SLB (SLB) Is Up 6.1% After Securing 5-Year Aramco Unconventional Gas Contract

- On 23 December 2025, SLB announced a five-year contract from Aramco to deliver stimulation, well intervention, frac automation, and digital solutions for Saudi Arabia’s unconventional gas fields as part of a broader multi-billion-dollar development program.

- This win highlights SLB’s growing role in advanced unconventional gas technologies that support Saudi Arabia’s push to diversify its energy mix and progress the global energy transition.

- Next, we’ll examine how this long-term Aramco unconventional gas contract may influence SLB’s investment narrative around digital and international growth.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

SLB Investment Narrative Recap

To own SLB, you need to believe in its ability to grow earnings by deepening its international footprint and scaling digital and production-optimization services, even if global upstream spending softens. The new five-year Aramco unconventional gas award reinforces SLB’s exposure to long cycle, digitally enabled projects, which can help offset some short cycle spending risk, but it does not remove the broader macro and commodity price risks that still dominate the nearer term story.

Among recent announcements, SLB’s December 2025 collaboration with Shell on digital and AI solutions is especially relevant, as it underlines the same theme as the Aramco win: using software, data platforms and automation to improve upstream efficiency. Together, these moves frame SLB’s near term catalyst as execution on higher value digital and international contracts while it still faces integration risk from ChampionX and potential pressure if operator budgets tighten.

Yet investors should be aware that if global upstream capital spending weakens faster than expected, especially in short cycle markets, then...

Read the full narrative on SLB (it's free!)

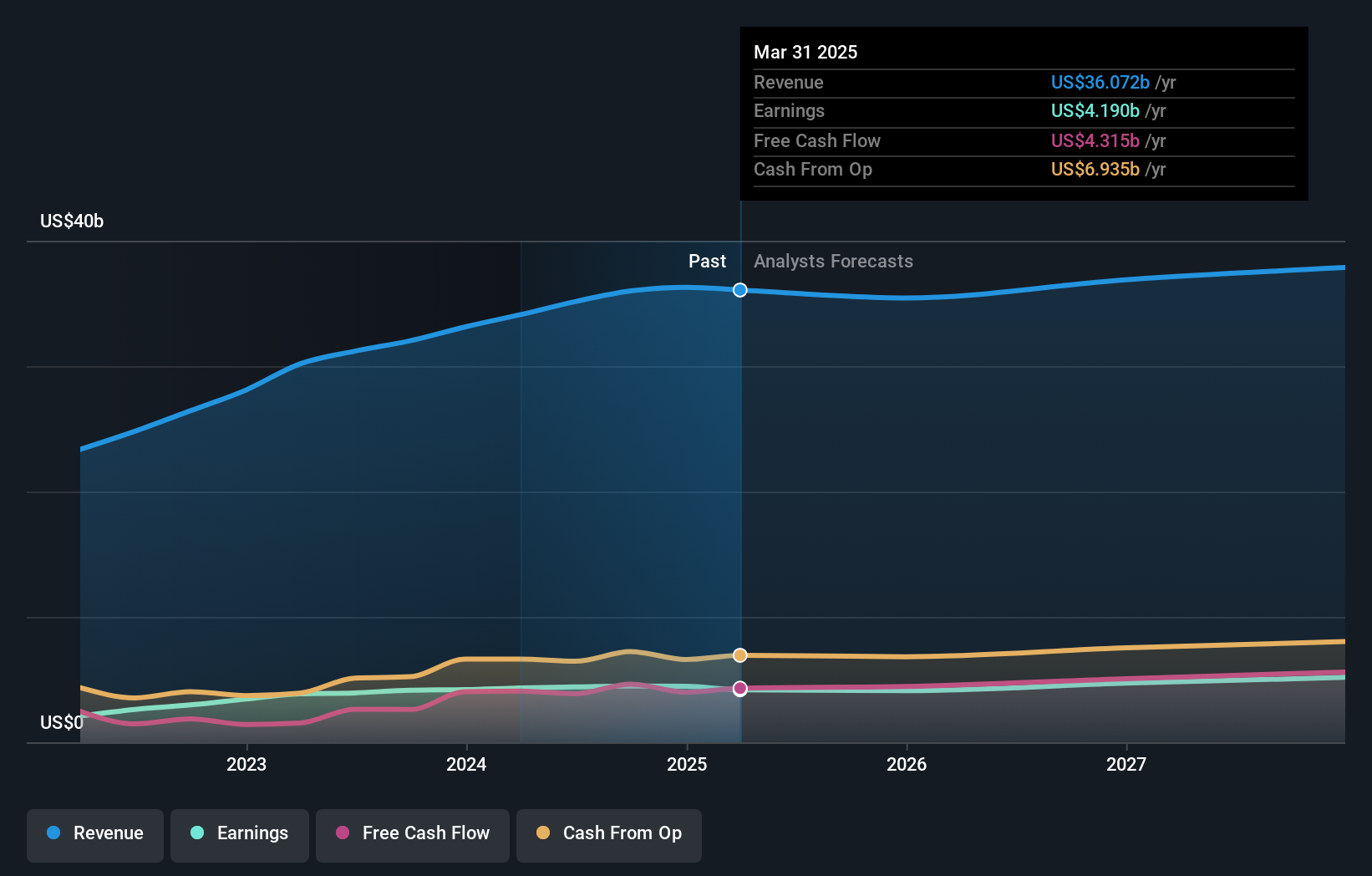

SLB's narrative projects $38.7 billion revenue and $4.9 billion earnings by 2028. This requires 2.9% yearly revenue growth and an earnings increase of about $0.8 billion from $4.1 billion.

Uncover how SLB's forecasts yield a $45.31 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Fourteen members of the Simply Wall St Community currently see SLB’s fair value anywhere between US$36 and about US$90, with most estimates clustering in the US$40s to US$60s. Set those diverse views against SLB’s reliance on continued international and unconventional spending, and you can see why it pays to compare several perspectives before forming a view on the company’s prospects.

Explore 14 other fair value estimates on SLB - why the stock might be worth over 2x more than the current price!

Build Your Own SLB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SLB research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SLB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SLB's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com