Is Fiserv a Hidden Opportunity After a 68.6% Share Price Slide?

- If you are wondering whether Fiserv is quietly turning into a value opportunity or just a value trap, you are in the right place to unpack what the current share price is really telling us.

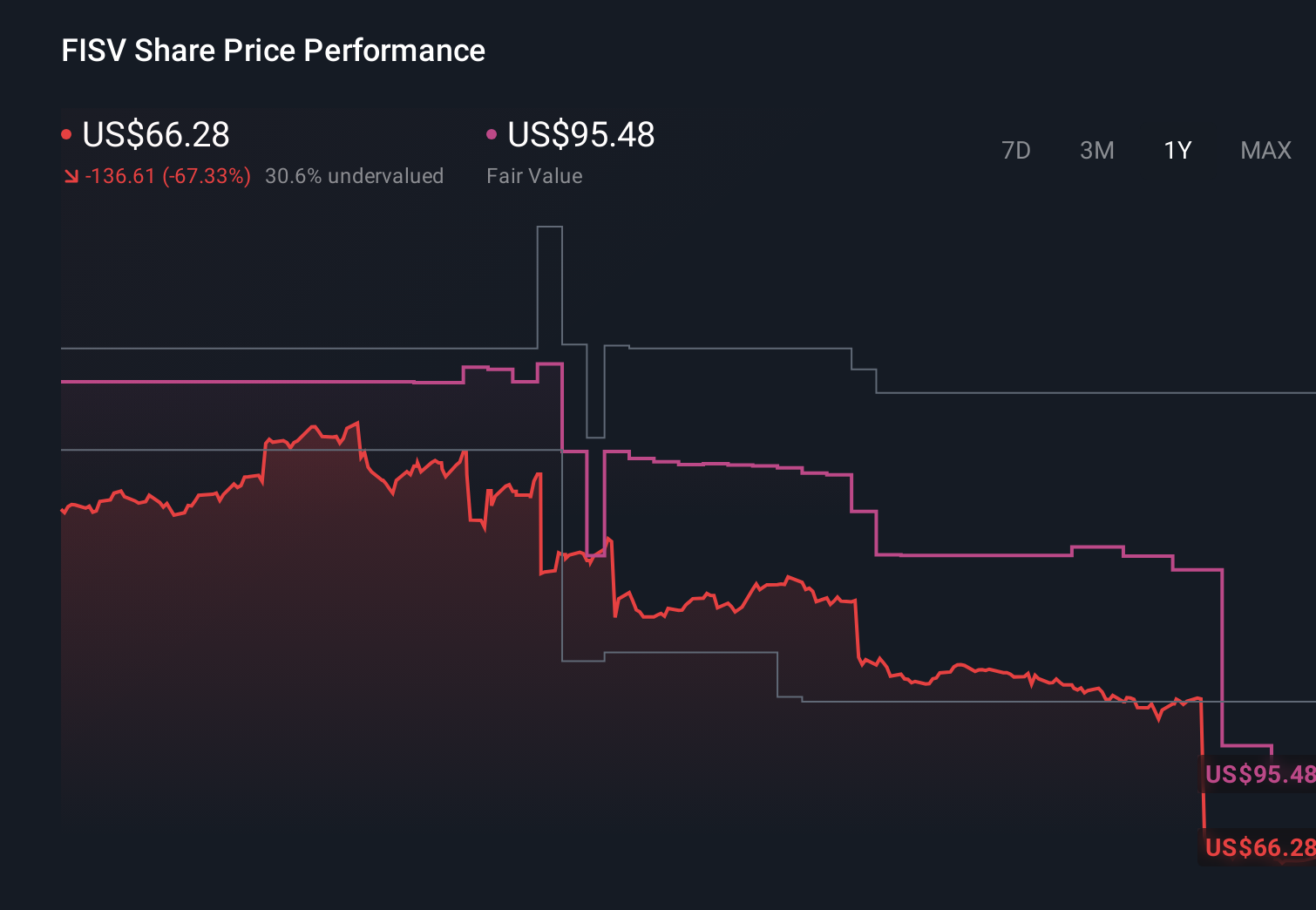

- Despite a flat year to date, the stock is down about 68.6% over the last 12 months and has dropped 35.8% over three years, a long slide that can both scare off momentum traders and attract patient value hunters.

- Those moves are set against a backdrop of ongoing integration of past acquisitions and continued investment in digital payments and financial technology platforms. These are areas where Fiserv aims to lock in long term growth. At the same time, shifting expectations around interest rates and competitive pressure in fintech have made investors more sensitive to what they are paying for those future cash flows.

- On our framework Fiserv scores a 5 out of 6 on undervaluation checks. This suggests the market may be mispricing at least some of its fundamentals. However, headline multiples never tell the full story, so next we will walk through each valuation approach and then finish with a more powerful way to think about what the stock is really worth.

