A Look At United Parcel Service’s Valuation As Earnings Slow And Turnaround Gains Investor Attention

United Parcel Service (UPS) is back in focus as it heads into its fiscal fourth quarter earnings release, with analysts expecting a 20% decline in diluted EPS compared with last year.

See our latest analysis for United Parcel Service.

At a share price of $101.02, UPS has seen a 6.48% 1 month share price return and a 17.49% 3 month share price return, yet the 1 year total shareholder return of 13.08% decline shows longer term momentum is still fading even as investors reassess its overhaul, dividend profile, and upcoming earnings.

If UPS has you thinking about where capital might work harder, it could be worth sizing up aerospace and defense stocks as another corner of the market responding to global trade and logistics themes.

With EPS expected to fall 20% and the stock trading at a roughly 25% intrinsic discount, the real question now is whether UPS is genuinely undervalued or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 6.1% Overvalued

According to NVF, the narrative fair value of United Parcel Service at $95.21 sits below the last close of $101.02, setting up a cautious stance on upside.

We believe in a cautious approach in our analysis as UPS has been clouded with sustainability issues, higher costs, and internal headwinds. Can UPS navigate financial and operational pressures with resilience? Launched in early 2025, UPS's "Efficiency Reimagined" outlined the company’s largest network overhaul in company history. This multi-year initiative reflects management's goals to streamline domestic operations.

Curious what has to go right for that price target to work? Revenue, margins and earnings are all pushed in a specific direction. The valuation leans heavily on one future profit multiple and a single discount rate assumption.

Result: Fair Value of $95.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if UPS cuts jobs or closes facilities more aggressively than expected, or if union disputes flare again, that cautious fair value case could quickly look out of date.

Find out about the key risks to this United Parcel Service narrative.

Another Angle: Multiples Paint a Different Picture

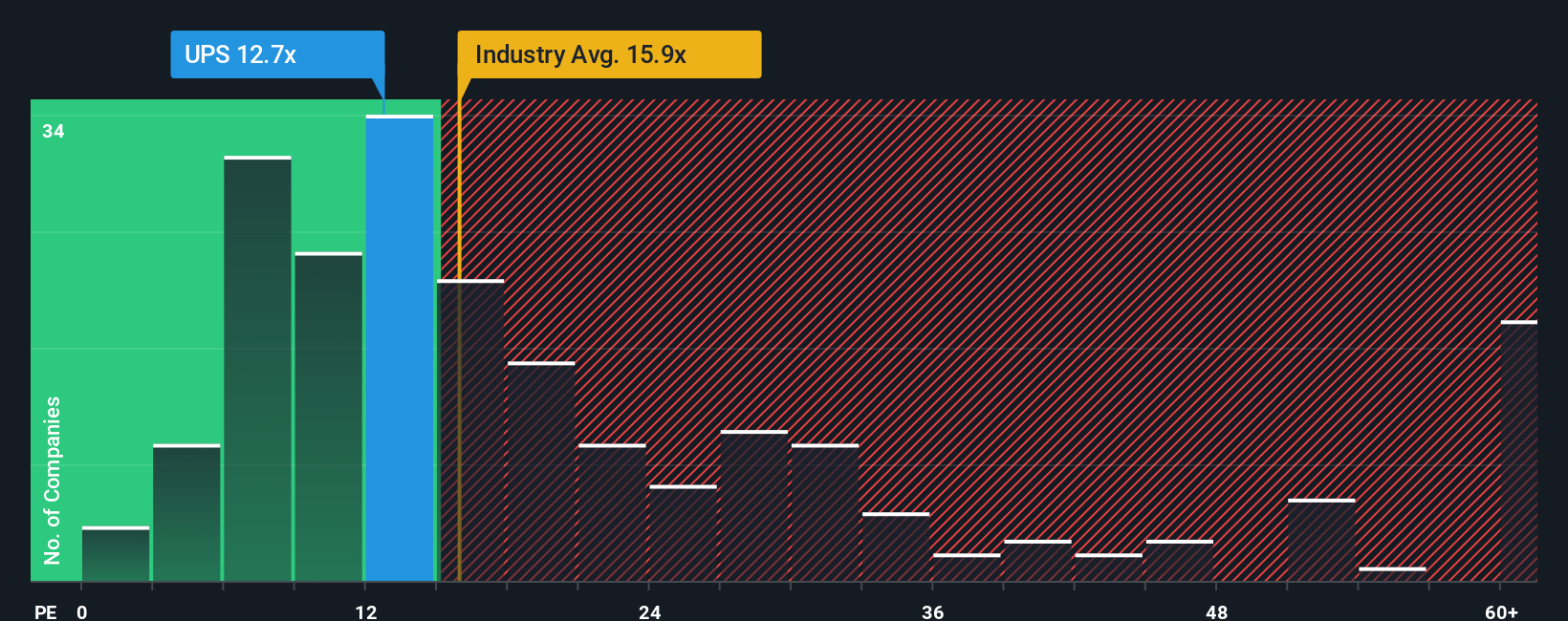

The user-driven fair value of $95.21 suggests UPS is 6.1% overvalued, yet our checks using a single P/E lens point the other way. At 15.6x earnings versus a peer average of 21.4x and a fair ratio of 20x, the stock screens as good value and raises the question: whose story do you trust more, the narrative or the numbers on comparables?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Parcel Service Narrative

If you see the numbers differently or prefer to pull apart the drivers yourself, you can shape a fresh UPS story in minutes, starting with Do it your way.

A great starting point for your United Parcel Service research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If UPS has sharpened your focus on where to put your next dollar, do not stop here. Widen the net and pressure test more ideas side by side.

- Target income-focused opportunities by checking out these 14 dividend stocks with yields > 3% that may appeal if regular cash returns matter to you.

- Hunt for potential mispricings by scanning these 875 undervalued stocks based on cash flows that might line up better with your return and risk expectations.

- Back bold growth themes by reviewing these 79 cryptocurrency and blockchain stocks tied to digital assets, payments, and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com