rate and foreign exchange strategy at Bank of America Securities, said: “The outflow of capital is unprecedented.” He mentioned that the Japanese government's introduction of the tax-free investment account NISA has accelerated the purchase of foreign stocks, “which is why the extent to which the yen has weakened for a long time has exceeded general expectations.”

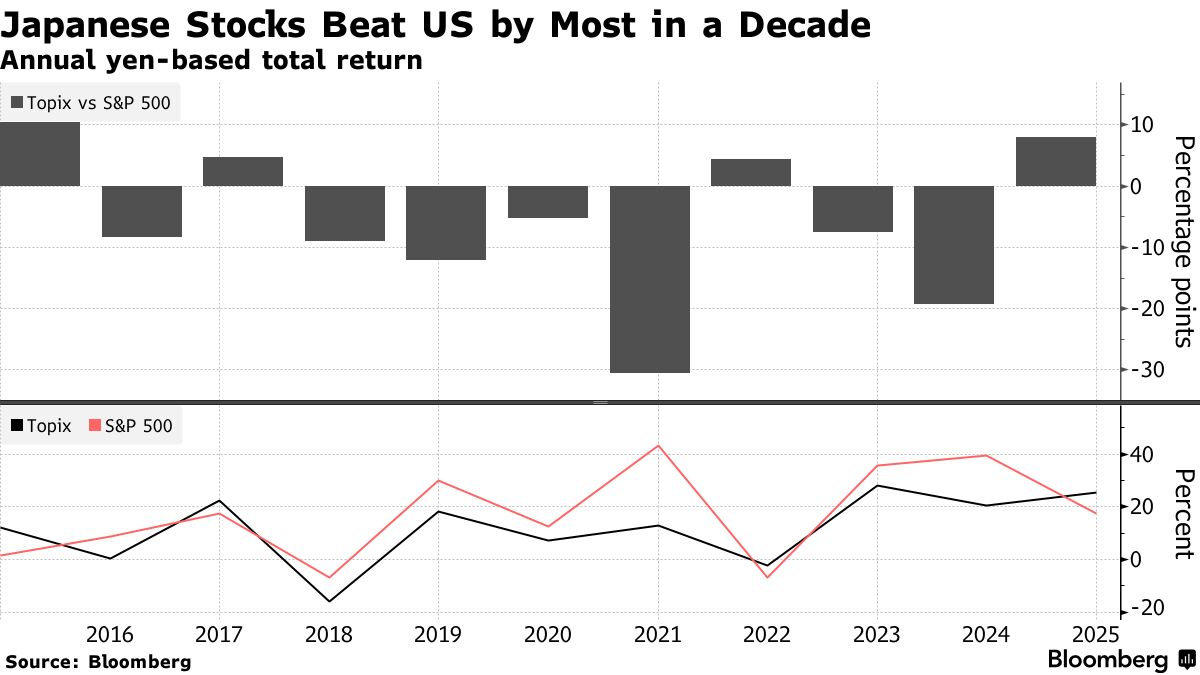

Thanks to strong corporate profits and the Takaichi Sanae government's policy stance supporting growth, the TSE Index rose 25% (in yen terms) in 2025, outperforming the S&P 500 index by the biggest margin since 2015.

Despite the rebound in the Japanese stock market, the above situation is still happening. Institutions such as J.P. Morgan Chase and BNP Paribas expect the yen to depreciate to 160 yen or more per dollar by the end of 2026. Structural factors are dragging down the yen, including the gap in bond yield between Japan and the US — Japan's benchmark 10-year Treasury yield is still about 2 percentage points lower than US Treasury bonds; the real interest rate after adjustment for inflation is still negative, making the yen unattractive to investors seeking returns.

However, the slowdown in the AI boom may prompt Japanese retail investors to turn their attention to the domestic stock market. Hideyuki Ishiguro, chief strategist at Nomura Asset Management, said that some retail investors are excessively heavy on US stocks, making their portfolios vulnerable to potential sell-offs in technology stocks. He said that due to excessive valuations in the technology industry, market concerns persist, and 2026 should be a year to reflect on asset diversification. He added,

The reverse investment mentality of many Japanese retail investors stems from the historical background of the Japanese market fluctuating within a relatively narrow range for more than 30 years — during that period, buying on dips was easier to profit. “These old stereotypes are deeply entrenched, and retail investors' selling behavior is likely to continue.”