Trump’s New Navy Frigate and Battleship Plans Might Change The Case For Investing In HII

- In recent days, President Trump announced that Huntington Ingalls Industries will build a new fleet of U.S. Navy frigates based on a proven Coast Guard design, alongside plans for a new “Trump class” of battleships where Huntington Ingalls and General Dynamics are expected to be the primary builders.

- This combination of fresh frigate work and potential battleship awards could materially reshape Huntington Ingalls’ future workload, revenue mix, and long-term visibility on U.S. naval shipbuilding programs.

- We’ll now examine how this prospective wave of new Navy frigate and battleship contracts could reshape Huntington Ingalls’ existing investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Huntington Ingalls Industries Investment Narrative Recap

To own Huntington Ingalls Industries, you need to believe the U.S. will keep funding large manned ships and advanced maritime technology, and that HII can execute on a heavy backlog despite labor and supply chain challenges. The new frigate and “Trump class” battleship plans, if converted into funded contracts, would strengthen short term revenue visibility but also heighten dependence on timely program awards, which is already one of the key risks for the business.

Among recent announcements, the extended partnership with Babcock International to support Virginia class submarine throughput stands out as closely related to this news. It underlines how HII is preparing for higher volumes on complex naval programs, which matters if frigate and battleship work accelerates. Together, these developments tighten the focus on execution risk, workforce capacity and the company’s ability to manage a larger, more complex backlog without margin slippage.

Yet even with all this apparent opportunity, investors should be aware of how much hinges on the timing and certainty of future Navy contract awards...

Read the full narrative on Huntington Ingalls Industries (it's free!)

Huntington Ingalls Industries’ narrative projects $13.6 billion revenue and $785.0 million earnings by 2028. This requires 5.4% yearly revenue growth and a $260.0 million earnings increase from $525.0 million today.

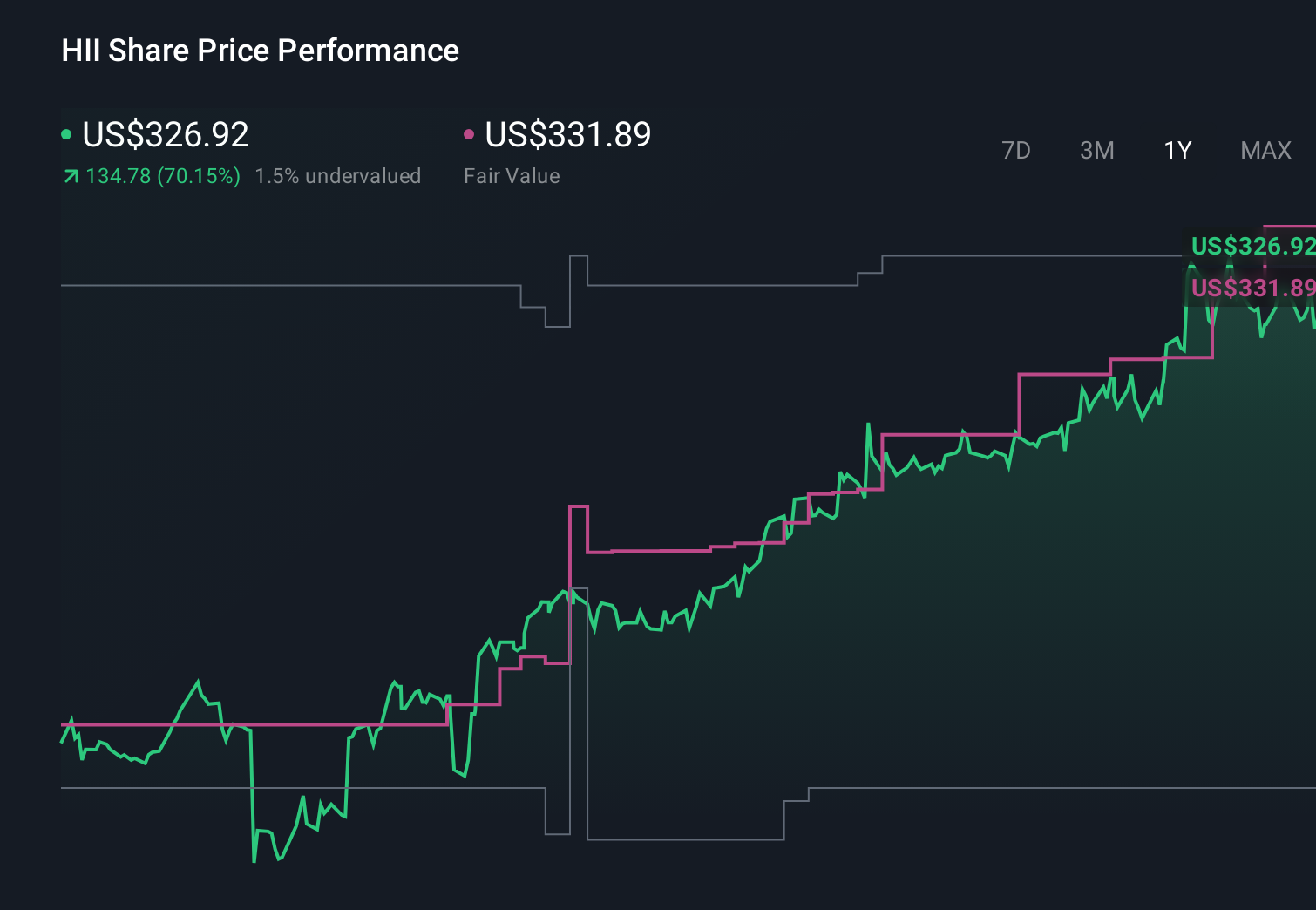

Uncover how Huntington Ingalls Industries' forecasts yield a $331.89 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently see HII’s fair value between US$180 and about US$452 per share, reflecting very different expectations. Against this wide range, the concentration of HII’s fortunes in a few large Navy programs means any delay or reshaping of future awards could have outsized implications for how those expectations play out.

Explore 7 other fair value estimates on Huntington Ingalls Industries - why the stock might be worth 49% less than the current price!

Build Your Own Huntington Ingalls Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Huntington Ingalls Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Huntington Ingalls Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Huntington Ingalls Industries' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com