Under the AI boom, Asian tech stocks lead the way, and emerging market stock indexes are poised to hit record highs

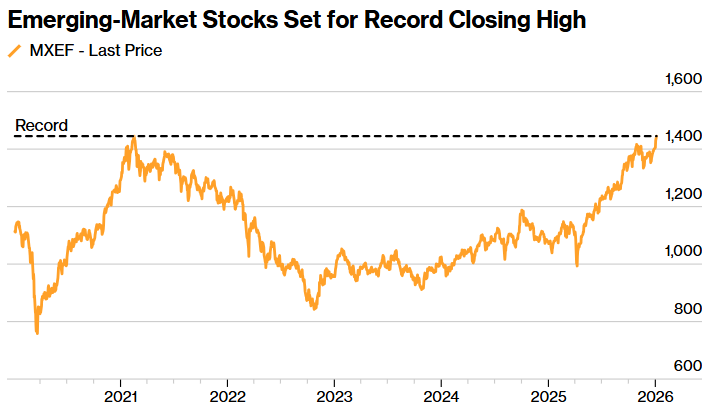

The Zhitong Finance App learned that emerging market stocks are expected to reach record highs, boosted by the continued strengthening of Asian technology stocks and the general rise in global stock markets. The MSCI Emerging Markets Index rose 1.3% on Monday and is expected to surpass the peak set five years ago. Hanmi Semiconductor and Kuaishou Technology were among the top performing stocks of the day, with gains of more than 10%.

This rise reflects strong investor demand for AI-related assets, which remain the focus of global stock markets. The benchmark stock indexes of South Korea and Taiwan, as well as the Asia Pacific indices, also hit new highs.

Emerging market assets showed strong performance at the beginning of the year. Analysts expect this wave of gains may continue until 2026 as the weak outlook for the US economy puts pressure on the dollar. Asia's many suppliers that supply critical components to the AI supply chain are also helping the region stand out.

However, these gains also come with a few issues. As the market heats up, the stock prices of some of the big AI and tech companies fluctuated due to concerns about overvaluation.

Charu Chanana, chief investment strategist at Saxo Bank, said: “In the short term, emerging markets may still be supported, but the trend may be more cautious and volatile, rather than rising in a straight line. The favorable factor is that the growth momentum of Asia's tech and artificial intelligence supply chains is likely to continue to drive up the index, especially as global risk appetite remains strong.”

Traders are currently looking for new catalysts to drive the next round of gains. The upcoming US economic data and key corporate earnings reports will provide clues about the health of the market. Market concerns about the prospects of the Federal Reserve's plan to cut interest rates, as well as the heightened geopolitical tension after the US raided Venezuelan leaders, all made market sentiment cautious.