Assessing Eastern Bankshares (EBC) Valuation After HoldCo Stake Increase And New Barclays Coverage

Recent moves by HoldCo Asset Management, which lifted its Eastern Bankshares (EBC) position to 1.2 million shares, along with fresh coverage from Barclays, have brought this regional bank into sharper institutional focus.

See our latest analysis for Eastern Bankshares.

Those moves come after a period where the share price has been relatively steady, with a 1 year total shareholder return of 11.03% and 3 year total shareholder return of 13.37%. This suggests momentum has been gradual rather than sharp.

If this kind of institutional interest in banks has your attention, it could be a useful moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

With earnings growing, a 1.1x forward P/B multiple, and the share price sitting about 20% below the average analyst target, the key question is whether Eastern Bankshares is undervalued or if the market already reflects its future growth.

Most Popular Narrative Narrative: 16.5% Undervalued

With Eastern Bankshares last closing at $18.54 against a narrative fair value of $22.20, the current valuation sits below that implied level.

The future accretion of the discount on acquired loans from the Cambridge merger, estimated to generate $12 million to $14 million per quarter, is expected to positively impact earnings, providing a predictable income stream. A strong credit reserve (1.4%) and an aggressive approach to loan loss provisioning offer stability and confidence in future earnings, supporting margin protection and potentially improving net margins as market conditions stabilize.

Curious what kind of earnings ramp, margin lift, and future P/E cutback need to line up for that higher fair value to stack up? The narrative pulls together bold revenue assumptions, a step change in profitability, and a lower valuation multiple, all grounded in one detailed earnings path. If you want to see exactly how those moving parts connect, the full story is worth a closer look.

Result: Fair Value of $22.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still pressure points to watch, including higher reserves tied to office loans and recent GAAP net losses linked to merger related items.

Find out about the key risks to this Eastern Bankshares narrative.

Another View: Rich Multiples vs Earnings Story

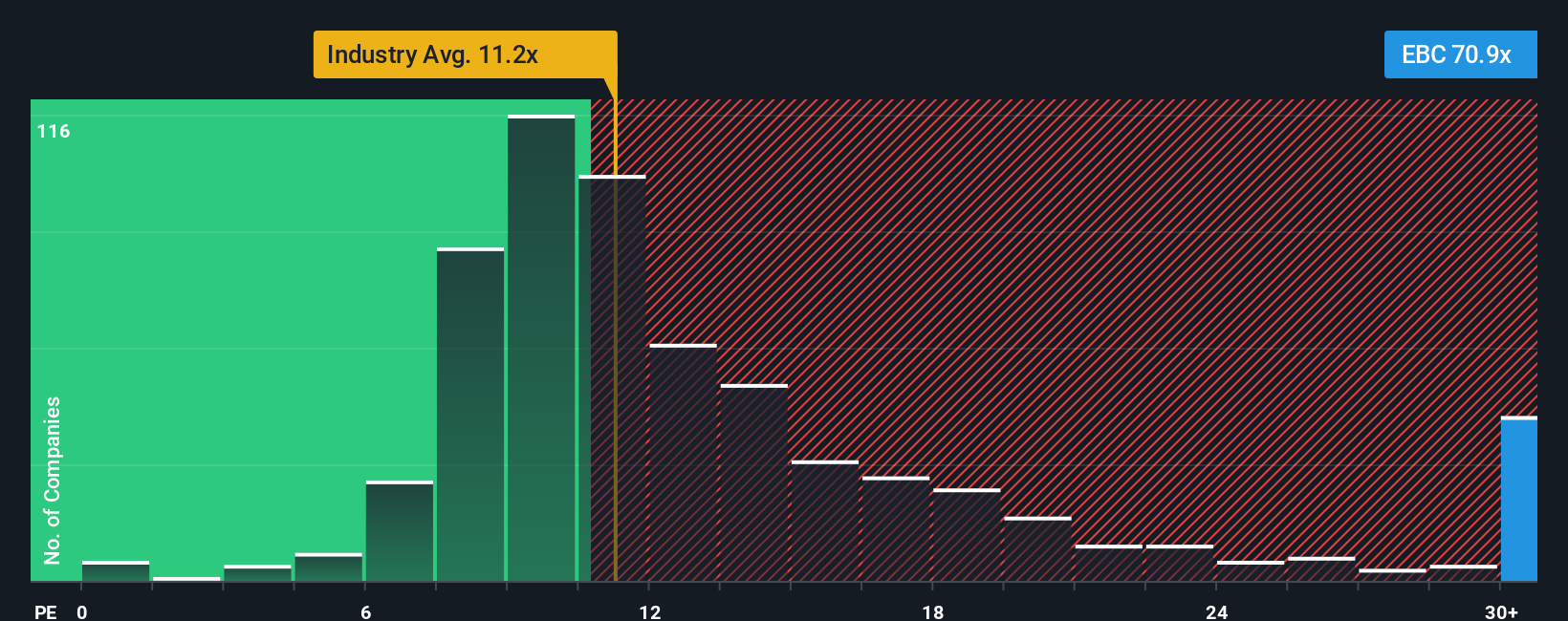

The narrative fair value of $22.20 suggests Eastern Bankshares is 16.5% undervalued, but the current P/E of 84.5x tells a different story. That is far higher than both the US Banks industry at 11.8x and the peer average at 27.3x, and also well above the fair ratio of 38.8x.

Such a wide gap means a lot of good news is already reflected in the shares, so any setback related to earnings, credit quality, or merger benefits could matter more than usual. With that kind of valuation tension, which signal do you think deserves more weight right now: the narrative fair value, or the earnings multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eastern Bankshares Narrative

If you see the numbers differently, or just prefer to stress test the assumptions yourself, you can build a fresh view in minutes: Do it your way.

A great starting point for your Eastern Bankshares research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Eastern Bankshares is on your radar, now is the time to widen your opportunity set so you are not relying on a single story.

- Target potential mispricings by scanning these 875 undervalued stocks based on cash flows that combine solid cash flow profiles with prices that may not fully reflect their fundamentals.

- Ride powerful secular themes by focusing on these 25 AI penny stocks that are using artificial intelligence to reshape how businesses operate and compete.

- Boost your income focus by zeroing in on these 14 dividend stocks with yields > 3% that offer yields above 3% while still tying back to underlying business performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com