Did Lucid’s Gravity SUV Push into Premium and Mid-Range EVs Just Shift Lucid Group’s (LCID) Investment Narrative?

- Lucid Group has moved past earlier supply-chain bottlenecks to ramp production and launch its Gravity three-row SUV, marking its first entry into the SUV market with most customer configurations reportedly priced above US$100,000.

- While the company remains loss-making in a pressured EV sector, expanding Gravity manufacturing and preparing a lower-priced mid-size crossover suggests a push to broaden its product mix and address more price-sensitive buyers.

- Now we’ll explore how resolving supply issues and scaling Gravity SUV production could influence Lucid’s longer-term investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

Lucid Group Investment Narrative Recap

To own Lucid, you need to believe it can turn premium EV technology and design into a sustainable, scaled business despite persistent losses and dilution risk. The latest news that Lucid has resolved key supply bottlenecks and is ramping Gravity production supports its near term volume and revenue catalyst, but does not remove the central risk around ongoing cash burn and dependence on external funding.

The expansion of Gravity SUV manufacturing, including a second assembly shift and reported strong demand at prices above US$100,000, directly connects to Lucid’s robotaxi-focused partnership that envisions at least 20,000 Gravity vehicles entering autonomous fleets over time. Together, these developments illustrate how successfully scaling Gravity could be critical to unlocking the high volume fleet opportunity that many investors see as a key upside driver for the stock.

Yet, against this growth ambition, investors also need to weigh how Lucid’s reliance on fresh capital and recent reverse stock split could affect existing shareholders...

Read the full narrative on Lucid Group (it's free!)

Lucid Group's narrative projects $5.6 billion revenue and $285.8 million earnings by 2028.

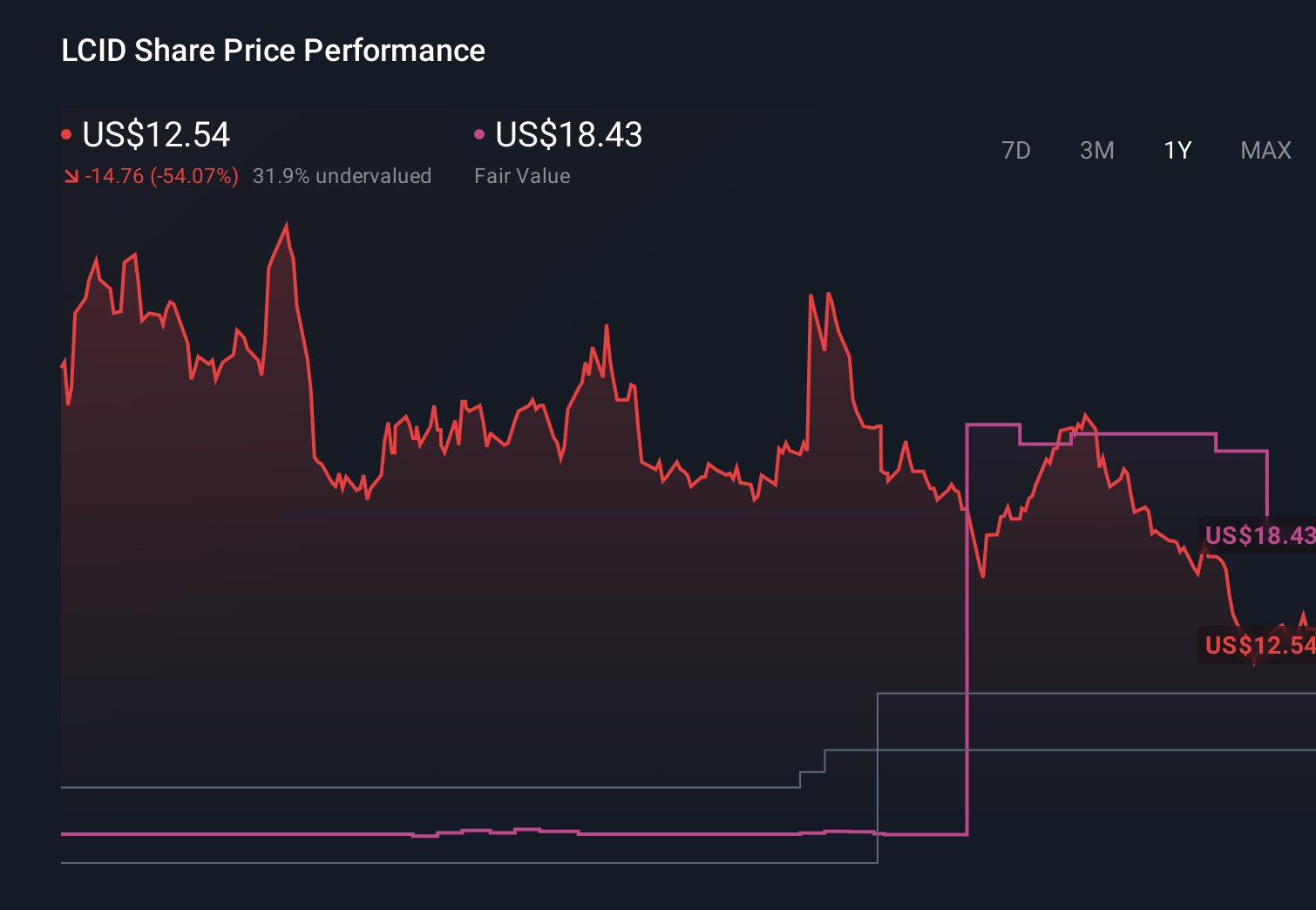

Uncover how Lucid Group's forecasts yield a $18.43 fair value, a 65% upside to its current price.

Exploring Other Perspectives

Eighteen fair value estimates from the Simply Wall St Community range from US$0.53 to US$28.77 per share, underlining how differently individual investors view Lucid’s potential. You can contrast those views with the current reality of deep losses, dilution risk and unresolved questions around when higher Gravity volumes might meaningfully improve the company’s financial profile.

Explore 18 other fair value estimates on Lucid Group - why the stock might be worth over 2x more than the current price!

Build Your Own Lucid Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lucid Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lucid Group's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com