Undiscovered European Stock Gems to Explore in January 2026

As the pan-European STOXX Europe 600 Index reaches new highs and closes out 2025 with its strongest yearly performance since 2021, investors are increasingly turning their attention to the region's promising small-cap landscape. In this buoyant economic environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for those looking to explore undiscovered gems in Europe's dynamic market.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intellego Technologies | 5.42% | 70.25% | 79.14% | ★★★★★★ |

| Arendals Fossekompani | 26.72% | 2.84% | 7.78% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Envirotainer | 43.54% | -23.63% | nan | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Darwin | 3.03% | 50.55% | 46377.71% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Spadel (ENXTBR:SPA)

Simply Wall St Value Rating: ★★★★★★

Overview: Spadel SA is a company that produces and markets natural mineral water in Belgium, with a market capitalization of €979.48 million.

Operations: Spadel's primary revenue stream comes from its non-alcoholic beverages segment, generating €399.96 million.

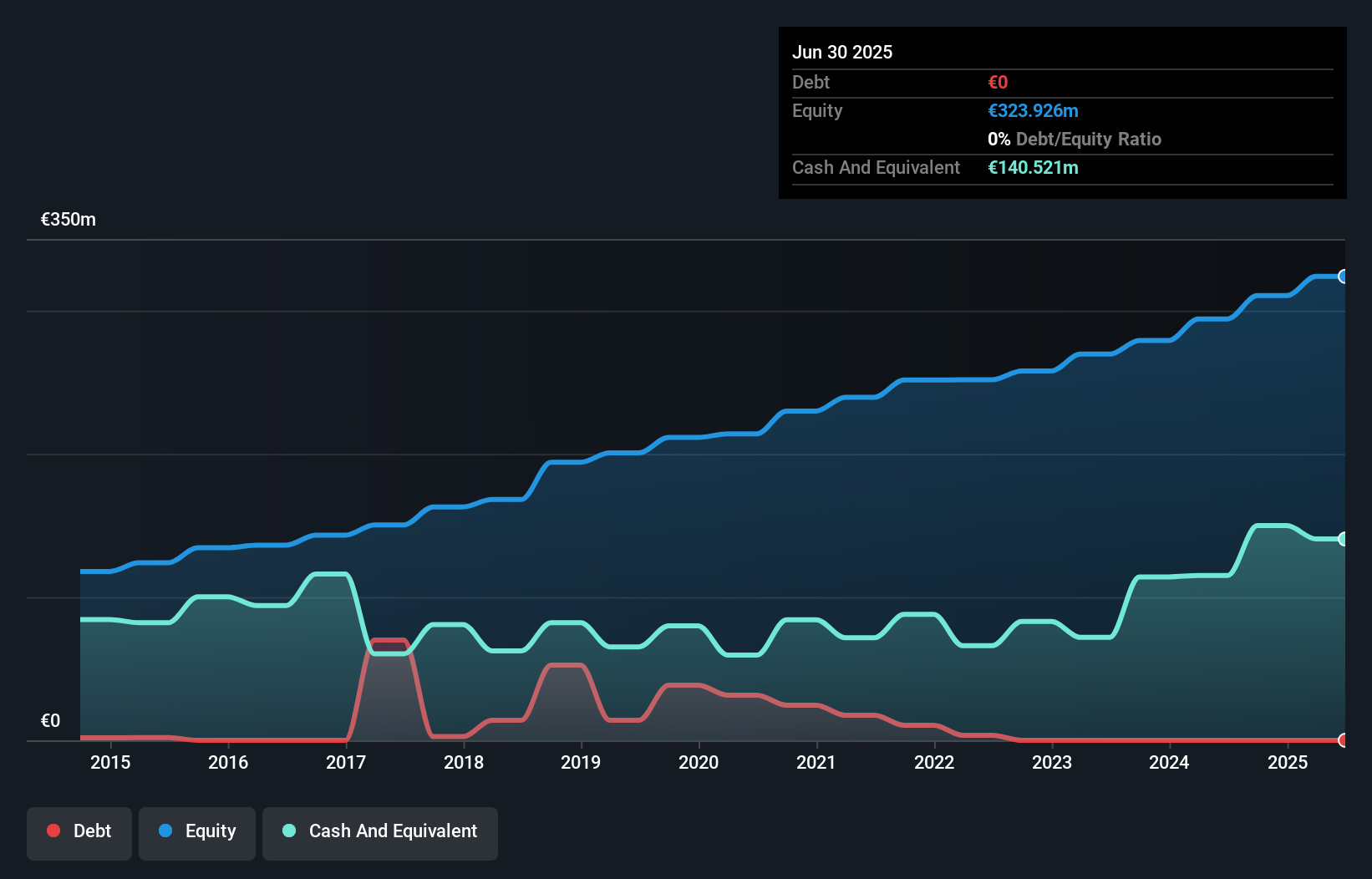

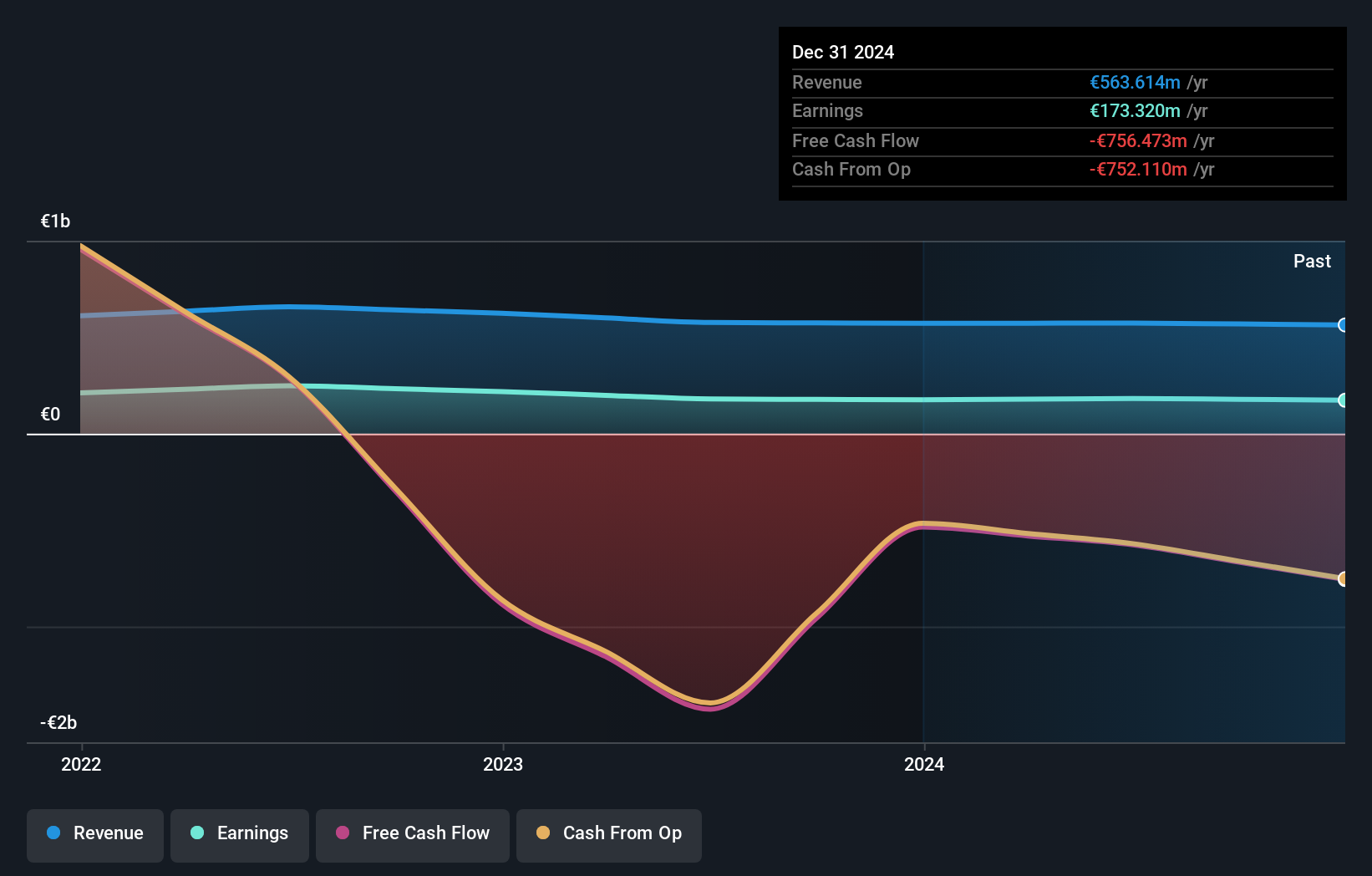

Spadel, a notable player in the European beverage sector, showcases impressive financial health with no debt currently, contrasting its 14.7% debt-to-equity ratio five years ago. The company has experienced a robust earnings growth of 27% over the past year, outpacing the broader beverage industry's -6%. This growth is underpinned by high-quality earnings and positive free cash flow. However, investors should be aware of its recent share price volatility over the last three months. With a levered free cash flow reaching €55.64 million as of June 2024, Spadel seems well-positioned for further potential in this competitive market.

- Get an in-depth perspective on Spadel's performance by reading our health report here.

Assess Spadel's past performance with our detailed historical performance reports.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers a variety of banking and financial services to diverse clients including individuals, farmers, professionals, businesses, and public authorities in France, with a market cap of €1.58 billion.