Find out why Fiserv's -68.6% return over the last year is lagging behind its peers.

Approach 1: Fiserv Excess Returns Analysis

The Excess Returns model looks at how much value Fiserv can create over and above the minimum return that shareholders require, based on its profitability and growth in book value per share.

Fiserv starts with a Book Value of $46.78 per share and a Stable EPS of $10.64 per share, derived from weighted future Return on Equity estimates from 8 analysts. With an Average Return on Equity of 17.18% and a Cost of Equity of $5.61 per share, the model calculates an Excess Return of $5.04 per share. This implies Fiserv is generating returns meaningfully above its equity cost.

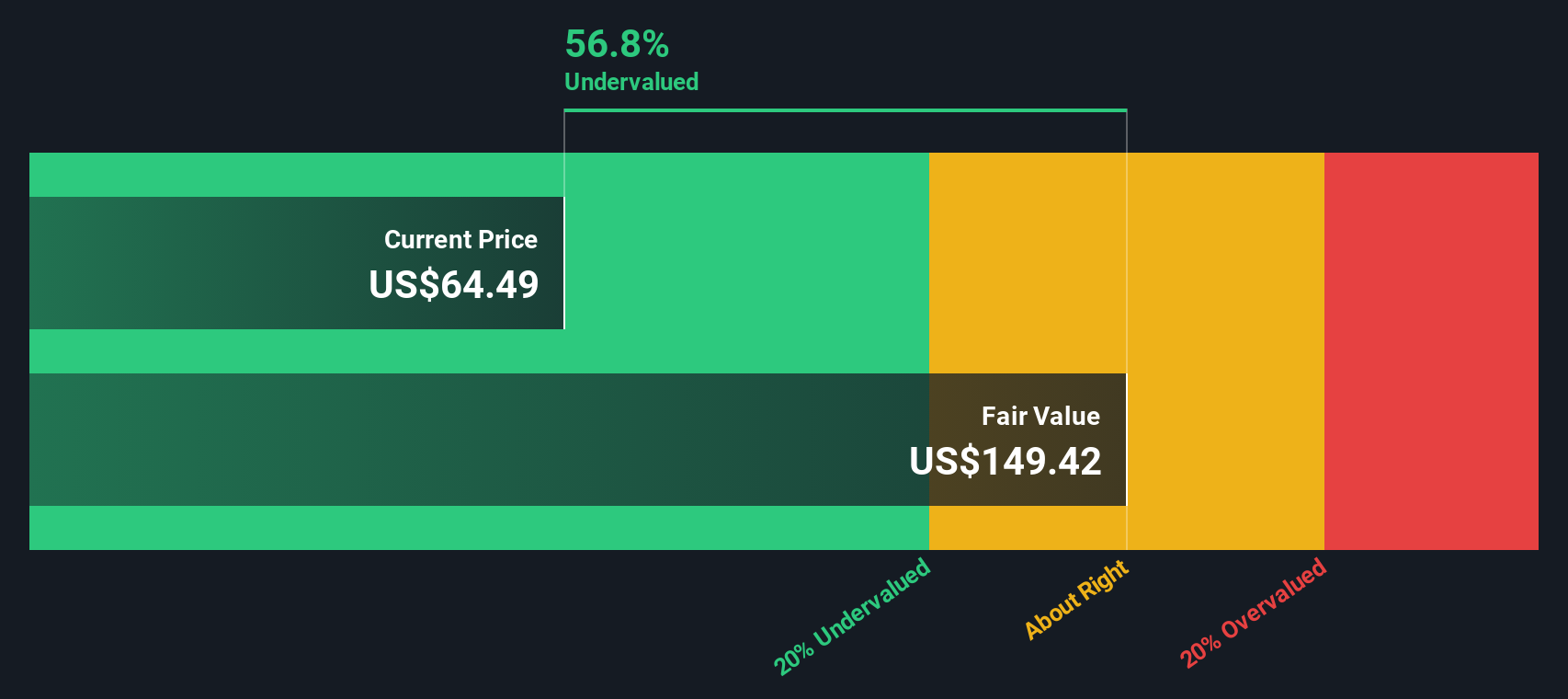

Looking forward, analysts expect Stable Book Value to rise to $61.95 per share, supported by estimates from 4 analysts. Plugging these inputs into the Excess Returns framework leads to an intrinsic value estimate of about $148.93 per share.

With the Excess Returns valuation implying the stock is roughly 56.0% undervalued versus the current market price, Fiserv screens as materially mispriced rather than fairly valued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Fiserv is undervalued by 56.0%. Track this in your watchlist or portfolio, or discover 875 more undervalued stocks based on cash flows.

