Walmart (WMT) Valuation Check as 2026 Health and AI Upgrades Reshape Its Growth Story

Walmart (WMT) is kicking off 2026 with a mix of health focused product moves and tech upgrades, from rolling out Lemme wellness gummies nationwide to tightening ingredients and overhauling self checkout with new AI tools.

See our latest analysis for Walmart.

Investors seem to be cautiously rewarding these health and tech pushes, with Walmart’s 90 day share price return of 9.8% and 1 year total shareholder return of 25.4% pointing to steady, not euphoric, momentum.

If Walmart’s moves have you thinking about where else growth and execution might line up, it could be worth exploring fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

With shares up strongly over the past year and trading only modestly below analyst targets, the key question now is whether Walmart is still mispriced or if the market is already accounting for years of health and AI driven growth.

Most Popular Narrative Narrative: 5.6% Undervalued

With Walmart closing at $112.76 against a widely followed fair value near $119, the dominant narrative sees modest upside still on the table.

Expansion of high margin business streams Walmart Connect (advertising, up 31 46% globally), marketplace, and Walmart+ memberships (global advertising up 46%, membership income up 15%) is diversifying Walmart's income base beyond retail, gradually transforming the company's profit mix and resulting in structurally higher net margins and earnings over time.

Want to see why a mature retailer is being modeled with the kind of margin and earnings profile usually reserved for premium platforms? The most popular narrative quietly rewrites Walmart’s profit mix, leans on steady top line growth, and bakes in a forward earnings multiple that many investors would not expect for this sector. Curious which assumptions have to hold for that valuation to work?

Result: Fair Value of $119.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent e commerce losses and rising wage and claims costs could crimp margins and challenge the idea that higher tech driven profitability is locked in.

Find out about the key risks to this Walmart narrative.

Another Way to Look at Value

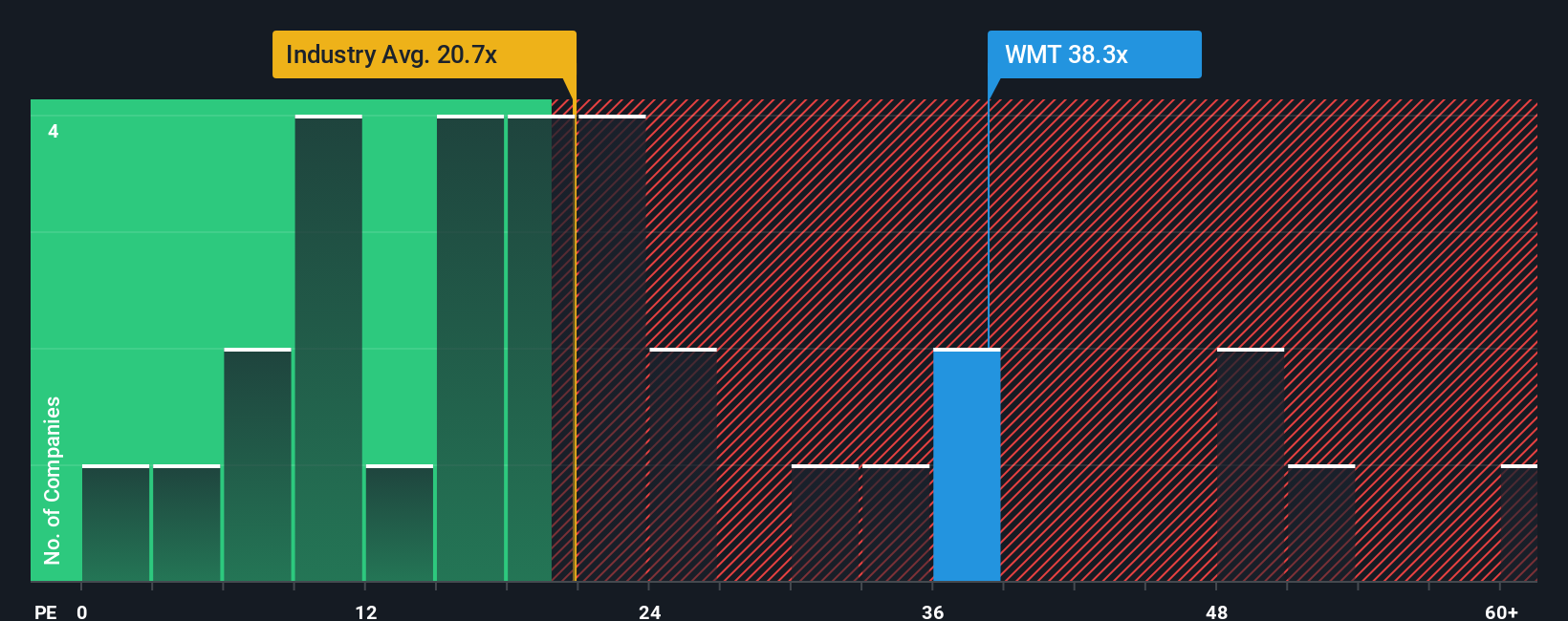

On earnings based valuation, Walmart looks stretched. Its price to earnings ratio of 39.2x sits well above the Consumer Retailing industry at 22.8x, the peer average at 26x, and even its own 38x fair ratio. This implies limited margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walmart Narrative

If you see the numbers differently or want to pressure test the assumptions yourself, you can spin up your own narrative in minutes: Do it your way.

A great starting point for your Walmart research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next potential opportunity by using our screeners to spot mispriced growth, resilient income, and the next wave of innovation.

- Target resilient income by reviewing established companies in these 14 dividend stocks with yields > 3% that can help underpin your portfolio with cash returns.

- Explore your growth potential by scanning these 25 AI penny stocks for businesses turning artificial intelligence into competitive advantages and revenue.

- Position yourself ahead of the crowd by using these 80 cryptocurrency and blockchain stocks to find listed players building infrastructure and services around digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com