Emerging market bonds are “ballasted” by local capital, and their ability to withstand volatility supports the continuation of the bull market in 2026

The Zhitong Finance App learned that fund managers said that emerging market bonds may be supported in 2026 because these securities are increasingly held by local investors. These investors are less affected by currency risk and are therefore more resilient to risk. In recent years, as capital markets in countries such as China, Mexico, and Indonesia have deepened, domestic funds have increasingly held local currency bonds. Local pension funds and insurance companies in developing countries have also increased their purchasing efforts to meet their growing liabilities.

Didier Lambert, head of local currency debt at J.P. Morgan Asset Management in London's emerging markets, said that the relative decline in foreign shareholding is “one of the main reasons we are optimistic about this asset class.” He added: “As emerging market economies increased their bond issuance after the COVID-19 pandemic, a large portion of it was purchased by local banks and pension funds.”

Lambert said he prefers local currency debt from emerging economies, which have “huge and strong local capital, which allows them to contain fluctuations, such as Mexico, South Africa, Brazil, India and Thailand.”

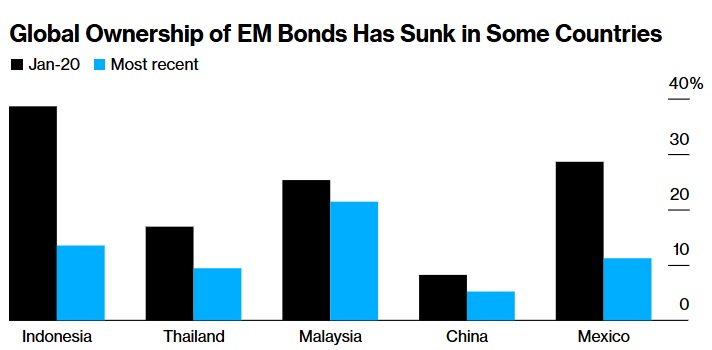

In some cases, the decline in foreign ownership has been quite significant. The share of Mexican bonds held by foreign investors has dropped from around 29% at the beginning of 2020 to about 11%, while the share of Indonesian bonds held by foreign investors also fell from nearly 40% to about 13% during the same period.

Emerging market bonds performed well in 2025. The Emerging Markets Bond Index had a return of 9.3% last year, the best return since 2019. In contrast, the developed market bond index has a return of 6.3%.

The higher the local ownership ratio, the lesser the impact of currency fluctuations. Global investors generally don't hedge against emerging market bonds, which means that depreciating local currencies can sometimes cause them to reduce their holdings.

Philip Fielding, Fidelity International's London-based fund manager, said: “Local bond buyers are generally unaffected by exchange rate risk and are often more strategic long-term holders, which indicates that the financial market is maturing and deepening.”

Emerging market bonds are generally less volatile than developed market bonds. The standard deviation of the yield change in the emerging market bond index over the past 12 months was only 0.02, while the corresponding standard deviation for developed country bond indices was 0.04.

Emerging market bonds are also increasingly immune to fluctuations in US Treasury bonds. The 120-day correlation between the Emerging Market Local Currency Government Bond Index and US Treasury yields fell to -0.06 in November, the lowest level since 2014. A correlation of -1 means that the trend of these two indicators is completely opposite.

Among them, the decline in offshore ownership was particularly significant in Indonesia. Since Indonesia's much-praised finance minister Sri Mulyani Indrawati resigned in September, global funds have withdrawn more than $4 billion from the country's sovereign debt. However, instead of falling, the price of Indonesian bonds has risen. This is partly due to the Bank of Indonesia's interest rate cut and the Bank of Indonesia's transfer of about 200 trillion Indonesian rupiah (about 11.9 billion US dollars) to state-owned banks, which will enable these banks to buy more bonds.

Philip McNicholas, an Asian sovereign wealth fund strategist at Robeco in Singapore, said that the withdrawal of overseas investors will help reduce the sensitivity of specific markets to global market forces “because it will give domestic factors greater importance.” He also said, “Furthermore, this may also mark the growing maturity of the domestic investor base.”