Approach 2: Fiserv Price vs Earnings

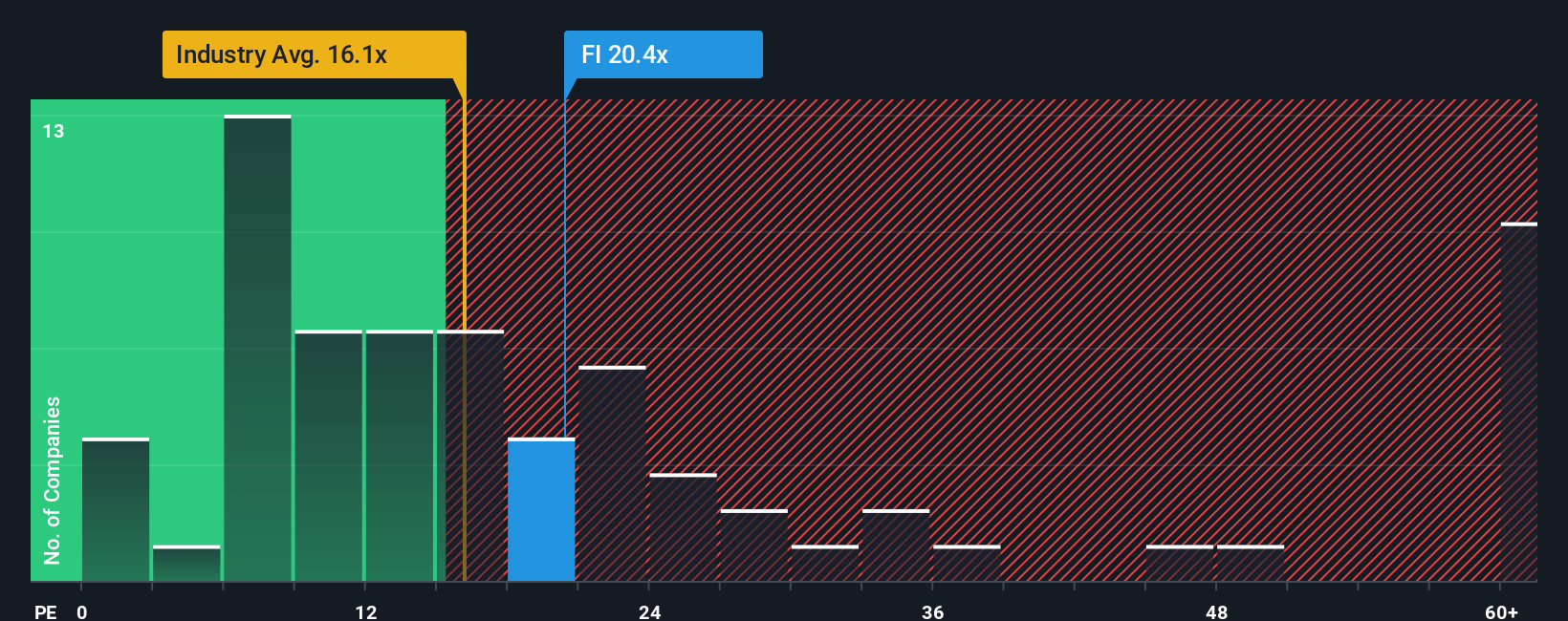

For a consistently profitable business like Fiserv, the Price to Earnings, or PE, ratio is a useful way to gauge what investors are paying today for each dollar of current earnings. In general, companies with faster, more reliable growth and lower perceived risk deserve a higher PE multiple, while slower growth or greater uncertainty should pull that multiple down.

Fiserv currently trades on a PE of about 9.78x, which is well below both the Diversified Financial industry average of roughly 13.70x and a peer group average of around 58.92x. On the surface, that discount suggests the market is skeptical about how durable Fiserv’s growth and competitive position really are.

Simply Wall St’s Fair Ratio framework takes this a step further. Instead of just comparing Fiserv to peers and the sector, it estimates what a reasonable PE should be given the company’s earnings growth, margins, industry, market cap and risk profile. For Fiserv, that Fair Ratio comes out at about 19.86x, implying the shares trade on a lower earnings multiple than this framework indicates. With the actual PE at 9.78x, the stock appears materially undervalued on this preferred multiple approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1464 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fiserv Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Fiserv’s business to a set of numbers, from future revenue, earnings and margins through to a fair value estimate, and then compare that fair value to today’s share price to decide if you want to buy, hold or sell.

On Simply Wall St, Narratives live in the Community page and are used by millions of investors as an easy, accessible tool to turn a company’s story into a structured forecast that is automatically updated when new information, like earnings releases or major news, comes in.

For Fiserv, for example, one optimistic Narrative might assume digital payments expansion, higher value added services adoption and improving margins that justify a fair value closer to the most bullish analyst target of around $250 per share. A more cautious Narrative might focus on execution risks, slower growth and margin pressure that support a fair value nearer the most bearish target of about $125. The platform lets you see and compare these perspectives in real time as the facts change.

Do you think there's more to the story for Fiserv? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com