Uncovering Asia's Hidden Stock Gems In January 2026

As we step into 2026, the Asian markets are drawing attention with mixed performances across key indices, reflecting a complex economic landscape. Notably, China's manufacturing sector shows signs of recovery, while South Korea's exports have reached record highs, suggesting potential opportunities for investors seeking hidden gems in the region. In such an environment, identifying promising stocks involves looking for companies that can leverage these macroeconomic trends to drive growth and innovation.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jiangyin Haida Rubber And Plastic | 11.87% | 8.96% | -3.28% | ★★★★★★ |

| Nantong Guosheng Intelligence Technology Group | NA | 5.01% | -3.27% | ★★★★★★ |

| Camelot Electronics TechnologyLtd | 10.07% | 11.02% | -5.75% | ★★★★★★ |

| Guangdong Green Precision Components | NA | -8.91% | -38.16% | ★★★★★★ |

| LanZhou Foci PharmaceuticalLtd | 1.63% | 7.07% | -12.27% | ★★★★★★ |

| Tibet Rhodiola Pharmaceutical Holding | 24.54% | 12.67% | 25.39% | ★★★★★☆ |

| Guangdong Goworld | 24.88% | -0.23% | -11.19% | ★★★★★☆ |

| Xinya Electronic | 51.57% | 28.63% | 3.77% | ★★★★★☆ |

| Shenzhen LiantronicsLtd | 218.35% | -12.53% | 83.11% | ★★★★☆☆ |

| Changzhou Nrb | 68.15% | 11.89% | 3.68% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhejiang Jinggong Integration Technology (SZSE:002006)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Jinggong Integration Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥12.04 billion.

Operations: Jinggong Integration Technology generates revenue primarily through its operations in the technology sector. The company has a market capitalization of CN¥12.04 billion, indicating its significant presence in the market.

Zhejiang Jinggong Integration Technology, a smaller player in the machinery sector, has been making waves with its impressive earnings growth of 93.4% over the past year, outpacing the industry's 6.1%. The company's net income for the first nine months of 2025 reached CNY 144.74 million, up from CNY 73.03 million a year earlier. Despite being profitable and having more cash than total debt, free cash flow remains negative at -CNY 307.52 million as of September 2025. Recent changes to company bylaws suggest strategic shifts that may impact future governance and operational decisions.

- Click here and access our complete health analysis report to understand the dynamics of Zhejiang Jinggong Integration Technology.

Learn about Zhejiang Jinggong Integration Technology's historical performance.

Qingdao Gon Technology (SZSE:002768)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Qingdao Gon Technology Co., Ltd. specializes in the research, development, manufacture, and sales of organic polymer modified materials both in China and internationally, with a market cap of CN¥13.96 billion.

Operations: Qingdao Gon Technology generates revenue primarily from the sales of organic polymer modified materials. The cost structure includes expenses related to research, development, and manufacturing processes. The company has experienced fluctuations in its net profit margin over recent periods.

Qingdao Gon Technology showcases promising potential with a debt to equity ratio rising from 30.8% to 79% over five years, indicating increased leverage. Despite this, the company has high-quality earnings and its interest payments are well covered by EBIT at 7.3x, suggesting financial stability. Trading at a price-to-earnings ratio of 16.8x below the CN market average of 44.7x, it represents good value relative to peers. Recent earnings show net income climbing to ¥615 million from ¥458 million last year, with basic EPS jumping from ¥1.69 to ¥2.32, reflecting robust growth in profitability and revenue performance.

- Get an in-depth perspective on Qingdao Gon Technology's performance by reading our health report here.

Gain insights into Qingdao Gon Technology's past trends and performance with our Past report.

Shanghai Fortune Techgroup (SZSE:300493)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Fortune Techgroup Co., Ltd. operates in China offering semiconductor products and solutions, with a market capitalization of approximately CN¥10.30 billion.

