AppLovin (APP): Reassessing Valuation After Share Price Slide Versus Strong AI‑Driven Growth

AppLovin (APP) just logged another sharp slide, breaking below its 50 day moving average even as its AI powered advertising engine delivers solid revenue and earnings growth that tell a very different story.

See our latest analysis for AppLovin.

That recent seven session slide and the latest 1 day share price return of minus 8.24 percent cap a choppy stretch, but a 1 year total shareholder return of 76.34 percent and a large 3 year total shareholder return of 6261.32 percent still signal that longer term momentum has been very strong, even if it is clearly cooling in the near term.

If AppLovin’s volatility has you rethinking concentration in one name, this could be a good moment to explore other high growth tech and AI ideas through high growth tech and AI stocks.

With revenue and earnings still climbing and Wall Street targets sitting nearly 20 percent above the current price, are investors being handed a rare discount on AppLovin, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 16.1% Undervalued

With AppLovin last closing at $618.32 against a narrative fair value near $737, the most followed view sees upside driven by compounding growth and margins.

Continuous advancements and adoption of the AXON machine learning platform are improving ad targeting, campaign ROI, and automation enhancing advertiser outcomes and enabling higher net margins through increased operating efficiency.

Want to see the math behind this upside case? The narrative leans on rapid revenue expansion, rising profit margins, and a rich but disciplined future earnings multiple. Curious which assumptions really move that fair value? Dive in to see how a high growth trajectory gets discounted at just under a 9 percent rate.

Result: Fair Value of $737.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view could be challenged if tighter data privacy rules or renewed mobile platform changes undercut AppLovin’s targeting edge and advertising margins.

Find out about the key risks to this AppLovin narrative.

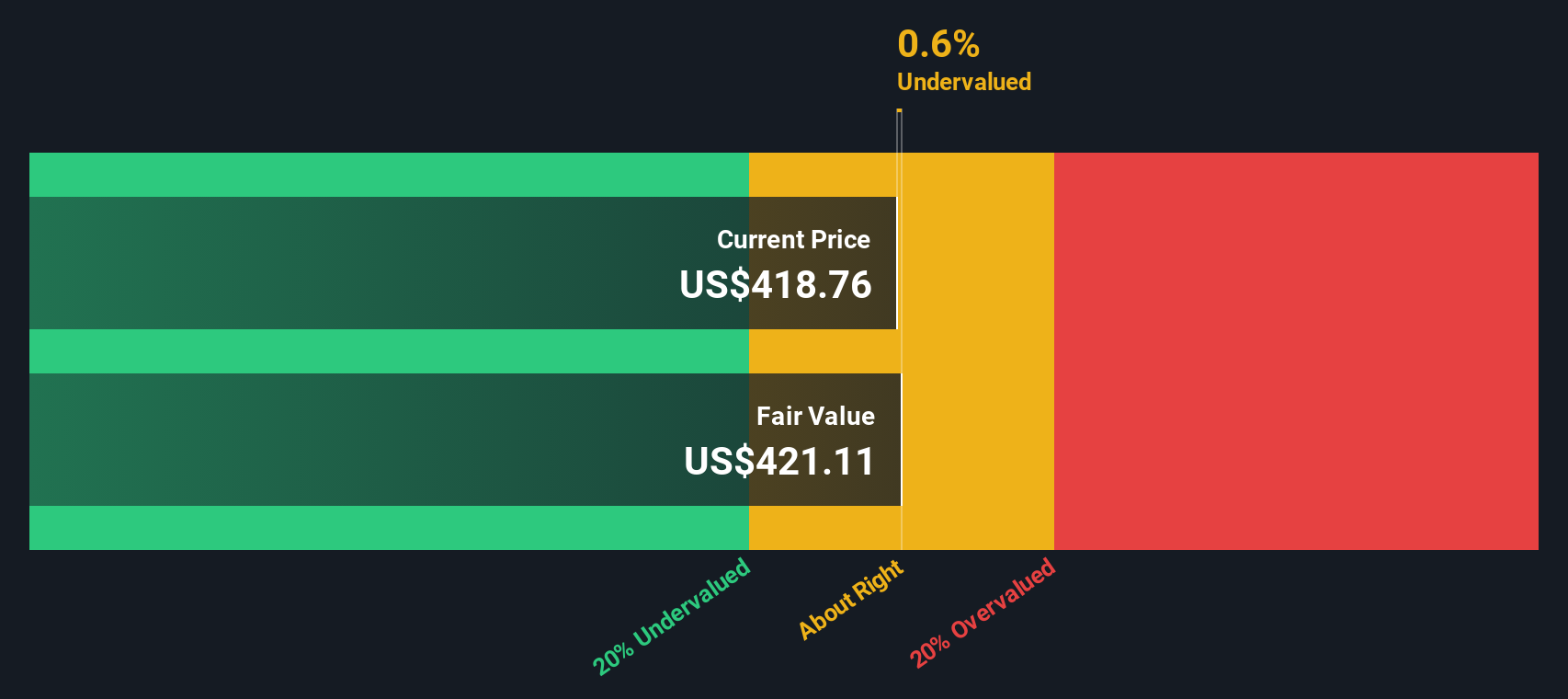

Another Way to Look at Valuation

That upbeat narrative clashes with a harsher reality from our SWS DCF model, which pegs fair value near $465.77, well below the $618.32 share price. On this view, the stock screens as overvalued and raises the question: are growth expectations already too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AppLovin Narrative

If you are not fully aligned with these views or would rather dig into the numbers yourself, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your AppLovin research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with one idea. Use the Simply Wall Street Screener now to uncover fresh opportunities that could quietly reshape your portfolio’s returns.

- Explore potential multibaggers early by targeting these 3571 penny stocks with strong financials that combine smaller market caps with strong financials and momentum.

- Consider companies at the forefront of automation by focusing on these 25 AI penny stocks that harness machine learning to support scalable, high margin business models.

- Look for quality at a discount by reviewing these 875 undervalued stocks based on cash flows where current prices may differ from the cash flows that drive long term intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com