Operations: CRBP2 generates revenue primarily through its retail banking segment, which accounts for €662.31 million. The company's financial performance is reflected in its net profit margin, which stands at 16%.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative, with assets totaling €41.6 billion and equity of €5.7 billion, stands out for its solid financial footing. It boasts total deposits of €32.7 billion against loans of €33.9 billion, indicating a balanced approach to lending and borrowing. The firm has high-quality earnings, growing by 6.7% last year compared to the industry average of -0.3%. A sufficient allowance for bad loans at 106% and an appropriate non-performing loan ratio of 1.6% further underscore its prudent risk management strategies in today's competitive banking landscape.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to various clients including individuals, businesses, and local authorities in France, with a market cap of €1.60 billion.

Operations: CRLA generates revenue through a diverse portfolio of banking products and services targeted at individuals, professionals, businesses, and local authorities. The company's net profit margin is a key indicator of its financial performance.

CRLA, a cooperative bank with total assets of €35.9 billion and equity of €5.7 billion, primarily relies on low-risk customer deposits for funding, comprising 95% of its liabilities. Its earnings growth of 1.2% over the past year outpaced the banking industry's -0.3%, highlighting its resilience in a challenging sector. With total loans at €28.8 billion and deposits at €28.6 billion, CRLA effectively manages its lending activities while maintaining an appropriate bad loans ratio of 1.5%. The bank's price-to-earnings ratio stands attractively at 8.7x compared to the French market average of 16.5x, suggesting potential value for investors seeking stability in their portfolios amidst economic uncertainties.

Summing It All Up

- Click through to start exploring the rest of the 296 European Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com