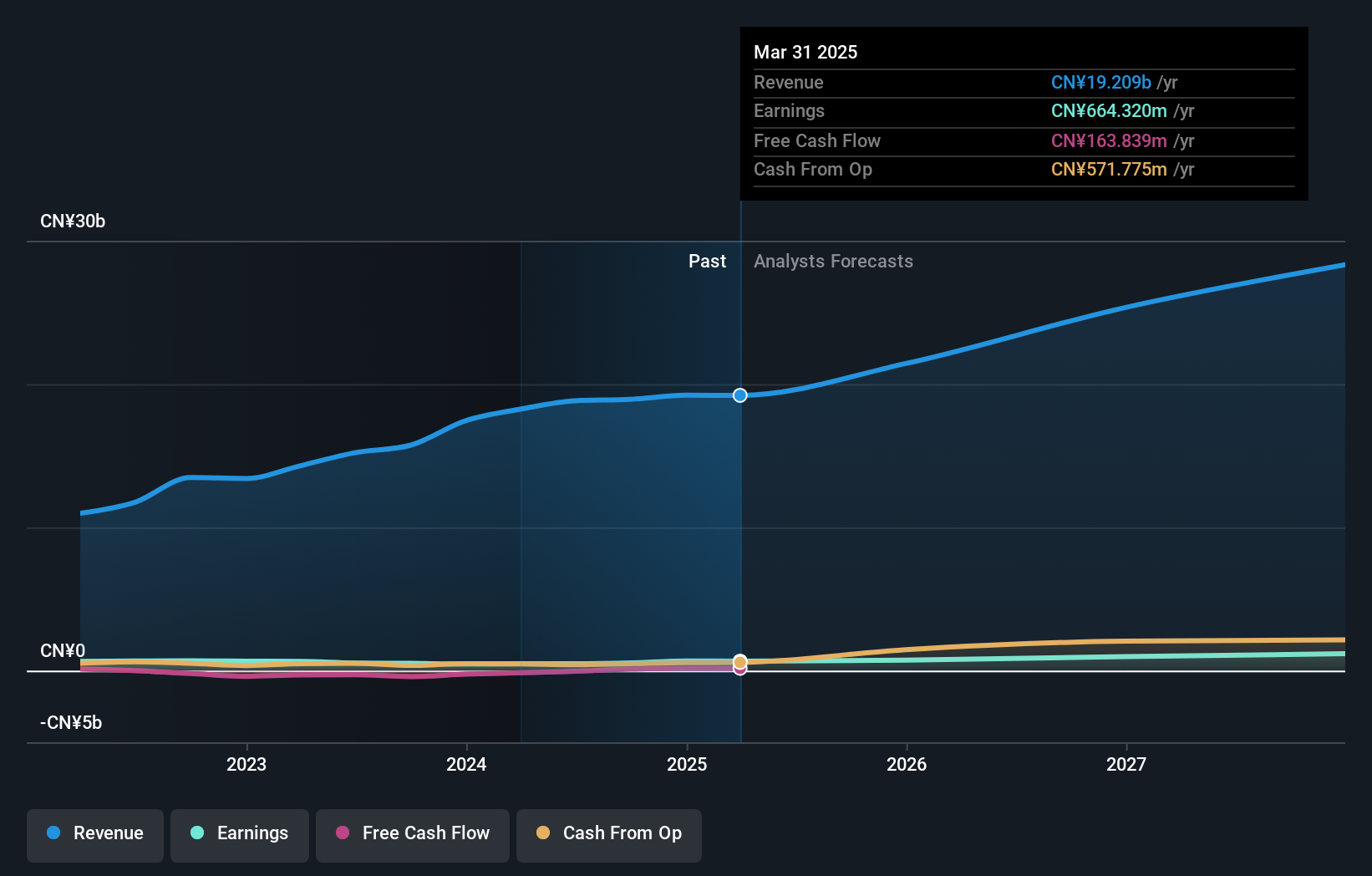

Operations: The company generates revenue primarily from the Software and Information Technology Service Industry, amounting to CN¥2.82 billion.

Shanghai Fortune Techgroup, a smaller player in the tech scene, has been making waves with its recent performance. Over the past nine months, sales climbed to CNY 2.15 billion from CNY 1.92 billion last year, while net income rose to CNY 46.08 million from CNY 37.13 million previously. Basic earnings per share ticked up to CNY 0.09 from CNY 0.07, showing steady progress in profitability despite not outpacing industry growth rates recently at 11%. The company has more cash than total debt and positive free cash flow of approximately US$104 million as of late September, hinting at sound financial health and potential for future growth amidst recent amendments in governance structures aimed at enhancing operational efficiency.

Turning Ideas Into Actions

- Click here to access our complete index of 2501 Asian Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com