Reassessing Coinbase (COIN) Valuation After Recent Share Price Pullback

Coinbase Global (COIN) has quietly slipped about 12% over the past month and nearly 39% in the past 3 months, even as its 3 year total return still sits above 600%.

See our latest analysis for Coinbase Global.

Despite the pullback, Coinbase's latest share price of $236.53 leaves its year to date share price return roughly flat. A 3 year total shareholder return above 600% shows how powerful the longer term crypto cycle has been, with recent weakness hinting that momentum is cooling as investors reassess regulatory and trading volume risks rather than abandoning the growth story outright.

If Coinbase's swings have you rethinking concentration in one name, this could be a good moment to explore other high growth tech and crypto adjacent ideas using high growth tech and AI stocks.

With shares lagging recently despite robust multi year returns and a lofty analyst target implying big upside, the key question now is simple: is Coinbase quietly undervalued or already priced for its next leg of growth?

Most Popular Narrative: 38.3% Undervalued

With Coinbase last closing at $236.53 against a narrative fair value near $383, the gap points to a market that may be underestimating future onchain expansion and margins.

Launch and adoption of proprietary blockchain platforms such as Base and the Base super app could drive user growth via novel on chain utilities (e.g., blockchain based identity, creator monetization, DeFi services), fostering ecosystem lock in and potentially improving net margins as higher margin, service based revenues increase in the overall mix.

Curious how steady top line growth, slimmer future margins and a richer earnings multiple still add up to that higher fair value? Explore the full narrative to see which long term assumptions drive the model.

Result: Fair Value of $383.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that bullish setup could unravel if spot trading volumes keep sliding and low cost bitcoin ETFs steadily siphon away Coinbase's most profitable retail flows.

Find out about the key risks to this Coinbase Global narrative.

Another View on Value

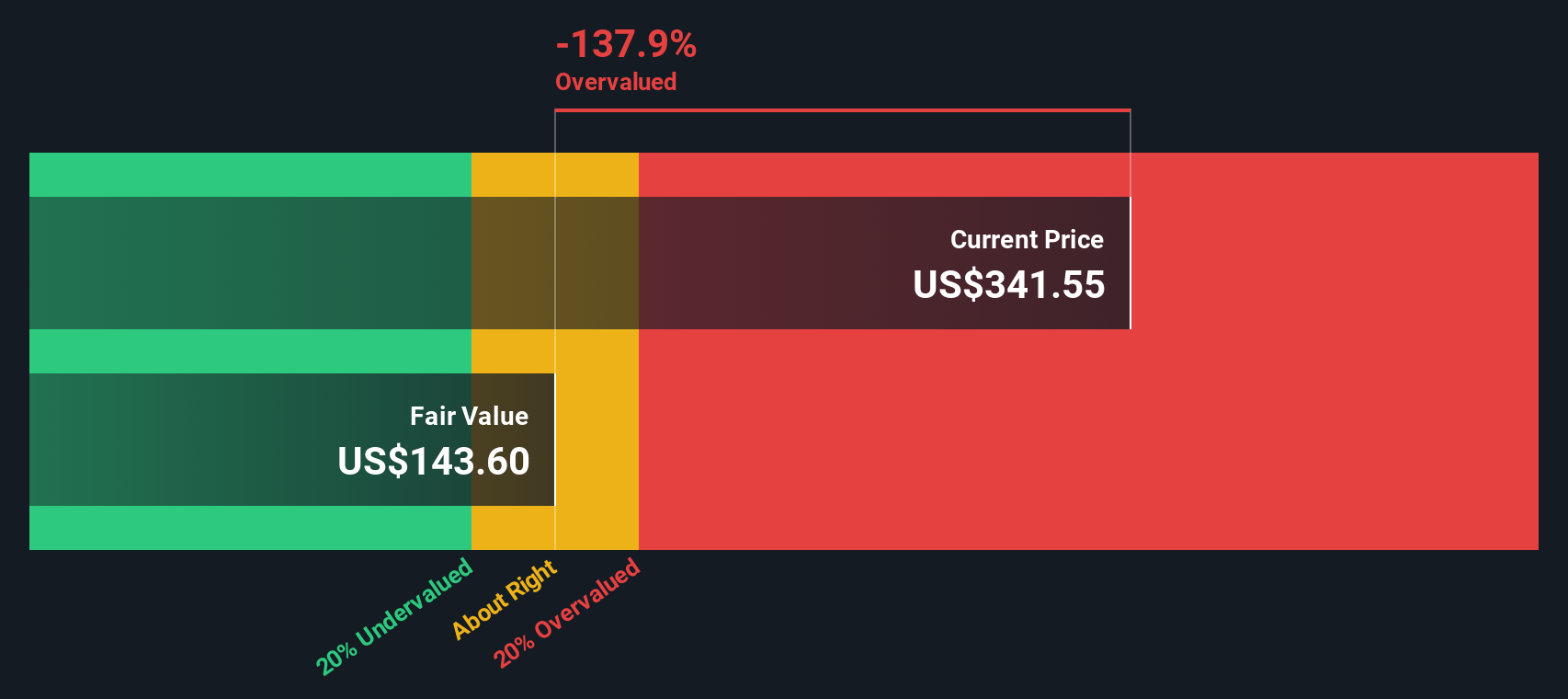

Our SWS DCF model paints a very different picture, suggesting Coinbase is overvalued at around $109.54 per share versus the current $236.53. That implies the market may be assuming far rosier long term cash flows than the model does, or simply not caring. Which side do you think is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coinbase Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coinbase Global Narrative

If you would rather interrogate the assumptions yourself and stress test the numbers, you can craft a custom Coinbase thesis in minutes, Do it your way.

A great starting point for your Coinbase Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more smart opportunities?

Before the next move in Coinbase steals the headlines, secure your edge by scanning other high potential ideas on Simply Wall St's powerful stock screener today.

- Capitalize on market mispricing by hunting for quality businesses trading below their estimated worth through these 875 undervalued stocks based on cash flows.

- Ride structural growth in digital assets by targeting listed companies geared to blockchain innovation and tokenization via these 80 cryptocurrency and blockchain stocks.

- Lock in potential income and stability by zeroing in on companies offering reliable payouts using these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com