Taking Another Look at Blackstone (BX) Valuation After Recent Share Price Strength

Blackstone (BX) has quietly outperformed over the past week, and that short stretch is giving investors a fresh reason to recheck the story behind this alternative asset manager at around $159 a share.

See our latest analysis for Blackstone.

That uptick sits against a choppier backdrop, with a modest 30 day share price return of 4.37 percent but a negative 1 year total shareholder return of 6.94 percent, suggesting near term momentum is improving while longer term gains are still consolidating after a stellar 3 year total shareholder return of 119.48 percent.

If Blackstone’s moves have you thinking about what else might be setting up for the next leg higher, this could be a good moment to explore fast growing stocks with high insider ownership.

With shares still trading below analyst targets despite strong multi year returns and double digit earnings growth, the key question is whether Blackstone is quietly undervalued or if the market is already pricing in its next phase of expansion.

Most Popular Narrative Narrative: 11.7% Undervalued

With Blackstone closing at $158.80 versus a narrative fair value near $179.78, followers see potential upside that depends on aggressive growth and profitability shifts.

The analysts have a consensus price target of $181.684 for Blackstone based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $215.0, and the most bearish reporting a price target of just $150.0.

Want to see why this story leans bullish despite divided analysts? The drivers highlighted include fast revenue growth, improving margins and a future earnings multiple that could be higher than current levels.

Result: Fair Value of $179.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, trade tensions and higher construction costs could pressure real estate values and delay deal activity, challenging the optimistic growth assumptions behind this bullish setup.

Find out about the key risks to this Blackstone narrative.

Another Angle on Valuation

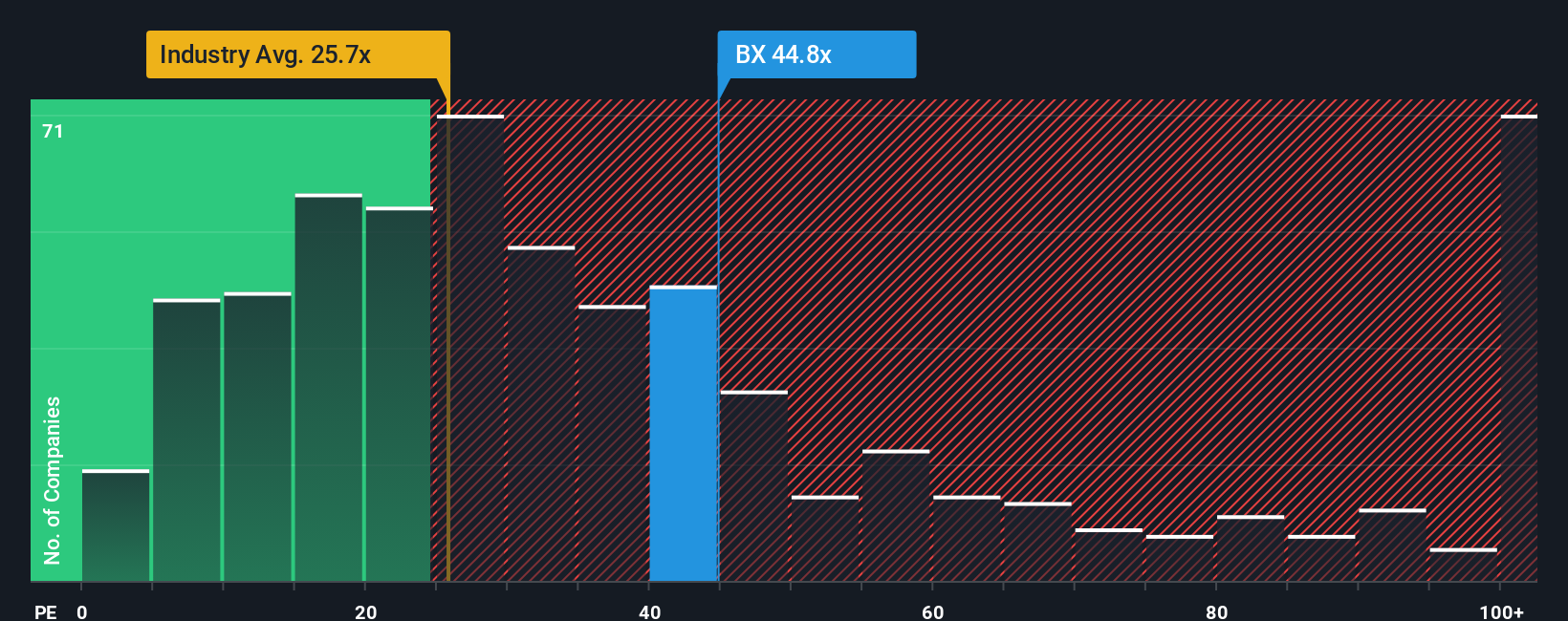

Blackstone’s upbeat narrative fair value contrasts with what its earnings multiple suggests. The stock trades at about 45.9 times earnings versus 25.6 times for the US Capital Markets industry and a 23.2 fair ratio, indicating that investors are already paying a steep premium for future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Narrative

If you see the numbers differently or simply want to dig into the details yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Blackstone research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh stocks tailored to your strategy before the market recognizes their full potential.

- Capitalize on potential multi baggers by scanning these 3571 penny stocks with strong financials with improving balance sheets and momentum building beneath the surface.

- Ride structural growth trends by targeting these 29 healthcare AI stocks transforming patient care, diagnostics and efficiency across the medical ecosystem.

- Lock in growing income streams by reviewing these 14 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com